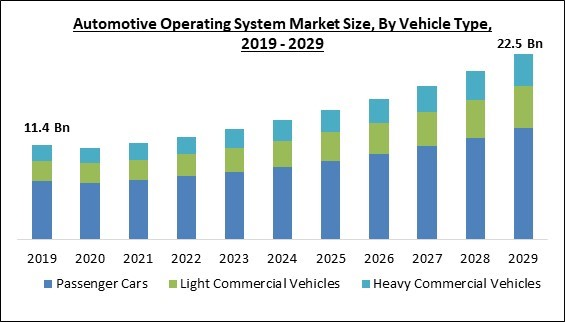

The Global Automotive Operating System Market size is expected to reach $22.5 billion by 2029, rising at a market growth of 9.1% CAGR during the forecast period.

An automotive operating system (automotive OS) is a platform for developing and managing all vehicle domain services and applications. It facilitates close, cross-company collaboration and comprises a software factory and a base layer. In addition, automotive OS is a framework for infotainment that automakers include in vehicles. Without a phone, drivers can use an interface made for the vehicle screen by downloading appropriate apps simply into their vehicles.

Every automotive OS differs significantly in terms of program size, functionality, complexity, the effort required for creation, needed hardware, lifetime maintenance, pricing, and support effort. A typical operating system might include as few as a few hundred lines of code or as many as tens of millions for popular OSes like Linux and Windows. The ecosystem and capabilities of the OS are also crucial for creating the software and app platforms needed for software-defined vehicles. For the finest OS to serve the expanding software-defined vehicles of the future, a sizable ecosystem and infrastructure are therefore necessary.

The OS kernel finds all the essential tools for controlling the software and hardware. The two primary methods of structuring the kernel are the monolithic kernel and the microkernel OS. All essential OS features, such as OS services and system calls, are in the kernel area under a monolithic design. The leading monolithic kernel operating system is Linux. A modest software platform called a hypervisor is used to manage many OS platforms as well as their apps. Infotainment and functional-safety features, such as a head-unit display (HUD) for a backup monitor, requires hypervisors.

COVID-19 Impact Analysis

Market growth and trends were significantly impacted by the COVID-19 pandemic. Yet the development of COVID-19 vaccinations was helpful for the car and transportation sectors. Following that, many companies began to resume production in areas worldwide where people had received vaccines while taking strict safety measures to protect employees. In addition, significant businesses that provide innovative technology & solutions to OEMs have also made a significant effort to repair the damage brought on by COVID-19 using a variety of strategies. Consequently, the rise of the automotive industry is expected to fuel the market's growth in the years to come.

Market Growth Factors

The increasing number of ECUs and domain controllers in automobiles

The cockpit has intelligent sensing and interaction capabilities owing to the cockpit domain controller. This contributes to a better interactive experience for users. The significance of cockpit domain controllers is anticipated to keep increasing due to evolving in-vehicle infotainment and expanding ADAS feature adoption. The Real-Time Operating System (RTOS), virtual machines, GPU, general-purpose OS (Android and Linux), and CPU, among others, are needed by domain controllers for the cockpit domain to operate properly. Operating system demand will rise as a result. Considering all the aforementioned factors, the market for automotive operating system is expected to grow throughout the forecast period.

Introduction of vehicles defined by software

When compared to hardware-defined vehicles, software-defined vehicles provide several benefits. For example, telematics, car diagnostic, and other software changes involving vehicle entertainment systems will demand a visit to the dealership. However, with software-defined vehicles, users can download over-the-air (OTA) upgrades that address security patches, infotainment enhancements, and monitoring and tuning essential features like the powertrain and driving dynamics. The market for automotive operating systems will be driven by this increase in demand for software-defined vehicles throughout the forecast period.

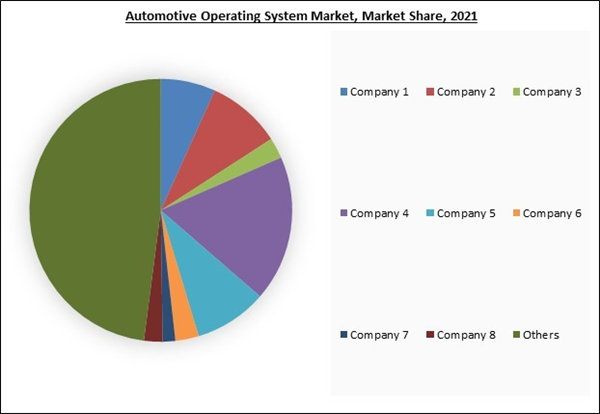

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market is and Partnerships & Collaborations.

Market Restraining Factors

Lack of basic and uninterrupted 4G/5G connectivity

A cloudy image of the adoption of 5G technology is impeding the transformation of some conceptual advancements to on-the-ground use in developing nations as well as in the periphery and main cities of wealthy nations. Thus, a lack of consistent and seamless communication will limit the possibilities for ADAS features, infotainment systems, cockpit domains, etc. For instance, ADAS needs fundamental infrastructures like well-marked lanes, orderly roadways, and GPS connectivity to function properly. Furthermore, because of the poor network connectivity on highways, automobiles are not connected to cloud data or other vehicles. These constraints are anticipated to limit the market for automotive operating system' expansion prospects during the projected time.

Type Outlook

Based on type, the automotive operating system market is categorized into QNX, Linux, Windows, Android, and others. The QNX segment garnered the highest revenue share in the automotive operating system market in 2022. Because of its compatibility with a wide range of hardware and support from industry-leading cluster UI frameworks, QNX has traditionally been one of the most popular OS among automakers. QNX is also utilized in several other applications, including ADAS features, cockpit controls, and in-car entertainment systems.

Vehicle Type Outlook

On the basis of vehicle type, the automotive operating system market is divided into passenger cars, light commercial vehicles, and heavy commercial vehicles. The light commercial vehicles (LCV) segment recorded a significant revenue share in the automotive operating system market in 2022. Van demand has historically been very strong in the logistics industry. In the developing market, automakers now provide more LCV models. Modern technologies for light commercial cars are increasingly in demand throughout many developed nations.

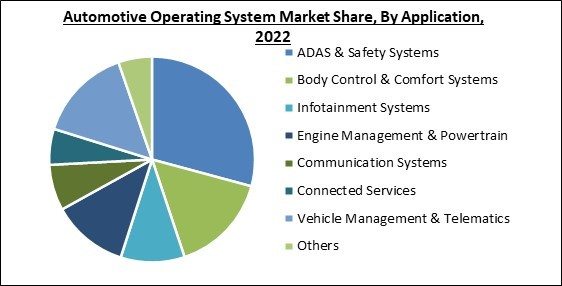

Application Outlook

On the basis of application, the automotive operating system market is fragmented into ADAS & safety systems, body control & comfort systems, communication systems, connected services, infotainment systems, engine management & powertrain, vehicle management & telematics, and others. The body control & comfort systems segment acquired a substantial revenue share in the automotive operating system market in 2022. Energy flow can be controlled by a body control module, preventing overloading of the electrics caused by too many functions using a lot of energy at once. At any given time, the most crucial function receives the best energy possible and takes precedence over all other functions.

Automotive Operating System Market Report Coverage

Growth Drivers

- The increasing number of ECUs and domain controllers in automobiles

- Introduction of vehicles defined by software

Restraints

- Lack of basic and uninterrupted 4G/5G connectivity

Regional Outlook

Region wise, the automotive operating system market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment garnered the largest revenue share in the automotive operating system market in 2022. This region has been a center for vehicle manufacturing in recent years. The four countries with the biggest shares of manufacture and sales of automobiles are India, Japan, China, and South Korea. Due to this, the volume of vehicles produced has increased over time, satisfying domestic and international demand.

Free Valuable Insights:

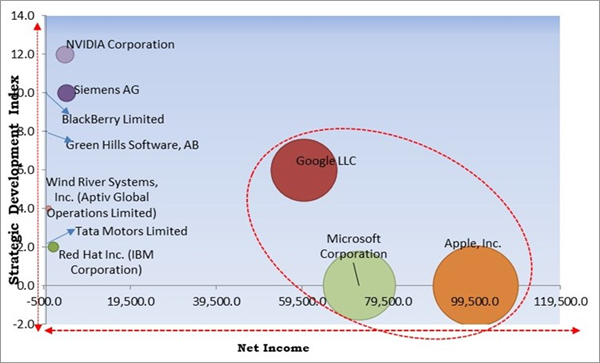

The Cardinal Matrix - Automotive Operating System Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Apple, Inc., Microsoft Corporation and Google LLC are the forerunners in the Automotive Operating System Market. Companies such as NVIDIA Corporation, Siemens AG, BlackBerry Limited are some of the key innovators in Automotive Operating System Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Apple, Inc., NVIDIA Corporation, Google LLC (Alphabet, Inc.), Red Hat Inc. (IBM Corporation), Microsoft Corporation, Siemens AG, BlackBerry Limited, Tata Motors Limited (Tata Group), Wind River Systems, Inc. (Aptiv Global Operations Limited) and Green Hills Software, AB.

Recent Strategies Deployed in Automotive Operating System Market

Partnerships, Collaborations and Agreements:

- Feb-2023: Green Hills Software entered into collaboration with Lattice Semiconductor, a leader in low-power programmable. The collaboration would enable the company to provide safe and secure solutions for embedded Industrial and Automotive applications.

- Jan-2023: NVIDIA partnered with Hon Hai Technology Group (Foxconn), a leader in technology manufacturing. The partnership would combine the strengths of both companies and enable them to develop an automated and autonomous vehicle platform that offers intelligent driving solutions.

- Jan-2023: Wind River joined hands with GuardKnox, an automotive cybersecurity software provider. With this collaboration, the company aimed at enabling automakers to use flexible and cost-effective solutions that would decrease complexities and shorten time-to-market for new automotive applications and features.

- Nov-2022: Google formed a partnership with Renault Group, a French automobile manufacturer. The partnership is aimed at accelerating the digital transformation of Renault Group by bringing the expertise of company in the cloud, AI, and Android to offer a secure, highly-personalized experience.

- Oct-2022: Siemens Smart Infrastructure formed a partnership with Volta Trucks, a manufacturer and services provider of full-electric commercial vehicles. The partnership is aimed to provide and scale eMobility charging infrastructure. Moreover, the company intends to develop Transportation as a Service solution for the Volta Trucks’ customers.

- Aug-2022: Green Hills Software teamed up with Andes Technology, a leading RISC-V CPU IP vendor. with this collaboration, the company aimed to provide an integrated and optimized platform for safe and secure computing on Andes Technology.

- Jun-2022: Blackberry Limited entered into a partnership with TTTech Auto, a safety solution provider for cars. Both companies would integrate Blackberry's QNX Neutrino Real-Time Operating System (RTOS) and TTTech Auto’s safe vehicle software platform MotionWise for the advancement of driver assistance systems and software-defined vehicles.

- May-2022: BlackBerry Limited joined hands with Magna International Inc., a global automotive supplier. Through this collaboration, the company would provide its QNX software including the QNX OS for Safety, QNX Software Development Platform, QNX Platform for ADAS, for system-level integration, performance optimization, and solution validation.

- May-2022: Red Hat, Inc., teamed up with General Motors, an American multinational automotive manufacturing company. The collaboration aimed to expand an ecosystem of innovation around the Red Hat In-Vehicle Operating System, which offers a Linux operating system foundation for GM’s Ultifi software platform evolution.

- Feb-2022: Google entered into a partnership with Mercedes-Benz, a German luxury and commercial vehicle automotive brand, for creating a next-generation digital luxury car experience. With this partnership, the company would offer its AI and data capabilities to create an enhanced customer experience and advance autonomous driving.

- Feb-2022: Tata Motors’ JLR partnered with NVIDIA, a US-based software company. The partnership involves developing and providing automated driving systems equipped with AI-enabled services. This partnership aligns and supports the automotive manufacturer company to realize its strategy, and further create a benchmark in technology, sustainability, and quality.

- Feb-2021: Google came into collaboration with Ford, an American multinational automobile manufacturer. The company's Android operating system would be integrated into Ford and Lincoln vehicles to design new consumer services and modernize internal operations.

- Dec-2021: BlackBerry Limited teamed up with BMW Group, a manufacturer of luxury vehicles and motorcycles. Through this collaboration, the company aims to develop technology for the automotive manufacturer’s next-generation vehicles.

Product Launches and Product Expansions:

- Sep-2022: NVIDIA launched DRIVE Thor, a centralized computer for safe and secure autonomous vehicles. The new DRIVE Thor enables IVI and advanced driver-assistance systems to run domain isolation that would allow concurrent time-critical processes to work without interruption and it also supports multi-domain computing for automated driving and IVI.

- Apr-2021: NVIDIA unveiled the next-generation AI-enabled processor for autonomous vehicles, NVIDIA DRIVE Atlan. This product is the latest addition to NVIDIA’s centralized compute roadmap for autonomous vehicles, and it integrates AI & software with enhancements in networking, computing, and security for extraordinary levels of performance & security.

Acquisitions and Mergers:

- Aug-2022: Siemens Smart Infrastructure completed the acquisition of Brightly Software, a leading U.S.-based software-as-a-service. This acquisition advances SI to a foremost standing in the software market for facilities and built infrastructure.

Scope of the Study

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Application

- ADAS & Safety Systems

- Body Control & Comfort Systems

- Infotainment Systems

- Engine Management & Powertrain

- Communication Systems

- Connected Services

- Vehicle Management & Telematics

- Others

By Type

- QNX

- Linux

- Windows

- Android

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Apple, Inc.

- NVIDIA Corporation

- Google LLC (Alphabet, Inc.)

- Red Hat Inc. (IBM Corporation)

- Microsoft Corporation

- Siemens AG

- BlackBerry Limited

- Tata Motors Limited (Tata Group)

- Wind River Systems, Inc. (Aptiv Global Operations Limited)

- Green Hills Software, AB

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Apple, Inc.

- NVIDIA Corporation

- Google LLC (Alphabet, Inc.)

- Red Hat Inc. (IBM Corporation)

- Microsoft Corporation

- Siemens AG

- BlackBerry Limited

- Tata Motors Limited (Tata Group)

- Wind River Systems, Inc. (Aptiv Global Operations Limited)

- Green Hills Software, AB