Supportive Government Regulations for Workplace Safety fuel the North America Industrial PPE Market

Many industries, such as construction, mining, oil & gas, automotive, and chemical, record numerous work-related deaths and injury cases annually. According to 'The International Labor Organization (ILO) estimates, 2.3 million women and men worldwide surrender to work-related accidents or diseases every year, reaching over 6000 deaths every day. Worldwide, around 340 million occupational accidents and 160 million victims of work-related illnesses annually. Industrial accidents are one of the major concerns across application industries as they can lead to severe consequences on human health. According to the International Journal for Research in Applied Science & Engineering Technology data published in April 2021, annually, 60% of fatal accidents are recorded in the building & construction industry globally, with one death in every 10 minutes due to an occupational casualty. The automotive industry also reports considerably high injury rates. According to the US Bureau of Labor Statistics data published in December 2022, 5,190 fatal work injury cases were recorded in the US in 2021, an 8.9% increase from 4,764 cases in 2020. Further, researchers from the University of Illinois at Chicago found that ~71% of workers suffered from injuries at one point in time at their workplace. The increasing number of cases of industrial accidents worldwide has prompted governments to impose supportive regulations. Global government agencies, such as Occupational Safety and Health Administration (OSHA) and the Federal Highway Administration, have specific standards for wearing high-visibility clothing, primarily for highway construction. These agencies commonly refer to industry consensus standards issued by the International Safety Equipment Association and the American National Standards Institute. This is known as the ANSI/ISEA 107 Standard or American National Standard for High Visibility Safety Apparel and Headwear. Further, according to 'The Respiratory Protection Standard', 29 CFR 1910.134 of OSHA, it is mandatory for employees to have a complete respiratory program. Workers wearing respiratory protection must participate in a written respiratory program and follow OSHA's guidelines.North America Industrial PPE Market Overview

The industrial personal protective equipment (PPE) market in North America has been segmented into the US, Canada, Mexico. The growth of the personal protective equipment market in North America is majorly attributed to the rising importance of personal safety across oil & gas, construction, manufacturing, healthcare, and transportation industries due to the increasing number of occupational injuries and associated deaths. Construction, oil & gas, and manufacturing are among the major industries in the region. According to the Associated General Contractors of America (AGC), the construction industry in the US generates nearly US$ 1.8 trillion of turnover every year. Thus, presence of a well-established construction industry in North America and rise in awareness about worker safety across the construction industry are significantly driving the industrial personal protective equipment (PPE) market.According to the Bureau of Labor Statistics, in 2021, 5,190 fatal work injuries were recorded in the US, an increase of 8.9% from 2020. The National Safety Council also provided data that depicts the number of preventable fatal injuries by the industry sector for 2020 and 2021.

North America Industrial PPE Market Segmentation

The North America industrial PPE market is segmented based on type, material, end-use industry, distribution channel, and country. Based on type, the North America industrial PPE market is segmented into hand and arm protection, body protection, respiratory protection, head and face protection, and others. The hand and arm protection segment held the largest market share in 2022.Based on material, the North America industrial PPE market is segmented into natural rubber, vinyl, polyethylene, nitrile, and others. The others segment held the largest market share in 2022.

Based on end-use industry, the North America industrial PPE market is segmented into manufacturing, construction, oil and gas, pharmaceuticals, and others. The others segment held the largest market share in 2022.

Based on distribution channel, the North America industrial PPE market is segmented into wholesalers, national retailers, regional retailers, and online platforms. The wholesalers segment held the largest market share in 2022.

Based on country, the North America industrial PPE market is segmented into the US, Canada, and Mexico. The US dominated the North America industrial PPE market share in 2022.

Honeywell International Inc.; Lakeland Industries, Inc.; DuPont de Nemours, Inc.; 3M Co.; Ansell Ltd.; VF Corp; Aramark; Kimberly-Clark Corp.; and W.L. Gore and Associates, Inc. are some of the leading players operating in the North America industrial PPE market.

Table of Contents

Companies Mentioned

- Honeywell International Inc.

- Lakeland Industries, Inc.

- DuPont de Nemours, Inc.

- 3M Co.

- Ansell Ltd.

- VF Corp

- Aramark

- Kimberly-Clark Corp.

- W.L. Gore and Associates, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 93 |

| Published | February 2024 |

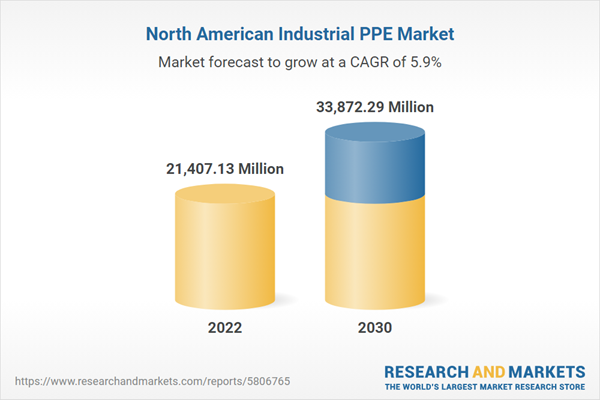

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 21407.13 Million |

| Forecasted Market Value by 2030 | 33872.29 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |