Skin antiseptics are compounds applied to the skin surface to eradicate or prevent the growth of germs. These substances are applied to the skin before surgical procedures to prevent infections. Skin antiseptics are crucial for maintaining a sterile environment when performing surgery or other invasive medical operations. The main goal of employing skin antiseptics is to lessen the number of bacteria on the skin's surface since these organisms might cause infections if they enter the body through a cut or other surgical invasion.

The danger of infections and the consequences they cause can be drastically decreased by healthcare professionals utilizing skin antiseptics. Also, there are numerous kinds of skin antiseptics available, including liquids, sprays, gels, and wipes. A wide variety of bacteria can be defeated by the active chemicals they contain. Povidone-iodine, chlorhexidine, and alcohol are the most often utilized active components in skin antiseptics.

The increased incidence of hospital-acquired infections is the primary factor driving the demand for skin antiseptics. Patients in a healthcare center can pick up bacteria, viruses, and other germs that cause these ailments. HAIs can result in various illnesses, from minor to serious, and can occasionally even result in death. Therefore, healthcare institutions must uphold strict hygiene standards, including skin antiseptics, to prevent HAIs. Skin antiseptics are furthermore crucial for lowering the risk of infection after intrusive treatments like surgeries and other medical procedures.

Moreover, a faster rate of growth in the antiseptic market has been observed globally due to rising healthcare costs. A greater emphasis is being placed on raising the standard of treatment and lowering infection rates as a result of the expanding healthcare sector. As a result, there is a rise in the demand for antiseptics, notably skin antiseptics.

COVID-19 Impact Analysis

The use of skin antiseptics extended outside of medical facilities, which had a favorable effect on the market expansion. The most popular skin antiseptics for skin disinfection are hand sanitizers having a significant proportion of alcohol content. They are capable of eliminating the COVID-19 virus as well as the majority of bacteria and viruses. Other skin antiseptics, like wipes and sprays with alcohol as an ingredient, are utilized in addition to hand sanitizers. Consequently, the pandemic contributed positively to market expansion.Market Growth Factors

Rise in occurrence of road accidents

Pedestrians, bicyclists, and motorcyclists make up more than half of all road traffic fatalities. Despite the fact that low- and middle-income nations have about 60% of the world's vehicles, they account for 93% of all traffic deaths. Given the rise in traffic-related injuries, healthcare practitioners are under a lot of pressure to deliver effective and timely care. The need for skin antiseptics for wound care and other uses will increase along with traffic accidents.Growing occurrence of HAI

The increase in the geriatric population, and the growth in cases of chronic conditions like diabetes, heart, cancer, obesity, and respiratory ailments are the leading causes of the rise in HAI. Over the years, the number of surgical operations carried out globally has risen significantly. The growing percentage of surgical operations has increased the demand for various surgical apparatus and medical devices. This is anticipated to increase the rate of hospital-acquired infections. In order to avoid the development of HAI, the market for cutaneous antiseptics is anticipated to expand.Market Restraining Factors

Concerns regarding the sterilization of skin antiseptics

Intrinsic contamination happens throughout the manufacturing process. Since most skin antiseptics are water-based, this problem will affect all water-based manufacturers unless the product can be sterilized or is sterilized after packaging. Due to the difficulty or impossibility of removing biofilms containing microorganisms from water systems, some of these organisms will undoubtedly infect the finished product during production. The main remedy for this would seem straightforward: sterilize the finished item. Over the projected time, the problem with skin antiseptics may impede market expansion.Type Outlook

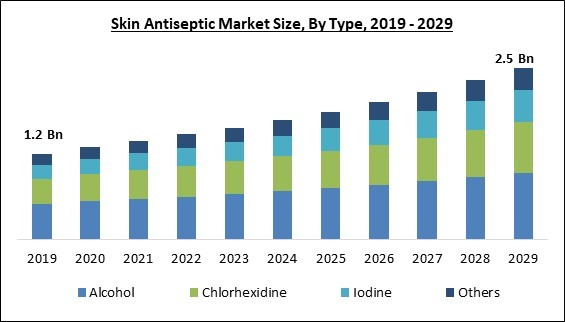

Based on type, the skin antiseptic market is segmented into alcohol, chlorhexidine, iodine and others. The chlorhexidine segment acquired a significant revenue share in the skin antiseptic market in 2022. Skin infections are treated with chlorhexidine, a topical antiseptic. It operates by eliminating skin-based fungi and germs. Therefore, skin problems like boils, acne, and eczema are frequently treated with this kind of treatment. Moreover, this substance is utilized to sanitize and clean the skin. Also, it helps to avoid skin inflammation.Distribution Channel Outlook

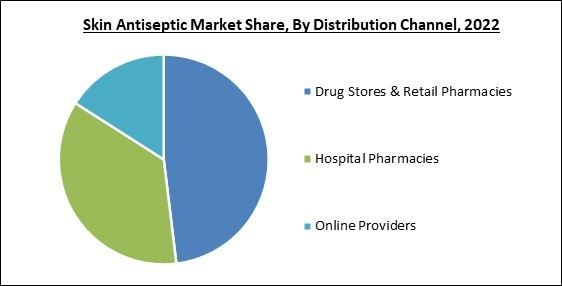

By distribution channel, the skin antiseptic market is bifurcated into hospital pharmacies, online providers, drug stores & retail pharmacies. In 2022, the drug stores & retail pharmacies segment dominated the skin antiseptic market with the maximum revenue share. It is primarily driven by the rising demand for outpatient treatments and the growing understanding of the significance of infection control. Additionally, the easy accessibility of skin antiseptics from these stores is one of the factors supporting market expansion in this segment.Form Outlook

On the basis of form, the skin antiseptic market is fragmented into solutions, cream, swab sticks, and others. The cream segment covered a considerable revenue share in the skin antiseptic market in 2022. Minor burns and scalds, cuts & grazes, chapped skin, tiny areas of sunburn, dryness, diaper rash, bug bites, spots, and pimples can all be treated with antiseptic cream also soothes and cures wounds while preventing infection. The key component promoting the growth is the creams' simple availability.Regional Outlook

Region wise, the skin antiseptic market is analyzed across North America, Europe, Asia Pacific and LAMEA. The Asia Pacific region garnered a significant revenue share in the skin antiseptic market in 2022. One of the main market drivers is the rise in healthcare spending in both the public and private sectors. The market is likely to increase as a result of this scenario, which is expected to attract several major and local businesses.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include XTTRIUM Laboratories, Sirmaxo Chemicals Private Limited, SCHÜLKE & Mayr GmbH, MÖLNLYCKE Health Care (Investor AB), Cardinal Health, Inc., Becton, Dickinson and Company, B. Braun Melsungen AG, 3M Company, PDI Healthcare, Inc. and Ecolab, Inc.

Recent Strategies Deployed in Skin Antiseptic Market

- Apr-2023: 3M Health Care launched the new FDA-approved 3M SoluPrep S Sterile Antiseptic Solution chlorhexidine gluconate (2% w/v) and isopropyl alcohol (70% v/v) Patient Preoperative Skin Preparation. The product has been shown to have fast-acting, broad-spectrum antibacterial action (in vitro; clinical significance unknown) and to persist in healthy human volunteers for at least 96 hours post-prep. 3M SoluPrep S Sterile Antiseptic Solution offers the efficacy healthcare professionals can rely on with the same active ingredients as the industry leader and additional benefits to help patients be protected. It is ideal for operating room nurses, doctors, and infection control professionals who want to prepare patient skin safely, effectively, and confidently before surgery to get rid of microorganisms on the skin that could potentially cause skin infections.

- Jul-2022: Schülke Group took over Wet Wipes A/S, a market leader in surface wipes in the Scandinavian healthcare market. The acquisition complemented the company's product portfolio and would help in further expansion to the Scandinavian market.

- Mar-2022: PDI Healthcare announced the dual launch of Sani-24® Germicidal Disposable Wipe, Sani-HyPerCide® Germicidal Spray, and Sani-HyPerCide® Germicidal Disposable Wipe, the novel, and innovative disinfectants. These products would help professionals in infection prevention in the fight against COVID-19 and healthcare-associated infections.

- Mar-2022: Cardinal Health introduced the first surgical incise drape utilizing industry-leading antiseptic Chlorhexidine Gluconate (CHG). The drape has patented BeneHold CHG adhesive technology from Avery Dennison, which helps lower the risk of surgical site contamination with microorganisms that are frequently linked to surgical site infections (SSIs). The incise film offers a sterile surface to create a barrier to contamination and is sturdy, conformable, and breathable. Using CHG's antimicrobial characteristics in the surgical drape's adhesive is a novel strategy that aims to improve patient care by further lowering the risk of microbial contamination. CHG is a trusted topical antiseptic for surgical patient skin preparation.

- Jan-2022: B. Braun opened a state-of-art Haemodialysis Concentrate Factory in the Thanh Oai Industrial Complex in Hanoi, Vietnam. With an initial investment of USD 5 million and a construction footprint of roughly 4000m2, the Haemodialysis Concentrate Factory enabled B. Braun Vietnam to supply the domestic and international markets with more than 2.5 million 10-litre canisters of hemodialysis each year. Additionally, it will make it possible for B. Braun Vietnam to continue serving the market and contribute to the daily protection and enhancement of the health of thousands of patients in Vietnam and all over the world.

- Jun-2021: Schülke & Mayr GmbH announced an exclusive distribution agreement with Bactiguard for its wound care solutions' range to German hospitals. The agreement enabled Schülke to add Bactiguard's hypochlorous acid-based portfolio to its extensive line of antibacterial and wound care products.

- Jul-2020: BD introduced the BD PurPrep patient preoperative skin preparation with a sterile solution. This solution is the first and single fully sterile povidone-iodine plus isopropyl alcohol single-use antiseptic skin preparation commercially accessible in the United States.

Scope of the Study

By Type

- Alcohol

- Chlorhexidine

- Iodine

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Providers

By Form

- Solutions

- Swab Sticks

- Cream

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- XTTRIUM Laboratories

- Sirmaxo Chemicals Private Limited

- SCHÜLKE & Mayr GmbH

- MÖLNLYCKE Health Care (Investor AB)

- Cardinal Health, Inc.

- Becton, Dickinson and Company

- B. Braun Melsungen AG

- 3M Company

- PDI Healthcare, Inc.

- Ecolab, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- XTTRIUM Laboratories

- Sirmaxo Chemicals Private Limited

- SCHÜLKE & Mayr GmbH

- MÖLNLYCKE Health Care (Investor AB)

- Cardinal Health, Inc.

- Becton, Dickinson and Company

- B. Braun Melsungen AG

- 3M Company

- PDI Healthcare, Inc.

- Ecolab, Inc.