Introduction

Drugs of Abuse Testing refers to the detection and analysis of illicit substances or prescription medications in biological samples such as urine, blood, or saliva. It plays a crucial role in various settings, including workplace drug testing, law enforcement, forensic investigations, and clinical toxicology. The objective of drugs of abuse testing is to identify the presence of drugs or their metabolites in the body, indicating recent drug use or potential substance abuse.Key Trends in the Drugs of Abuse Testing Market

Some key trends involved in the drugs of abuse testing market are as follows:- Increasing Substance Abuse Epidemic: The rising prevalence of drug abuse worldwide, including the misuse of opioids, stimulants, cannabis, and other illicit substances, has fueled the demand for drugs of abuse testing. Government initiatives and public awareness campaigns aimed at combating substance abuse are driving the adoption of testing methods

- Technological Advancements: The field of drugs of abuse testing has witnessed significant advancements in testing methods and technologies. Rapid and point-of-care testing devices, such as immunoassays and oral fluid tests, provide quick and convenient results. Furthermore, the emergence of advanced analytical techniques, including mass spectrometry and chromatography, has improved the accuracy and sensitivity of drug detection

- Legalization of Cannabis: The growing legalization of cannabis for medical and recreational purposes in several countries has impacted the drugs of abuse testing market. The need for accurate and reliable testing methods to differentiate between therapeutic and illicit cannabis use has increased. This has led to the development of specialized tests capable of detecting specific cannabis compounds and determining impairment levels

Drugs of Abuse Testing Market Segmentations

Market Breakup by Product Type

Analyzers

- Immunoassay Analyzers

- Chromatographic Devices

- Breath Analyzers

Rapid Testing Devices

- Urine Testing Devices

- Oral Fluid Testing Devices

Consumables

- Others

Market Breakup by Sample Type

- Saliva

- Urine

- Blood

- Others

Market Breakup by End Users

- Hospitals

- Diagnostics Laboratories

- Forensic Laboratories

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

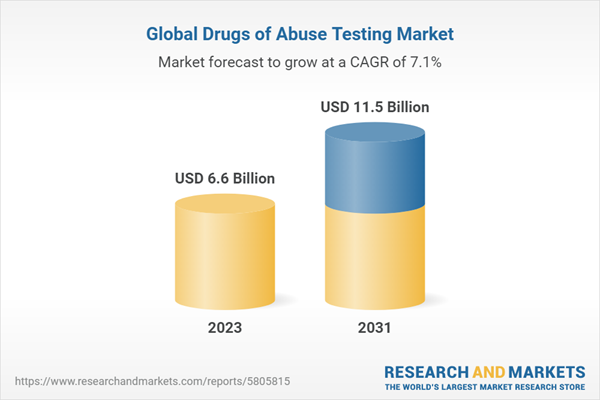

Drugs of Abuse Testing Market Scenario

The Drugs of Abuse Testing market is an essential component of the healthcare industry, focusing on the detection and analysis of illicit substances and prescription medications in biological samples. The market plays a vital role in various sectors, including healthcare, law enforcement, workplace safety, and forensic investigations. Drugs of abuse testing is critical in identifying drug use patterns, monitoring substance abuse, and ensuring public safety.The market for Drugs of Abuse Testing is driven by several factors. Firstly, the rising prevalence of drug abuse and the opioid crisis globally have created a pressing need for effective testing methods. The increased awareness of the social and economic burden associated with substance abuse has led to the implementation of stringent regulations and workplace drug testing programs.

Technological advancements have also played a significant role in shaping the market. Innovations in testing methods, such as rapid immunoassays, oral fluid tests, and advanced analytical techniques like mass spectrometry, have improved the accuracy, sensitivity, and speed of drug detection. These advancements have led to the development of more reliable and convenient testing solutions.

Drugs of Abuse Testing Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Danaher Corporation (Beckman Coulter, Inc.)

- Quest Diagnostics Inc

- LabCorp

- Drägerwerk AG & Co. KGaA

- Abbot Laboratories

- Express Diagnostics International INC

- F. HOFFMANN-LA ROCHE LTD. (GENENTECH INC.)

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Siemens AG

- Thermo fisher Scientific inc.

Table of Contents

Companies Mentioned

- Danaher Corporation (Beckman Coulter Inc.)

- Quest Diagnostics Inc.

- LabCorp

- Drägerwerk AG & Co. KGaA

- Abbot Laboratories

- Express Diagnostics International INC

- F. HOFFMANN-LA ROCHE LTD. (GENENTECH INC.)

- Laboratory Corporation Of America Holdings

- Quest Diagnostics Incorporated

- Siemens AG

- Thermo fisher Scientific inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 6.6 Billion |

| Forecasted Market Value ( USD | $ 11.5 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |