Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

- The strong penetration of subsea cable connectivity in the region, linking them to other European countries, as well as the U.S., aids in projecting the Nordic region as an attractive destination for data center construction and supports the Nordic data center construction market growth. For instance, the AEC-2 cable links Norway and Denmark to the Nordic, and the C-Lion1 cable connects Finland with Germany through high-speed and high-capacity connectivity.

- The regulatory policy framework in most of the Nordic countries is conducive to data center construction and operations. The licensing process is business-friendly, and power supply stability also adds to the political stability of the region.

- Furthermore, the electricity costs in the Nordic countries are comparatively lower, compared to other countries in Europe. The reasons for the affordability of electricity can be attributed to low grid fees and taxes in countries like Norway. Large investments in renewable hydropower in Norway also help keep the electricity prices lower.

NORDIC DATA CENTER CONSTRUCTION MARKET KEY TRENDS

AI Initiatives

1. The Nordic enterprises are at the forefront of generative AI adoption. According to the results of a survey published by Cognizant in October 2024, the average spending per company on generative AI in the region amounted to $49.7 million for the year, which is slightly above the global average of $47 million. Furthermore, 65% of the businesses surveyed stated that they wanted to accelerate their generative AI strategies.2. Around half of the businesses in Finland, Norway, Denmark, and Sweden utilize AI for their business needs. The most common use of AI in the Nordics is for process automation or improving products & services. The extensive AI use in the region necessitates the construction of a greater number of data centers, as technology evolves and supports the Nordic data center construction market growth.

Increase in District Heating Ecosystem

The trend of using district heating systems to reuse heat emitted from the data centers continues to gain momentum in the Nordics, as operators and governments prioritize energy efficiency, reduce carbon footprints, and align with global sustainability goals. For instance, Stack Infrastructure uses heat exchangers designed specifically to re-use the waste heat generated from the data center and feed it into municipal district heating systems to warm residential spaces.Evolution of Edge Data Centers

The emergence of services that require short response times, such as 5G, AI, etc,. requires the establishment of data centers that are in close proximity to the industry. In addition, the aquaculture industry in Norway is the leader in the adoption of new technologies to increase productivity and enhance competitiveness. This industry uses sensors to control and monitor fish farming. Edge data centers find use cases in these industries. Companies like Blix Solutions, AtlasEdge, and T.Loop have established data centers in the Nordic region due to the growing demand for low latency in data transmission.SEGMENTATION INSIGHTS

There is a notable shift toward the use of electric power modules to reduce the data center construction time significantly. The electric power modules have all the critical power, backup, cooling, and control systems, like UPSs, switchgear, and power distribution. These prefabricated power modules speed up modular data center construction.In terms of cooling, many data centers in the Nordics rely on free cooling techniques to keep the servers and infrastructure cool, while reducing energy consumption and minimizing the carbon footprint. The Nordic countries have a lower number of days with lower temperatures, which allows for better PUE than data centers in warmer climatic regions. Norway-based data centers also utilize cold seawater from neighboring fjords for cooling.

- Facility Type

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

- Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

- Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

- Cooling System

- CRAC & CRAH Units

- Chillers Units

- Cooling Towers, Condensers, and Dry Coolers

- Other Cooling Units

- Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

- General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM/BMS Solutions

- Tier Standards

- Tier I & Tier II

- Tier III

- Tier IV

GEOGRAPHICAL ANALYSIS

Countries like Sweden and Norway have emerged as key players in the Nordic data center construction market, leveraging their renewable energy, regulatory, and connectivity advantages to attract global enterprises and cloud providers. The governments in countries like Norway have framed strategies to underline the attractiveness of Norway for data centers. Norway government’s 2021 data center strategy document states clearly that the government wants even more companies to choose Norway as a location for their data center. The geographical advantage of the Nordic countries is poised to play a critical role in the future of global data networks.Furthermore, Denmark has rapidly established itself as a significant investment hub for data centers in the Nordics with Copenhagen as a prime location for hyper-scale, enterprise, colocation facilities, and cloud regions. Other areas, such as Odense and Jutland saw substantial infrastructure growth. The country has made significant advances in its digital infrastructure through nationwide investments in 5G networks, big data and IoT, green energy solutions, and smart city initiatives. Also, Finland has rapidly positioned itself as one of the leading data center investment hubs in the Nordic data center construction market. Helsinki continues to emerge as a key site for extensive facilities housing a huge number of hyperscale and colocation data centers. Other cities, such as Espoo and Tampere, experienced significant growth in data center infrastructure. The investments by the country in digital transformation, particularly through the expansion of 5G networks, drive advances in areas such as IoT, smart cities, and digital innovation, aligning with the fourth industrial revolution.

- Nordic

- Denmark

- Sweden

- Norway

- Finland

- Iceland

NORDIC DATA CENTER CONSTRUCTION MARKET VENDOR INSIGHTS

Key support infrastructure providers in the Nordic data center construction market include ABB, Alfa Laval, Carrier, Caterpillar, Cummins, Eaton, Hitec Power Protection, Legrand, NetNordic Group, etc. These businesses help operators meet the growing demand for high-performance computing by enabling the smooth integration of cutting-edge technologies like AI and 5G within data center settings.On the investment side, prominent players in the Nordic data center construction market include AQ Compute, AtNorth, Bahnhof, Digital Realty, Evroc, Conapto, T.Loop, Stack Infrastructure, EcoDataCenter, Equinix, and Green Mountain, among others. In addition, notable construction contractors in the Nordic data center construction market include Arup, Coromatic, Caverion, Cowi, Designer Group, Ethos Engineering, Dornan, Exyte, Granlund, MT Hojgaard, etc. To comply with industry requirements and certifications, design contractors give top priority to data center facilities' durability, scalability, efficiency, and dependability.

The Nordic data center market experiences robust growth, driven by significant investments from leading technology companies and specialized data center providers. Key players such as Apple, AQ Compute, atNorth, and Bahnhof expand their data center facilities and incorporate advanced technologies to meet the increasing demand for data processing and storage capabilities. Apple is a notable example, with its expansion in Viborg, Denmark, which aligns with its commitment to achieving carbon neutrality by 2030. This facility not only supports the operational needs of Apple but also contributes to the local district heating system, showcasing the innovative approach of the company toward sustainability.

Prominent Data Center Investors

- AQ Compute

- atNorth

- Bahnhof

- Digital Realty

- Evroc

- Conapto

- T.Loop

- STACK Infrastructure

- EcoDataCenter (Areim)

- Equinix

- Green Mountain

- Hyperco

- Lefdal Mine Data Centers

- Verne (Ardian)

- Nebius

- Meta

- Microsoft

- TNordicASS

- XTX Markets

Key Data Center Support Infrastructure Providers

- ABB

- Alfa Laval

- Carrier

- Caterpillar

- Cummins

- Eaton

- Hitec Power Protection (Air Water)

- Legrand

- NetNordic Group

- Riello Elettronica

- Rittal

- Rolls-Royce

- Schneider Electric

- Socomec

- Stulz

- Trane Technologies (Ingersoll Rand)

- Vertiv

Prominent Construction Contractors

- Arup

- Coromatic

- Caverion (Assemblin Caverion Group)

- COWI

- Designer Group

- Ethos Engineering

- Dornan (Turner Construction Company)

- Exyte (M+W Group)

- Granlund

- MT Højgaard

- Mace Group

- ISG

- Sweco

- Mercury

- Ramboll Group

- YIT

- Kirby

- NCC

- Winthrop Technologies

- Collen

KEY QUESTIONS ANSWERED

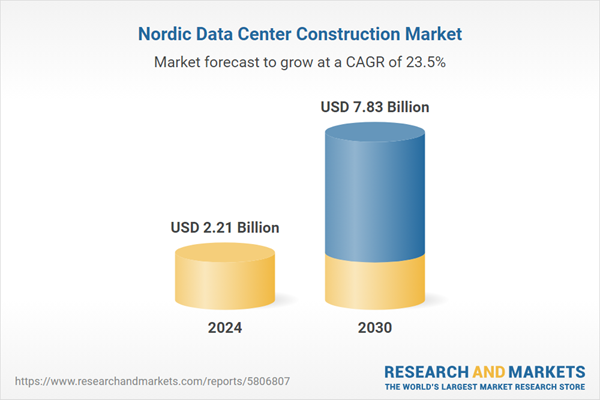

1. How big is the Nordic data center construction market?2. What is the growth rate of the Nordic data center construction market?

3. What is the estimated market size in terms of area in the Nordic data center construction market by 2030?

4. What is the estimated market size in terms of area in the Nordic data center construction market by 2030?

5. How many MW of power capacity is expected to reach the Nordic data center construction market by 2030?

Table of Contents

Companies Mentioned

- AQ Compute

- atNorth

- Bahnhof

- Digital Realty

- Evroc

- Conapto

- T.Loop

- STACK Infrastructure

- EcoDataCenter (Areim)

- Equinix

- Green Mountain

- Hyperco

- Lefdal Mine Data Centers

- Verne (Ardian)

- Nebius

- Meta

- Microsoft

- TNordicASS

- XTX Markets

- ABB

- Alfa Laval

- Carrier

- Caterpillar

- Cummins

- Eaton

- Hitec Power Protection (Air Water)

- Legrand

- NetNordic Group

- Riello Elettronica

- Rittal

- Rolls-Royce

- Schneider Electric

- Socomec

- Stulz

- Trane Technologies (Ingersoll Rand)

- Vertiv

- Arup

- Coromatic

- Caverion (Assemblin Caverion Group)

- COWI

- Designer Group

- Ethos Engineering

- Dornan (Turner Construction Company)

- Exyte (M+W Group)

- Granlund

- MT Højgaard

- Mace Group

- ISG

- Sweco

- Mercury

- Ramboll Group

- YIT

- Kirby

- NCC

- Winthrop Technologies

- Collen

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 342 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.21 Billion |

| Forecasted Market Value ( USD | $ 7.83 Billion |

| Compound Annual Growth Rate | 23.4% |

| Regions Covered | Denmark, Finland, Iceland, Norway, Sweden |

| No. of Companies Mentioned | 57 |