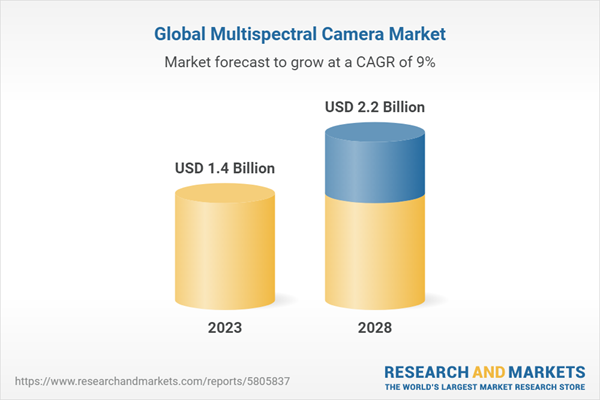

The Multispectral Camera Market is estimated to be USD 1.4 billion in 2023 and is projected to reach USD 2.2 billion by 2028, at a CAGR of 9.0% during the forecast period. Due to a number of factors, the global market for multispectral cameras is expanding significantly. Through the use of numerous spectral bands to capture images, multispectral cameras have completely changed the way that imaging technology is analyzed and interpreted. These cameras have numerous uses in a variety of sectors, including agricultural, defense, environmental monitoring, and healthcare.

Target and Tracking: The largest share of the Multispectral Camera Market by defense application in 2023

Based on Defense Application, the multispectral camera market has been segmented into target and tracking, Imaging Systems, Intelligence, Surveillance, and Reconnaissance target and tracking is expected to be the fastest-growing segment, during the forecast period. A multispectral camera in target and tracking applications refers to the use of a camera that can capture images in multiple spectral bands or wavelengths. Unlike conventional cameras that capture images in the visible spectrum (RGB), multispectral cameras can capture images in additional spectral bands, such as infrared (IR) or ultraviolet (UV), allowing for enhanced imaging capabilities. In target and tracking applications, multispectral cameras can be used to improve the detection, identification, and tracking of objects or targets.

Survey and mapping: The largest share of the Multispectral Camera Market by defense application in 2023.

Based on Commercial Application, the multispectral camera market has been segmented into survey and mapping, remote sensing, environmental monitoring, life science and medical diagnostics and other. The use of multispectral cameras in surveying and mapping applications is growing due to their ability to capture images in multiple spectral bands. These cameras offer valuable benefits for vegetation analysis, which is crucial in various fields such as agriculture, forestry, and environmental monitoring. By capturing images in specific spectral bands, multispectral cameras can provide detailed information about vegetation health, density, and species composition. This data is essential for assessing the quality of agricultural crops, monitoring forest health, detecting invasive species, and studying ecological changes

Uncooled technology Segment: The second largest segment of the Multispectral Camera Market by type in 2023

Uncooled multispectral cameras have secured the second-largest market share in their usage primarily due to their cost-effectiveness. Unlike cooled multispectral cameras that require complex and expensive cooling mechanisms, uncooled cameras operate without the need for active cooling. This eliminates the high costs associated with cooling components like cryogenic coolers, making uncooled multispectral cameras more affordable and accessible to a wider range of users and industries. The cost-effectiveness of uncooled multispectral cameras has been instrumental in their adoption across various applications. Industries such as agriculture, environmental monitoring, infrastructure inspection, and security can benefit from the capabilities offered by multispectral imaging, but often face budget constraints. Uncooled cameras provide a cost-efficient solution that allows these industries to leverage multispectral imaging without compromising on image quality or performance.

India to account for the largest CAGR in the Multispectral Camera Market in the forecasted year

India has witnessed significant growth in the use of multispectral cameras in recent years. Several factors contribute to this trend:

- Agriculture: India has a large agricultural sector, and multispectral cameras have proven to be valuable tools for crop monitoring, precision agriculture, and yield optimization. Multispectral cameras can assess plant health, identify crop diseases or nutrient deficiencies, and provide insights into irrigation needs. As Indian farmers increasingly adopt technology-driven farming practices, multispectral cameras offer crucial data for improving crop productivity and reducing input costs.

- Research and academia: India have a vibrant research and academic community involved in various scientific disciplines. Multispectral cameras are widely used in research applications such as ecology, forestry, geology, and atmospheric studies. They enable researchers to analyse and understand complex environmental phenomena, study biodiversity, and monitor ecosystem dynamics.

Break-up of profiles of primary participants in the multispectral camera market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level Executives - 35%, Director level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Rest of the world - 5%, Middle East & Africa - 10%

Prominent companies in the multispectral camera market are Teledyne FLIR (US), Leonardo DRS (US), Collins Aerospace (US), Hensoldt (Germany), JAI (Denmark), TetraCam Inc. (US), Telops Inc. (Canada), DJI (China), Paras Aerospace (India), Cubert GMBH (Germany), HGH Group (France), Ocean Insight (US), Sepctral Devices (UK), Silios technology (France), Unispectral (Israel), Opgal Optronics Industries Ltd. (Israel).

Research Coverage: The market study covers the multispectral camera market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such Cooling Technology, Application, End Use, Spectrum region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies. Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall multispectral camera market and its subsegments. The report covers the entire ecosystem of the multispectral camera industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and there are several factors that could contribute to an increase in the multispectral camera market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the multispectral camera market .

- Market Development: Comprehensive information about lucrative markets - the report analyses the multispectral camera market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the multispectral camera market .

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Teledyne FLIR (US), Leonardo DRS (US), Collins Aerospace (US), Hensoldt (Germany), JAI (Denmark), TetraCam Inc. (US), Telops Inc. (Canada), DJI (China), Paras Aerospace (India), Cubert GMBH (Germany), HGH Group (France), Ocean Insight (US), Sepctral Devices (UK), Silios technology (France), Unispectral (Israel), Opgal Optronics Industries Ltd. (Israel).

among others in the multispectral camera market.

Table of Contents

Companies Mentioned

- Bayspec Inc.

- Collins Aerospace

- Cubert GmbH

- DJI

- Headwall Photonics

- Hensoldt

- Hgh Group

- Iberoptics Sistemas

- Jai

- Leonardo Drs

- Neo As

- Ocean Insight

- Opgal Optronic Industries Ltd.

- Paras Aerospace

- Photon Etc.

- Raptor Photonics Ltd.

- Silios Technologies

- Spectral Devices

- Surface Optics Corporation

- Teledyne Flir

- Telops Inc.

- Tetracam Inc.

- Unispectral

- Wingtra Ag

- Xenics Nv

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 223 |

| Published | May 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |