Stepper motors are critical components in applications requiring high precision, torque, and efficiency, owing to their advanced design and streamlined production. They are widely utilized in robotics, semiconductor manufacturing, and medical equipment such as X-ray machines and blood analyzers. The market is experiencing robust growth driven by increasing automation, technological advancements, and favorable investments in healthcare infrastructure, which enhance the demand for precise motion control solutions across various industries.

Market Drivers

- Rapid Industrialization: Developing nations, particularly China, are driving stepper motor demand through rapid industrial growth. China's Made in China 2025 initiative and tax incentives aim to boost automobile production to 35 million units annually by 2025, up from 22.3 million in 2018. This expansion of manufacturing facilities increases the need for stepper motors in automated machinery, supporting market growth.

- Industrial Automation: The rise of industrial automation, particularly in robotics, significantly fuels the stepper motor market. In 2024, Asia and Australia saw 70,000 industrial robot deployments, reflecting a growing reliance on automation. Stepper motors, valued for their precise control, are integral to robotic systems, driving demand in industries such as automotive, electronics, and manufacturing.

Market Restraints

While the provided data does not explicitly detail restraints, potential challenges include high initial costs for advanced stepper motor systems, which may limit adoption among small and medium-sized enterprises. Additionally, compatibility issues with legacy systems and the need for specialized maintenance could pose hurdles in certain industrial applications.Segmentation Analysis

By Application

: Stepper motors are prominent in robotics and semiconductor sectors, where precision and high torque are essential. In medical applications, their use in X-ray machines and blood analyzers is growing due to investments in healthcare infrastructure, which prioritize technological adoption for improved medical equipment performance.By End-User Industry

: The automotive sector is a key driver, particularly in China, where increased production capacity demands precise motion control. The robotics industry, fueled by automation trends, and the medical sector, with its focus on advanced diagnostics, are also significant contributors to market growth.Geographical Outlook

North America is poised for robust growth in the stepper motors market, driven by widespread industrial automation and continuous technological advancements. The region's increasing adoption of industrial robots underscores the demand for reliable motion control solutions, positioning stepper motors for sustained expansion. The U.S., in particular, benefits from a strong industrial base and innovation in automation technologies, further supporting market growth.Key Developments

- Oriental Motors USA Corp (2024): The company offers a diverse range of stepper motor products, including 2-Phase & 5-Phase Stepper Motors and AlphaStep Closed Loop Stepper Motors. Oriental Motors emphasizes product innovation and expansion to meet diverse industry needs, maintaining a competitive edge through enhanced offerings tailored to automation and precision applications.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Stepper Motors Market Segmentation

By Type

- Permanent Magnet Stepper Motor

- Variable Reluctance Stepper Motor

- Hybrid Synchronous Stepper Motor

By Torque

- Low Torque

- High Torque

By Distribution Channel

- Online

- Offline

By End-User

- Automotive

- Aerospace & Defense

- Electrical & Electornics

- Healthcare

- Manufacturing

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Nippon Pulse Motor Co., Ltd.

- AMETEK Inc.

- ORIENTAL MOTORS USA CORP

- Nidec Corporation

- MinebeaMitsumi Inc.

- Nanotec Electronic GmbH & Co. KG

- SANYO DENKI Co., Ltd.

- Schneider Electric SE

- MOONS' Industries

- Regal Rexnord Corporation

Table Information

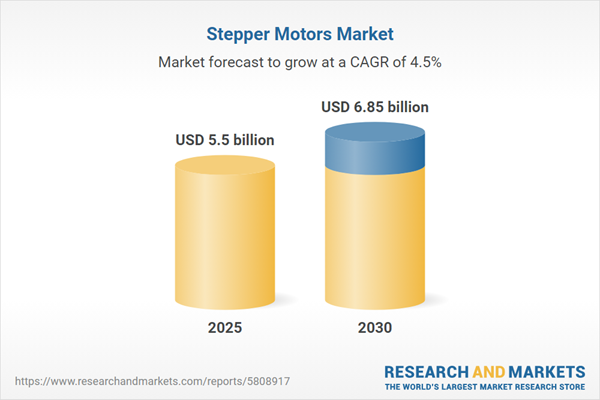

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 5.5 billion |

| Forecasted Market Value ( USD | $ 6.85 billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |