Electronic data management effectively and securely organizes, stores, safeguards, and retrieves electronic data. Managing numerous forms of electronic data, such as papers, photographs, video & audio files, and other digital information, is a part of this. One of the reasons influencing the market development for electronic data management is the increasing uptake of cutting-edge technologies like artificial intelligence (AI), cloud computing, real-time GPS monitoring, and other solutions.

Electronic data management benefits businesses and companies by providing a centralized interface with consumer apps, data management, better transparency, and support for current regulations and compliances. Demand for data fusion and visual analytics has increased, which has aided the market's expansion. Real-time analysis and real-time data synthesis for good decision-making are made feasible by artificial intelligence in cognitive media solutions.

Companies are also introducing products that use artificial intelligence to enhance the AI capabilities of analytics. In addition, several businesses are implementing business analytics software to represent dynamic data in their operations. IoT, data privacy & security, cloud computing, collaboration, and remote work are a few developments expected to impact the future of electronic dance music (EDM). The significance of EDM will probably continue to increase as long as businesses produce and handle enormous amounts of data.

The ability to share information more widely within an electronic data management system presents a significant security risk. As a result, if adequate security measures are not implemented to thwart hackers, important corporate data could end up in the wrong hands. In addition, it can be expensive to implement an EDM system, especially for small & medium-sized businesses. Expenses may include the purchase of software and hardware, as well as maintenance and continuing support. Large enterprises may find these expenses enormous, especially installing an on-premises solution that calls for a sizable hardware infrastructure. Over the projected time, it is predicted that these factors will restrain the expansion of the electronic data management market.

COVID-19 Impact Analysis

The COVID-19 outbreak positively affected the electronic data management market because companies had to adapt quickly to new ways of working and managing data remotely. The pandemic's most important repercussions have been a shift toward remote work and virtual collaboration, raising the demand for cloud-based data management systems. Also, as businesses look for ways to safely store and share data across remote teams and regions, there has been a rise in demand for cloud storage and collaboration tools.Market Growth Factors

Growing adoption of EDM solutions

The market is expanding due to the use of corporate databases in industries like telecom, IT, aerospace, healthcare, and government. In addition, due to the requirement to manage the massive amount of data produced each year, enterprise databases have become increasingly utilized in IT departments. Enterprise data management has become increasingly popular, which has prompted businesses to use it more frequently. In addition, manufacturing companies are using fresh, modern strategies to support businesses with data management. Therefore, these elements will probably fuel the growth of the enterprise data management market throughout the forecast year.Growing data management & risk management solutions

Enterprises currently have a ton of unstructured data. Any business must be able to create and gather useful data from them in real time. Organizations can access data through EDM. This increased demand from the IT, financial, and other industries for this readily available data will greatly impact the corporate data management industry. Also, this market is in high demand due to growing technical breakthroughs, the launch of new products and services, and other strategic collaborations by the leading players. As an illustration, it is anticipated that the rise of data management and risk management solutions will accelerate market growth.Market Restraining Factors

High cost of installation and lack of awareness regarding technology

Most of an organization's processes can be automated using enterprise software. This technology can manage an infinite amount of data while making useful alterations. Contract management offers a plethora of features and advantages that are extremely beneficial. On the other hand, it is anticipated that a lack of awareness regarding the technology will slow down the pace of adoption. In addition, the availability of data silos is likely to act as a barrier to the expansion of the market throughout the anticipated time period. As a result, the variables discussed thus far are expected to inhibit the expansion of the market.Offering Outlook

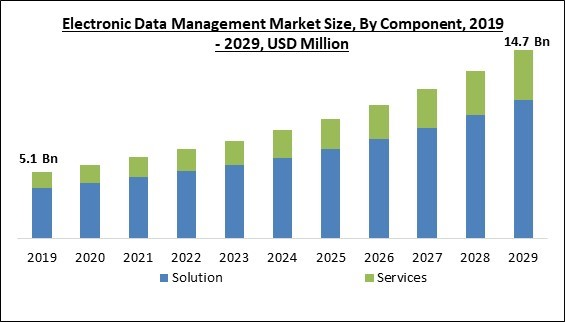

Based on offering, the electronic data management market is segmented into solution, and services. In 2022, the solutions segment held the highest revenue share in the electronic data management market. Using redundant or unstructured data can be challenging, but electronic data management solutions help create a framework for obtaining valuable information. Furthermore, these alternatives provide correct information and aid in data management across departments. Therefore, businesses' intense attention to guaranteeing timely, correct information during the projection period is expected to be the primary driver of market growth.Deployment Type Outlook

On the basis of deployment type, the electronic data management market is classified into cloud, and on-premises. The on-premise segment garnered a significant revenue share in the electronic data management market in 2022. By installing on-premises, a company may completely control the software and hardware it uses, where it is housed, and who gets access to it. The gear could consist of servers made expressly for this function or similar generic servers & storage systems used for other reasons.Organization Size Outlook

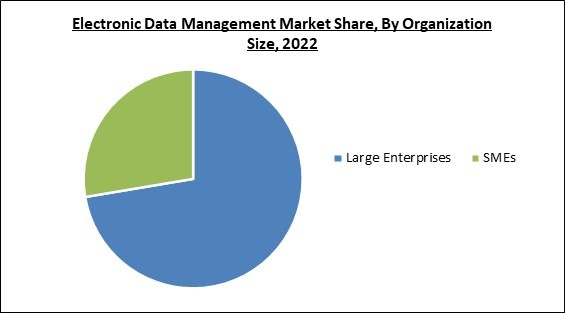

By organization size, the electronic data management market is bifurcated into large enterprises, small and medium enterprises. In 2022, the large enterprise segment witnessed the largest revenue share in the electronic data management market. Managing & organizing their data sets can be difficult for large companies with numerous departments that regularly process significant amounts of data. Maintaining accuracy and consistency across all the data sources can be challenging as data volume and diversity rise. Large businesses must properly organize, handle, and analyze enormous amounts of data, which requires electronic data management. Managing electronic data has become vital to corporate operations with the increasing reliance on digital technologies and processes.End-user Outlook

Based on end-user, the electronic data management market is categorized into BFSI, healthcare, retail, IT & telecom, manufacturing, and others. The IT & telecom segment recorded a remarkable revenue share in the electronic data management market in 2022. The main reason is the increased demand for data management and storage among top IT companies worldwide. In addition, IT and telecom firms keep expanding their innovation efforts to support long-term initiatives in prospective strategic fields.

Regional Outlook

Region wise, the electronic data management market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the electronic data management market by generating the highest revenue share. It is because of the rising use of cloud computing and the rising need for large corporations and SMEs to increase operational efficiency. The region is home to the top global technology companies that are driving innovations in the electronic data management market. Due to North America's advanced IT infrastructure and a high degree of digital maturity, the market is expanding.The Cardinal Matrix - Electronic Data Management Market Competition Analysis

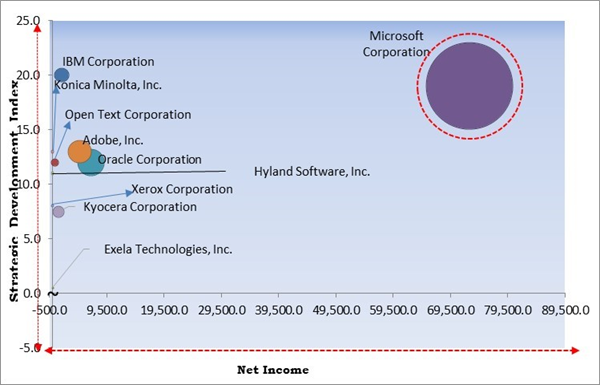

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunner in the Electronic Data Management Market. Companies such as Adobe, Inc., Oracle Corporation, and Kyocera Corporation are some of the key innovators in Electronic Data Management Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, Oracle Corporation, IBM Corporation, Open Text Corporation, Adobe, Inc., Kyocera Corporation, Konica Minolta, Inc., Hyland Software, Inc., Xerox Corporation and Exela Technologies, Inc.

Strategies Deployed in Electronic Data Management Market

Partnerships, Collaborations and Agreements:

- Mar-2023: IBM came into partnership with Adobe to provide aid to marketing and creative enterprises in the optimization of their content supply chain. With this partnership, combining the power of Adobe Commerce with IBM iX Experience Orchestrator would be helpful in providing businesses with the best services in the processes such as creation, management, deployment, and analyzing content.

- Oct-2022: Open Text came into partnership with Google Cloud, a subsidiary of Google, LLC, for digitalization and streamlining workflows. Through this partnership, Open Text Core Content would be integrated with Google Workspace to enable users in syncing content to several devices for offline access and empower them to access and edit the content under the business applications.

