A decentralized and shared digital distributed ledger that keeps track and gives the history of a person's transactions, including claims, is known as a blockchain in insurance. This technology aids insurers in preventing, detecting, and combating fraud. In addition, for customers and insurers to manage claims in a transparent and timely manner, smart contracts are available due to blockchain technology. Insurance companies have started testing and validating new models based on blockchain technology, starting with internal, low-risk prototypes and pilot projects within their infrastructure.

Blockchain is a technique that securely saves cryptographic data. Many people used to favor insurance brokers. Paper-based policies, payments, contracts, and claims were vulnerable to numerous mistakes. This form of insurance carries a significant amount of risk. Among the threats are policy loss, abuse, and misinterpretation. However, all of these tasks have become simple with the aid of blockchain in the insurance market. In several places, blockchain technology for insurance is getting a lot of attention.

It is a technology with unique components like Bitcoin and cryptocurrency. Blockchain has a significant impact on insurance firms. Blockchain has many advantages in the insurance industry. With regard to insurance technology, the blockchain has features for high security and fraud avoidance. The curriculum also includes property-casualty management as a key component. It oversees the administration of reinsurance, life insurance, and health insurance.

COVID-19 Impact Analysis

The demand for the market is anticipated to increase dramatically after COVID-19. Additionally, Blockchain adoption in the insurance industry will be higher. The main causes of the rising demand are fraud prevention measures and strong security features. After the COVID-19 pandemic has passed and the insurance sector has recovered, blockchain adoption is anticipated to soar in the upcoming years. Also, many people adopted life and health insurance during this time because of their worries about their health during the pandemic. Although the pandemic had a minor impact on market growth, the above-mentioned factors caused the market to rebound and experience significant growth during and after the pandemic.Market Growth Factors

The use of cutting-edge software platforms

Especially in the BFSI sector, blockchain is expected to expand extremely quickly. The technology development is anticipated to give blockchain service providers previously unheard-of options to adapt their offerings and make them available to such banks. As a result of the phenomenal expansion of BaaS, some giants of the IT industry have begun adding BaaS modules to their cloud computing platforms. As a result, the expansion of the blockchain in the insurance market is being driven by these insurance-related aspects.Rising demand for safe online platforms

The adoption of secure online platforms is driving the expansion of the blockchain in insurance, as the insurance sector is increasingly utilizing digital technology to boost operations, expedite procedures, and improve customer experience. Due to this, there is an increasing need for secure online platforms that can give users an effortless and secure digital experience. In addition, the move toward working-from-home trends and online access to services, including insurance, has also been pushed by the pandemic. As a result, there is a growing demand for safe online platforms that can offer dependable and secure access to data and services as more consumers access insurance services online and conduct business remotely.Market Restraining Factors

Regulatory status uncertainty and a lack of consistent norms

Blockchain technology used in insurance is constantly evolving. These developments impact the existing regulatory requirements. However, this aspect impacts technology utilization as it is challenging for regulatory bodies to keep up with technological changes. Regulatory agencies must comprehend how the rules can affect the entire application of technology in light of these technological breakthroughs. Regulator uncertainty is still a worry in the insurance industry's adoption of blockchain technology. Hence, uncertain rules and a lack of uniform standards for writing cryptocurrency transactions on blockchain technology impact its adoption in the insurance sector.Component Outlook

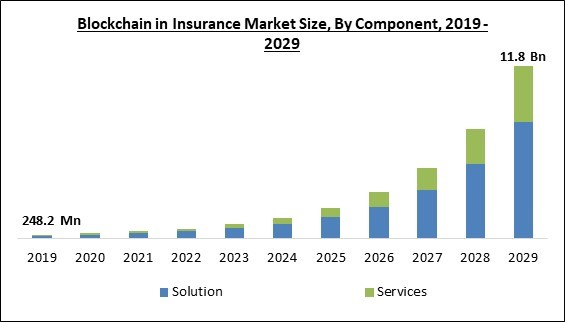

Based on component, the blockchain in insurance market is segmented into solution and services. The services segment acquired a substantial revenue share in the blockchain in insurance market in 2022. This is because these services can provide insurance with a focus on the needs of the customer and maximizing profits. Additionally, for insurance firms, blockchain technology holds a lot of promise because it supports several key operations, such as the gathering of data on insured individuals.Application Outlook

On the basis of application, the blockchain in insurance market is divided into GRC management, claims management, identity management & fraud detection, payments and others. The claims management segment procured a significant revenue share in the blockchain in insurance market in 2022. This is due to the fact that the system offers a complete record of customer and insurance data, which aids in preventing duplicate claim payments. Insurance businesses may simplify claim intake and validation using blockchain technology, which ensures fair and transparent claim resolution.Enterprise Size Outlook

By enterprise size, the blockchain in insurance market is classified into large enterprises and small and medium-sized enterprises. The large enterprises segment witnessed the largest revenue share in the blockchain in insurance market in 2022. This is because with blockchain the information is secure and automated. The use of a smart contract on blockchain technology enables this type of payment contract to be performed without human interaction. This potent technology can benefit big businesses with the automation of the contract.Regional Outlook

Region-wise, the blockchain in insurance market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the blockchain in insurance market in 2022. This is due to the fact that major North American retail banking service providers are utilizing blockchain technology to benefit their clients and combat fraud. Due to the quick adoption of the technology for KYC/ID fraud prevention and risk scoring, it is also projected that blockchain technology would be advantageous for the insurance industry.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Amazon Web Services, Inc. (Amazon.com, Inc.), Microsoft Corporation, Oracle Corporation, IBM Corporation, RecordsKeeper, Symbiont, Xceedance, Auxesis Services & Technologies (P) Ltd., Cornerstone Insurance Brokers Ltd. (SafeShare) and ConsenSys Software Inc.

Scope of the Study

By Enterprise Size

- Large Enterprises

- Small & Medium-sized Enterprises

By Component

- Solution

- Services

By Application

- Identity Management & Fraud Detection

- Claims Management

- Payments

- GRC Management

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- RecordsKeeper

- Symbiont

- Xceedance

- Auxesis Services & Technologies (P) Ltd.

- Cornerstone Insurance Brokers Ltd. (SafeShare)

- ConsenSys Software Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- RecordsKeeper

- Symbiont

- Xceedance

- Auxesis Services & Technologies (P) Ltd.

- Cornerstone Insurance Brokers Ltd. (SafeShare)

- ConsenSys Software Inc.