Speak directly to the analyst to clarify any post sales queries you may have.

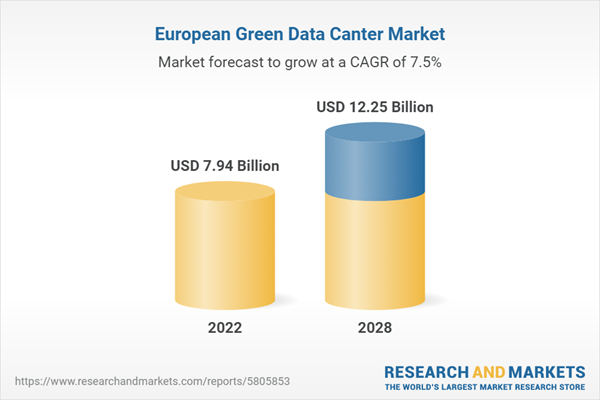

The Europe green data center is expected to grow at a CAGR of 7.49% from 2022-2028.

KEY HIGHLIGHTS

- Climate Neutral Data Center Pact has played a major role in increasing the sustainability of European data centers as all the signatories will be relying on renewable energy for their facilities by 2030.

- As of October 2022, over 100 companies have signed the Climate Neutral Data Center Pact, which operates more than 90% of data center capacity across Europe.

- Hyperscale operators in the Europe green data center market like AWS and Microsoft and colocation operators like Kao Data, NorthC Datacenters, and Data4 are taking multiple steps to improve their sustainability credentials.

- A few of the initiatives taken by major operators are: replacing diesel with HVO (Hydrogenated Vegetable Oil), the use of recycled construction material, the use of Fuel cells, vegetable oil, and other sustainable fuel sources and replacement of VRLA batteries with Lithium-ion batteries

- Data Center investors are moving to new locations like Spain, Portugal, Greece, and other sites where the availability of renewable energy is high with average land prices.

- Europe is at the forefront of renewable energy adoption. Europe’s commitment to adopting renewable energy and phasing out fossil fuels will promote the growth of renewable energy adoption by data center companies.

KEY TRENDS

- Hyperscale players such as Amazon Web Services (AWS), Google, Meta, and Microsoft are procuring renewable energy for their data centers.. AWS meets 85% of its energy requirements from renewable energy. Google and Meta meet 100% of their energy requirements for data centers from renewable energy. Microsoft will power all data centers with 100% renewable energy by 2025.

- Colocation operators in the Europe green data center market such as Equinix, Digital Realty, CyrusOne, Vantage Data Centers, OVHcloud, VIRTUS Data Centres, QTS Realty Trust, and others are proactively signing PPAs and procuring renewable energy to power their facilities to meet their sustainability goal.

- In September 2022, OVHcloud started constructing a new facility in Germany, renewable energy will be procured from Energieversorgung Limburg (EVL).

SEGMENTATION INSIGHTS

Electrical Infrastructure: Efficient and sustainable power infrastructure replacing traditional power systems.

- The increasing demand for efficiency in data centers has fueled the growth of efficient infrastructure such as lithium-ion UPS systems, fuel cells, HVO, Natural Gas generators, nuclear energy reactors, and more. AWS will use HVO across all of its European facilities. It has already replaced diesel with HVO in Ireland facility.

- Companies are using Microgrids and Smart grids to further stabilize power supply to the data center and back to the grid in the hour of need. Microsoft has partnered with Eaton, which will outfit all of Microsoft’s data centers with grid-interactive UPS.

Mechanical Infrastructure: Europe is to witness an increase in advanced cooling technologies.

- Most companies have deployed free cooling, and zero-water cooling, leveraging the cold temperature of the region. Colt Data Centre Services uses free cooling most of the year in the Paris Southwest data center; the same will be used in the announced expansion of this data center. DigiPlex has deployed air-free cooling in Sweden’s Stockholm 1 data center.

General Construction: Adopting sustainable and innovative construction design/material in Europe in data centers.

- Hyperscale operators like AWS, Microsoft, Apple, and Google are leading in using sustainable materials to construct facilities.

- Companies introduce technologies like green concrete, modular data centers, and more in their data center construction.

- Data4 has been using low-carbon concrete in its data centers since 2021.

- Zetto, a TV streaming service provider, placed its servers in windmills of WestfalenWind from where it has been streaming.

- Companies are investing in additional infrastructure like Aquifer Thermal Storage Systems to conserve heat.

GEOGRAPHICAL ANALYSIS

- The Nordic region is the most suitable region for green data center development as there is no need for water cooling. Nordic countries also source the maximum power supply from renewable energy.

- Site selection for data centers across Europe will mostly depend on access to renewable energy.

- There is continuous investment in renewable energy projects across Nordics and Western Europe, where data center companies also participate.

Segmentation By Geography

- Europe

- Western Europe

- UK

- Germany

- France

- Netherlands

- Ireland

- Switzerland

- Other Western European Countries

- Nordics

- Sweden

- Finland & Iceland

- Denmark

- Norway

- Central and Eastern Europe

- Russia & Czech Republic

- Poland & Austria

- Other Central & Eastern European Countries

KEY MARKET PARTICIPANTS

- Renewable energy companies like Engie, TotalEnergies, EDF Renewables, ENEL Group, Ørsted, and much more supply renewable energy to European green data center market operators. These companies are setting up new plants exclusively for data center companies, thus providing clean power sources for companies.

Key Vendors

- Amazon Web Services (AWS)

- Atman

- Beyond.pl

- Bulk Infrastructure

- CyrusOne

- Data4

- Digital Realty

- EdgeConneX

- Equinix

- Green Mountain

- Iron Mountain

- Kao Data

- Keppel Data Centres

- LCL Data Centers

- Microsoft

- Nautilus Data Technologies

- NorthC Datacenters

- NTT Global Data Centers

- OVHcloud

- Switch Datacenters

- STACK Infrastructure

- Serverfarm

- Scaleway

- Telehouse

- Vantage Data Centers

- VIRTUS Data Centers

- Verne Global

Renewable Energy Providers

- ACCONIA Energia

- Better Energy

- Bryt Energy

- Conrad Energy

- Datafarm Energy

- Eneco

- Enel Group

- Engie

- ERG

- GreenYellow

- HDF Energy

- Ilmatar Energy

- Neoen

- NTR

- Ørsted

- RWE Renewables

- ScottishPower

- Shell

- TotalEnergies

KEY QUESTIONS ANSWERED:

1. How big is the Europe green data center market?

2. What is the growth rate of the Europe green data center market?

3. What are the latest Europe green data center market trends?

4. Which region holds the largest Europe green data center market share?

5. How much MW of power capacity is expected to reach the Europe green data center market by 2028?

Table of Contents

Companies Mentioned

- Amazon Web Services (AWS)

- Atman

- Beyond.pl

- Bulk Infrastructure

- CyrusOne

- Data4

- Digital Realty

- EdgeConneX

- Equinix

- Green Mountain

- Iron Mountain

- Kao Data

- Keppel Data Centres

- LCL Data Centers

- Microsoft

- Nautilus Data Technologies

- NorthC Datacenters

- NTT Global Data Centers

- OVHcloud

- Switch Datacenters

- STACK Infrastructure

- Serverfarm

- Scaleway

- Telehouse

- Vantage Data Centers

- VIRTUS Data Centers

- Verne Global

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 259 |

| Published | May 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 7.94 Billion |

| Forecasted Market Value ( USD | $ 12.25 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 28 |