- Oct-2022: Microsoft expanded its partnership with UBS, a multinational investment bank and financial services enterprise, to advance Microsoft cloud capabilities to serve banks and financial industries better. With this expansion of the partnership, both companies would bring the capabilities of their cloud-based offerings to jointly develop advanced and powerful products and solutions to fulfil the digital requirements of the bank and financial services sector.

- Oct-2022: Microsoft signed a partnership with Databricks, a Software company, for advancing cloud-based analytics solutions. Through this partnership, combining Microsoft's cloud offerings with Databricks's software capabilities would advance Microsoft's Intelligent Data Platform, enabling developers, DBAs, Data Engineers, Data Scientists, Business Analysts, and Data Officers in getting a seamless experience with analytics and machine learning applications.

- Sep-2022: Konica Minolta partnered with Mobotix, an IP video technology provider, to better provide Indian customers with AI-enabled and IoT-powered smart video security and analytics offerings. With this partnership, Konica's deep expertise in offering AI and Deep Learning solutions would be integrated with Mobotix's advanced camera technology to serve businesses and governments by delivering smart security solutions that safeguard their assets, workforce, and operations.

- Jun-2022: Oracle and Kyndryl, an IT infrastructure services provider, partnered to help customers in digitalizing their entire business journey with the use of cloud solutions. Through this partnership, Kyndryl’s technological expertise would be integrated with Oracle Cloud Infrastructure capabilities boosting businesses to shift their critical workloads to the cloud and streamline their mission-critical operations.

- May-2022: Oracle partnered with Data Intensity, a cloud migration and management service provider, for driving and transforming Oracle-powered workloads to Oracle Cloud Infrastructure (OCI). Through this partnership, Data Intensity's expertise in providing management services would be combined with Oracle Cloud Infrastructure to develop EASE, a model that fulfills the critical business requirements of cloud-driven trends, benefiting Oracle to help its customers in their digital journey with value-added offerings.

- Apr-2022: Konica Minolta came into partnership with ELO Digital Office, an enterprise content management software provider, to support businesses in the digital transformation of their entire processes of information management. Through this partnership, Konica's capabilities in information management would be combined with ELO Digital Office’s robust enterprise content management technology including Data Capture, Business Process Automation, and Document and Records Management, helping businesses to enhance records management capabilities and transform their business operations digitally.

- Nov-2021: Oracle expanded its partnership with Airtel, a Telecommunications company, to strengthen the growth of India’s digital economy by offering Indian businesses an extensive range of cloud solutions. With this partnership, Oracle would leverage the power of Airtel Nxtra, the data center subsidiary of Airtel offering 5G data network requirements, to jointly develop cloud solutions for digitizing the Indian economy.

- Oct-2021: IBM collaborated with Apptio, a technology business management SaaS application, for helping clients in improving hybrid cloud technology decision-making and drive the adoption of Red Hat OpenShift and IBM's open hybrid cloud strategy. Together, the companies aim to assist clients to execute their workloads in the best hybrid cloud environment, whether in the cloud or on-premises.

- Jul-2021: IBM signed an agreement to acquire Bluetab, an IT Services company serving large corporations in the highly specialized Data Solutions space. The acquisition would enable IBM to advance its AI and hybrid cloud strategy further throughout Latin America, Europe, and North America.

- Jul-2021: Oracle came into partnership with Everest, a financial technology provider, to serve banks better with blockchain technology. With this partnership, Oracle's Financial software capabilities would be combined with Everest's expertise in blockchain technology to empower Oracle in offering banks the blockchain for identity and account creation.

Product Launches and Product Expansions:

- Apr-2023: IBM unveiled PureData System, an addition to IBM's PureSystems lineup of integrated systems, for the management of the huge amount of data in cloud workspaces. PureData System would include three workload-specific models namely, PureData System for Transactions, PureData System for Analytics, and PureData System for Operational Analytics, to facilitate worldwide companies in quick management and analysis of petabytes of data.

- Mar-2023: Adobe released Adobe Product Analytics; a product analytics category built on the Adobe Experience Platform. With the use of Adobe Product Analytics users would be able to analyze patterns and altercation in customer engagement over time, the growth rate in the user base, and required trends across audiences. Moreover, the offering would empower users to readily optimize products and analyze the impact of feature releases helpful in knowing the effect of engagement.

- Mar-2023: Adobe introduced Firefly, a portfolio of Creative Generative AI models. Firefly, a part of Adobe Sensei's generative AI services lineup, would be centered around the creation of images and text effects, providing more precision, and speed to Creative Cloud, Document Cloud, Experience Cloud, and Adobe Express workflows where content is needed to be generated and modified.

- Nov-2022: IBM announced the launch of Business Analytics Enterprise, a portfolio of business intelligence planning, budgeting, reporting, forecasting, and dashboard solutions, to offer users a powerful view of data sources across their business. IBM Business Analytics Enterprise would also incorporate the latest IBM Analytics Content Hub facilitating users in managing and accessing analytics and planning tools from several vendors in a single, and personalized dashboard.

- Nov-2022: Microsoft released Microsoft Supply Chain Platform, an open, and flexible offering that enables visibility and control across supply chain management, to strengthen businesses in bringing low-code, security, and SaaS applications in a composable platform. Supply Chain Platform's resiliency would allow businesses to gain insights into their supply chain data investment and take action on it.

- Oct-2022: Open Text released Cloud Editions 22.4 (CE 22.4). The Cloud Editions 22.4 (CE 22.4), a lineup of innovative solutions offering consistent and integrated information management in the cloud, would deliver customers the tools and services empowering customers to accelerate the cloud-based digital transformation of their businesses required for modern work.

- Jul-2022: OpenText introduced three innovative offerings on the Salesforce AppExchange namely, OpenText Core Content, a Content Services platform, OpenText Media Management, a digital asset management solution and OpenText Documentum, a platform that organizes and makes information easily accessible. With these offerings, OpenText would be able to serve existing OpenText customers by empowering them to easily manage the information utilizing powerful SaaS platforms with applications.

- Jun-2022: Adobe announced the launch of Adobe Real-Time CDP, an offering to its customer data platform (CDP) family. Adobe Real-Time CDP, a part of Adobe Experience Cloud and an AI-based tool, would be capable of offering real-time information and more than one petabyte of data processing per day, supporting worldwide brands to provide personalized experiences to customers in real-time. The offering would empower brands to collect first-party data and utilize consent-based practices to develop actionable client profiles, segment populations, and deliver personalized experiences to audiences.

- Jun-2022: Kyocera released Kyocera Cloud Information Manager, a powerful Cloud-based entry-level SaaS solution for SMBs enabling businesses to shift their operations from paper-based to digital document management empowering remote staff to access documents anytime and from anywhere. Kyocera Cloud Information Manager facilitates enterprises in digitalizing their physical documents.

- Mar-2022: Hyland introduced content services and intelligent automation products incorporating Content Services, Hyland Healthcare solution, and Capture. The Content Services include the Alfresco platform, Perceptive Content, and Intelligent Automation, the innovative tools offering cloud-based business solutions, efficient performance, augmented security, scalability, and visibility to businesses. The advanced Hyland Healthcare offering would provide access to the patient information not residing in the electronic medical record. The powerful Capture within Hyland’s cloud-derived capture product would deliver automatic detachment by barcode for automated document splitting of 1D and 2D barcodes.

- Jul-2021: Konica introduced Cloud Data Centre services, an Infrastructure as a Service (IaaS) package to Konica's cloud suite, allowing enterprises to cut costs and effort required in IT infrastructure while increasing security. Utilizing the power of Cloud Data Centre would enable IT teams to shift their focus from manual computing, storage, and network infrastructure to more innovative jobs helpful to propel the digital transformation of the organizations.

Acquisitions and Mergers:

- Jan-2023: Microsoft completed the acquisition of Fungible, a data processing unit (DPU) company, to facilitate Microsoft in delivering multiple data processing unit offerings. With this acquisition, Fungible's leading technologies in augmenting networking and storage performance would be integrated with Microsoft’s data center infrastructure to innovate and advance DPU solutions, and network, and hardware systems.

- Jan-2023: OpenText acquired Micro Focus International plc, a provider of targeted critical software technology, to provide aid to customers in the digital transformation of their businesses. With this acquisition, Micro Focus' offerings capabilities would be leveraged by OpenText, facilitating businesses of all sizes in propelling their digital transformation beneficial in operational security, getting information deep insights, and in the management of hybrid and complex digital infrastructure through the utilization of advanced tools such as Cybersecurity, Digital Operations Management, Applications Modernization & Delivery, and AI & Analytics.

- Jul-2022: IBM took over Databand.ai, a data observability enterprise, to boost IBM's hybrid cloud and AI offerings. Through this acquisition, the combined power of Databand’s data observability platform and IBM Observability by Instana APM and IBM Watson Studio would empower IBM to deliver improved observability tools all over IT operations.

- Jun-2022: Oracle took over Cerner, a U.S.-based health information technology services, devices, and hardware provider. Through this acquisition, Leveraging the power of Cerner in providing advanced healthcare facilities and utilizing the capabilities of Oracle's Autonomous Database, low-code development tools, and Voice Digital Assistant user interface would enable Oracle to better serve the healthcare sector allowing medical professionals to deliver high-level patient care through modernized electronic health records.

- Mar-2022: Microsoft acquired Nuance Communications, Inc., a conversational AI, and ambient intelligence company. The acquisition integrated Microsoft's secure and trusted industry cloud offerings with Nuance's best-in-class conversational AI and ambient intelligence. This acquisition will assist providers in providing healthcare that is more inexpensive, efficient, and accessible, as well as assist businesses across all industries in providing more individualized and engaging customer experiences.

- Jul-2021: Microsoft announced the acquisition of CloudKnox Security, a provider of complete visibility into privileged access. The acquisition helped Microsoft Azure Active Directory clients with continuous monitoring, granular visibility, and automated remediation of multi and hybrid cloud permissions.

- Jun-2021: Xerox took over Document Systems, a document solutions supplier operating in Southern California, for extending its reach in the U.S. by delivering document solutions to U.S. SMBs. With this acquisition, Document Systems' business would come under Xerox enterprise empowering Xerox to improve its capabilities in offering document management services delivering increased productivity and enabling Xerox to serve SMBs better.

- Apr-2021: Hyland took over Nuxeo, a software enterprise producing an open-source content management system, to advance Hyland's cloud-native platforms and open-source offerings. Through this acquisition, Nuxeo's entire business incorporating AI and machine learning services and cloud-native products and technology would be transferred to Hyland, enabling Hyland to deliver its customers the enhanced cloud-based, open source, and low-code content services platform.

- Apr-2021: Xerox completed the acquisition of Groupe CT, a document management provider, to serve small and medium businesses. With this acquisition, Groupe CT's document management services capabilities would be leveraged by Xerox in advancing their suite of workplace solutions, facilitating Xerox in helping SMBs to digitalize their business operations.

- Feb-2021: Konica acquired Data Connect Technologies, a technology services enterprise. Through this acquisition, leveraging the power of Data Connect in offering Information and Communication Technology solutions, Konica would be able to broaden its offerings such as MFP products, workflow services to Optimized Print solutions, and Managed IT services and better extend its reach in providing services to customers.

Geographical Expansions:

- Oct-2021: Kyocera expanded its geographical footprint with the launch of business optimization and workflow tools namely, Kyocera Capture Manager (KCM)and Kyocera Smart Information Manager (KSIM) in the South African region. The new offerings are developed for supporting enterprises in transforming paper-based workspaces into digital-based businesses. KCM would capture all forms of documents and once KCM scans the documents, KSIM would filter documents, enabling enterprises to easily access the documents. With this expansion, Kyocera's reach in offering digitally driven services in the South African region would be enhanced.

- Sep-2021: Exela expanded its geographical footprints in the United Kingdom with the launch of an electronic signature solution namely DrySign. The new offering would just need an internet-enabled system empowering UK users to sign documents from anywhere at a low cost. Moreover, the DrySign platform would remove the requirement to print, scan, email, and post files.

Scope of the Study

By Offering

- Solution

- Services

By Deployment Type

- Cloud

- On-premise

By Organization Size

- Large Enterprises

- SMEs

By End-user

- BFSI

- Retail

- Manufacturing

- IT & Telecom

- Healthcare

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Open Text Corporation

- Adobe, Inc.

- Kyocera Corporation

- Konica Minolta, Inc.

- Hyland Software, Inc.

- Xerox Corporation

- Exela Technologies, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Open Text Corporation

- Adobe, Inc.

- Kyocera Corporation

- Konica Minolta, Inc.

- Hyland Software, Inc.

- Xerox Corporation

- Exela Technologies, Inc.