Introduction

Anti-infective drugs play a crucial role in the treatment and prevention of various infectious diseases caused by bacteria, viruses, fungi, and parasites. These medications are designed to target and eliminate the infectious agents, thereby helping to control the spread of infections and improve patient outcomes.The use of anti-infective drugs is widespread across various healthcare settings, including hospitals, clinics, and community healthcare centers. They are prescribed for a wide range of conditions, including respiratory infections, urinary tract infections, skin and soft tissue infections, sexually transmitted infections, and many others.

The market for anti-infective drugs is driven by the constant emergence of new infectious diseases and the growing prevalence of drug-resistant pathogens. With the increasing global population, the risk of infectious disease outbreaks also rises, creating a higher demand for effective treatments.

Key advancements in the field of anti-infective drug development include the discovery of novel drug targets, the development of new drug formulations, and the introduction of combination therapies to combat drug resistance. These advancements have resulted in more effective and targeted treatment options, leading to improved patient outcomes.

The market for anti-infective drugs is influenced by factors such as government initiatives to control infectious diseases, the growing awareness of healthcare-associated infections, and the increasing investment in research and development activities. Additionally, the availability of generic versions of anti-infective drugs has contributed to cost savings and improved access to treatment options.

However, challenges such as the development of drug resistance, the high cost of drug development, and the regulatory complexities associated with clinical trials and approvals pose significant hurdles in the market. Efforts to address these challenges include the implementation of antimicrobial stewardship programs, the development of new diagnostic tools to aid in appropriate prescribing, and increased collaboration between researchers, pharmaceutical companies, and healthcare organizations.

Key Trends in the Anti-Infective Market

Some of the key trends involved in the anti-infective market are as follows:- Rising prevalence of drug-resistant infections: One of the key trends in the anti-infective market is the increasing prevalence of drug-resistant pathogens. Antibiotic resistance has become a major global health concern, leading to a need for the development of new anti-infective drugs or alternative treatment strategies to combat resistant infections

- Focus on precision medicine and targeted therapies: There is a growing emphasis on precision medicine in the field of anti-infectives. Researchers are exploring targeted therapies that specifically act on the molecular mechanisms of infectious agents, allowing for more effective and tailored treatment approaches. This trend includes the development of antiviral drugs targeting specific viral proteins, antimicrobial peptides with selective activity against bacteria, and antifungal agents that inhibit specific fungal enzymes

- Increased investment in research and development: The demand for effective anti-infective drugs has prompted increased investment in research and development activities. Pharmaceutical companies, academic institutions, and government organizations are investing resources in discovering new drug targets, developing novel compounds, and conducting clinical trials to evaluate the safety and efficacy of new anti-infective treatments. This trend is expected to drive innovation and the discovery of new therapeutic options in the market

- Adoption of combination therapies: Combination therapies involving multiple anti-infective drugs or drug classes are being explored to address drug resistance and improve treatment outcomes. By using different mechanisms of action, combination therapies can enhance efficacy, prevent the emergence of resistance, and increase treatment success rates. This approach is particularly relevant in the treatment of complex infections or infections caused by multidrug-resistant pathogens

Anti-Infective Market Segmentations

Market Breakup by Drug Type

- Antibiotics

- Antifungal

- Antiviral

- Others

Market Breakup by Indication

- HIV Infection

- Pneumonia

- Respiratory Virus Infection

- Sepsis

- Tuberculosis

- Others indication

Market Breakup by Route of Administration

- Topical

- Oral

- Intravenous (IV)

- Others

Market Breakup by Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Anti-Infective Market Scenario

The global market for anti-infective drugs is a vital segment of the pharmaceutical industry. Anti-infective drugs are used to treat and prevent various infectious diseases caused by bacteria, viruses, fungi, and parasites. The market encompasses a wide range of therapeutic options, including antibiotics, antivirals, antifungals, and antiparasitic drugs.The market for anti-infective drugs is driven by several factors. Firstly, the increasing incidence of infectious diseases and the emergence of drug-resistant pathogens contribute to the demand for effective treatment options. Additionally, the growing global population, urbanization, and globalization increase the risk of infectious disease outbreaks, further fueling the market growth.

Moreover, the rising awareness of healthcare-associated infections and the importance of infection control measures drive the adoption of anti-infective drugs. Governments and healthcare organizations are taking initiatives to prevent and control infectious diseases, which further support market growth.

In recent years, there has been a focus on the development of novel drug candidates and the improvement of existing treatments. The market is witnessing advancements in drug delivery systems, combination therapies, and personalized medicine approaches. These developments aim to enhance the efficacy of anti-infective drugs, reduce side effects, and address drug resistance.

Anti-Infective Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Gilead Sciences, Inc

- Sandoz International GmbH

- Pfizer Inc

- GlaxoSmithKline plc

- Abbott

- Alcon Pharmaceuticals Ltd

- Astellas Pharma Inc

- Astrazeneca plc

- Bayer Healthcare AG

- Alkem Labs

Table of Contents

Companies Mentioned

- Gilead Sciences Inc.

- Sandoz International GmbH

- Pfizer Inc.

- GlaxoSmithKline plc.

- Abbott

- Alcon Pharmaceuticals Ltd.

- Astellas Pharma Inc.

- Astrazeneca plc.

- Bayer Healthcare AG

- Alkem Labs

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2023 |

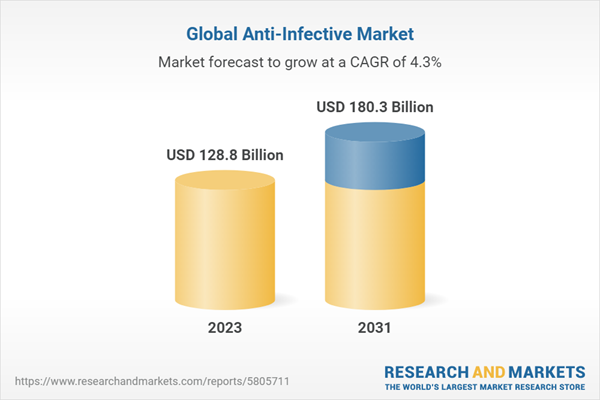

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 128.8 Billion |

| Forecasted Market Value ( USD | $ 180.3 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |