Rodless actuators are pivotal in industrial automation, offering compact, efficient linear motion solutions. Unlike rod-style actuators, they integrate load-carrying mechanisms within a self-contained unit, eliminating external guidance needs. This design optimizes space and supports payloads with minimal deflection, making them ideal for industries like automotive, aerospace, and packaging. Available in screw-driven and belt-driven configurations, screw-driven models excel in high axial force tasks, while belt-driven variants suit high-speed, long-stroke applications. Their versatility and precision drive significant market growth.

Market Drivers

- Industrial Automation Surge: The push for Industry 4.0 fuels demand for rodless actuators in robotic systems, with global industrial robot installations reaching 553,000 units in 2023 (International Federation of Robotics, 2024). They enable precise motion in compact setups for automotive and electronics industries.

- Space Optimization: Rodless actuators contained stroke length suits space-constrained environments like semiconductor manufacturing and cleanrooms, enhancing production efficiency.

- Material and Design Advancements: Innovations like lightweight composites and corrosion-resistant coatings improve durability. In 2024, Parker Hannifin launched rodless actuators for harsh environments, targeting aerospace and marine applications. Bosch Rexroth's IoT-enabled actuators introduced in 2024 offer real-time monitoring and predictive maintenance for smart factories.

- Energy Efficiency: Electromechanical rodless actuators reduce energy consumption by up to 30% compared to pneumatic systems (Automation World, 2025), aligning with sustainability goals, particularly in EV production lines.

- End-Use Industry Growth: Automotive, aerospace, and e-commerce-driven packaging sectors drive demand. A 2025 Airbus case study noted a 15% reduction in wing assembly time using rodless actuators, while EV production and high-speed sorting in packaging amplify their adoption.

Market Restraints

- High Initial Costs: Electromechanical rodless actuators cost 20-40% more than pneumatic systems (2024 industry report), deterring SMEs in price-sensitive markets.

- Limited Load Capacity: Rodless actuators, especially belt-driven models, are typically limited to payloads under 1,000 kg (2025 technical review), restricting use in heavy-duty industries like mining.

- Maintenance Complexity: Screw-driven models require specialized repairs, potentially increasing downtime by 25% compared to pneumatic systems (Manufacturing Global, 2024).

- Legacy System Compatibility: Integrating rodless actuators into older systems can incur retrofitting costs up to 15% of project budgets (2025 automation report).

Segmentation Analysis

By Type

: Screw actuators dominate due to high axial force and precision, driven by advancements like THK Co.'s 2024 high-efficiency ball screw actuators for compact automation.By Application

: The opening and closing dampers segment grows notably, particularly in HVAC systems. Siemens 2024 IoT-integrated actuators enhance energy efficiency in smart buildings.By End-User

: Manufacturing leads, driven by automation in automotive (EV assembly), electronics, and packaging, supported by Bosch Rexroth's IoT-enabled actuators.Geographical Outlook

North America leads, with the U.S. belt-driven actuator market valued at USD 0.8 billion in 2024. The region's advanced infrastructure, automotive, and aerospace sectors, alongside IoT adoption, drive growth. Canada and Mexico contribute through aerospace and EV production, respectively.Key Developments

- Bosch Rexroth (2024): Launched IoT-enabled rodless actuators for smart manufacturing, enhancing efficiency and predictive maintenance.

- Festo-Phoenix Contact Partnership (2024): Festo integrated PLCnext Technology into intelligent automation devices, strengthening IoT-enabled rodless actuator offerings.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Rodless Actuators Market Segmentation

By Type

- Mechanically Coupled

- Magnetically Coupled

By Distribution Channel

- Online

- Offline

By Distribution Channel

- Online

- Offline

By Application

- Robotics & Automation

- Material Handling

- Testing & Inspection Equipment

- Positioning & Conveying

- Others

By End-User

- Automotive

- Aerospace & Defense

- Food & Beverage

- Logistics & Warehousing

- Semiconductor & Electronics

- Packaging

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Parker Hannifin Corporation

- Festo AG & Co. KG

- SMC Corporation

- Tolomatic, Inc.

- Thomson Industries, Inc. (Regal Rexnord Corporation)

- Bosch Rexroth Corporation

- Norgren Ltd

- Rollon Corp. (Timken Company)

- Camozzi Automation S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | August 2025 |

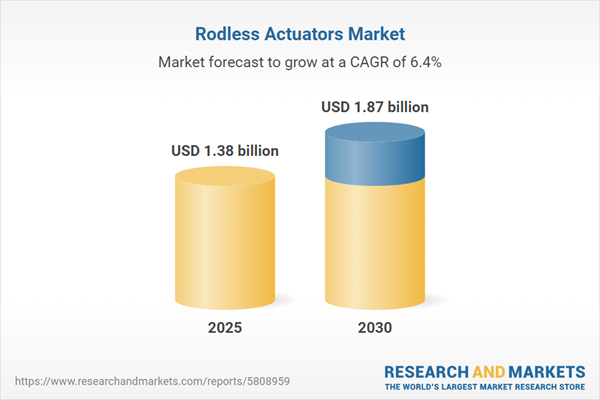

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.38 billion |

| Forecasted Market Value ( USD | $ 1.87 billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |