Human Platelet Lysate: Introduction

Human platelet lysate (HPL) is a cell culture supplement derived from human platelets, primarily used in regenerative medicine and cell therapy applications. It contains growth factors, cytokines, and other bioactive components that promote cell proliferation, differentiation, and tissue regeneration. HPL serves as an alternative to traditional animal-derived culture supplements and offers several advantages, including better cell viability, reduced risk of contamination, and improved clinical outcomes.Key Trends in the Human Platelet Lysate Market

Key trends in the market for human platelet lysate include:

- Increasing demand for regenerative medicine: The field of regenerative medicine is rapidly growing, driven by the need for innovative therapies to treat various diseases and injuries. Human platelet lysate plays a crucial role in supporting cell-based therapies, including stem cell transplantation, tissue engineering, and wound healing. As the demand for regenerative medicine continues to rise, the market for human platelet lysate is expected to witness significant growth

- Focus on quality and safety: With the growing importance of cell-based therapies in clinical practice, ensuring the quality and safety of human platelet lysate has become paramount. Manufacturers are implementing stringent quality control measures to ensure the absence of contaminants, such as viruses and endotoxins, in their products. Additionally, regulatory authorities are establishing guidelines and standards for the production and use of human platelet lysate, further emphasizing the importance of quality and safety

- Advancements in manufacturing processes: The manufacturing processes for human platelet lysate are continuously evolving to improve product consistency, scalability, and cost-effectiveness. Manufacturers are exploring new methods, such as freeze-drying and pathogen inactivation techniques, to enhance the stability and shelf life of the lysate. These advancements enable easier storage, transportation, and use of human platelet lysate, expanding its applicability in both research and clinical settings

Human Platelet Lysate Market Segmentations

Market Breakup by Type

- Heparin-based Human Platelet Lysate

- Heparin-free Human Platelet Lysate

- Others

Market Breakup by Applications

- Research

- Therapeutic

- Others

Market Breakup by End User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Others

Market Breakup by Distribution Channel

- Online Stores

- Retail Stores

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Human Platelet Lysate Market Scenario

The market for human platelet lysate (HPL) is experiencing substantial growth as it plays a pivotal role in the field of regenerative medicine and cell-based therapies. HPL, derived from human platelets, contains valuable growth factors and bioactive components that promote cell proliferation and tissue regeneration. It serves as a safer and more effective alternative to animal-derived culture supplements, driving its widespread adoption in research laboratories, biopharmaceutical companies, and clinical settings.The market is primarily driven by the increasing demand for regenerative medicine, which aims to develop innovative therapies for various diseases and injuries. HPL supports the growth and differentiation of stem cells, making it a vital component in tissue engineering, wound healing, and cell transplantation procedures. As regenerative medicine continues to gain momentum, the demand for high-quality HPL is expected to rise significantly.

Quality and safety are paramount in the market, with manufacturers implementing stringent quality control measures to ensure product purity and minimize the risk of contamination. Regulatory authorities are also establishing guidelines and standards to ensure the safe and effective use of HPL in clinical applications.

Advancements in manufacturing processes, including freeze-drying and pathogen inactivation techniques, are enhancing the stability and shelf life of HPL products. These developments improve product consistency, scalability, and cost-effectiveness, facilitating their broader utilization in research and clinical settings.

Collaborations and partnerships among researchers, clinicians, and biopharmaceutical companies are driving innovation in the field of HPL. These collaborations foster knowledge sharing, research collaborations, and the development of standardized protocols, further propelling market growth.

Human Platelet Lysate Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Merck KGaA

- Compass Biomedical, Inc

- STEMCELL Technologies Inc

- Sartorius AG

- Life Science Group Ltd.

Table of Contents

Companies Mentioned

- Merck KGaA

- Compass Biomedical Inc.

- STEMCELL Technologies Inc.

- Sartorius AG

- Life Science Group Ltd.

Table Information

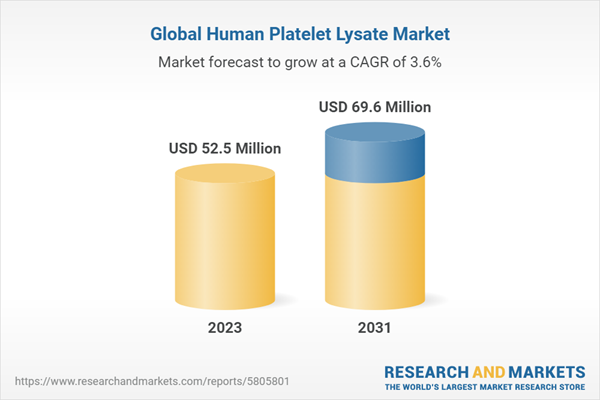

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 52.5 Million |

| Forecasted Market Value ( USD | $ 69.6 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |