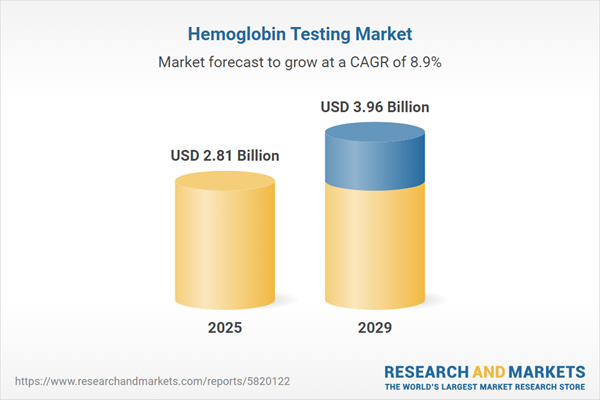

The hemoglobin testing market size is expected to see strong growth in the next few years. It will grow to $3.96 billion in 2029 at a compound annual growth rate (CAGR) of 8.9%. The growth in the forecast period can be attributed to rising healthcare investments, integration with chronic disease management, point-of-care testing expansion, increasing focus on preventive healthcare, and global health pandemic preparedness. Major trends in the forecast period include telemedicine and remote monitoring, technological advancements, home-based testing kits, integration with electronic health records (EHR), and a focus on non-invasive methods.

The hemoglobin testing market is poised for growth, driven by the increasing prevalence of chronic disorders such as diabetes. Diabetes, a chronic condition characterized by insufficient insulin production or utilization, necessitates regular monitoring through Hemoglobin A1c tests (HbA1c). These tests, recommended by the American Diabetes Association, play a crucial role in diabetes diagnosis. With over 34 million Americans having diabetes and an additional 88 million at risk, the demand for HbA1c testing devices is set to rise. Furthermore, global projections indicate a substantial increase in diabetes cases, reaching 783,700 individuals by 2045, emphasizing the pivotal role of hemoglobin A1c testing devices in managing chronic disorders.

The increasing incidence of anemia is expected to enhance the growth of the hemoglobin testing market in the future. Anemia is a medical condition marked by a shortage of red blood cells or a reduction in the amount of hemoglobin, a protein in red blood cells responsible for transporting oxygen to body tissues. The rising prevalence of anemia fuels the demand for hemoglobin testing, driven by a heightened need for early detection, routine testing, greater awareness, a focus on preventive healthcare, and an increase in anemia-related conditions. These factors collectively contribute to the market's significant growth, as diagnostic services are crucial in identifying and managing anemia on a larger scale. For example, a report published in July 2023 by the Institute for Health Metrics and Evaluation, an independent research center at the University of Washington School of Medicine, estimated that about one-fourth of the global population is anemic, with a notable increase in cases among women, pregnant women, young girls, and children under five. Therefore, the rising prevalence of anemia is driving the growth of the hemoglobin testing market.

The increasing healthcare expenditure is projected to drive the growth of the hemoglobin testing market in the future. Healthcare expenditure refers to the total funds, both public and private, allocated to the healthcare sector within a specific geographical area, country, or economy over a defined period. A rise in healthcare spending enhances hemoglobin testing by supporting advanced diagnostic technologies, increasing access to testing, and promoting comprehensive screening initiatives for the detection and management of anemia. For example, a report from the Office for National Statistics, a UK-based government department, revealed that total healthcare expenditure grew by 5.6% in nominal terms from 2022 to 2023, compared to a mere 0.9% increase in 2022. Thus, the growing healthcare expenditure is a key driver of the hemoglobin testing market.

Leading companies in the hemoglobin testing market are creating innovative fingerstick blood test solutions to enable patients to conveniently monitor their hemoglobin levels at home, support early detection of anemia, and enhance overall health management. These advanced fingerstick blood test methods allow for quick and easy blood sample collection through a simple finger prick, making diagnostic testing more efficient and less invasive. For example, in February 2024, Sanguina Inc., a health technology company based in the U.S., launched AnemoCheck Home, the first FDA-cleared home hemoglobin test kit. AnemoCheck Home is designed to provide users with accurate hemoglobin readings using a simple finger prick. This user-friendly kit includes all the necessary components, such as a testing device and clear instructions, enabling individuals to conduct the test without needing a laboratory visit. AnemoCheck Home not only allows patients to regularly monitor their hemoglobin levels but also promotes early detection of potential health issues like anemia.

Key companies in the hemoglobin testing market are introducing innovative solutions like indigenous rapid hemoglobin testing kits to deliver quick and accurate assessments of hemoglobin levels, improve accessibility for patients in remote areas, and enable timely diagnosis and management of conditions such as anemia. These indigenous rapid hemoglobin testing kits are locally developed diagnostic tools designed to efficiently measure hemoglobin levels in individuals. For instance, in June 2023, the Indian Institute of Toxicology Research (IITR), a research organization based in India, launched SenzHb, a rapid hemoglobin testing kit. SenzHb is a state-of-the-art diagnostic tool that enables fast and precise measurement of hemoglobin levels through a simple, user-friendly interface. This innovative kit requires only a small blood sample, making it suitable for use in various settings, including rural and underserved communities.

Major companies operating in the hemoglobin testing market include Abbott Laboratories Inc., Bayer Medical Care Inc., Danaher Corporation, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche AG, Bio-Rad Laboratories Inc., Daiichi Sankyo Inc., ACON Laboratories Inc., DiaSys Diagnostic Systems GmbH, EKF Diagnostics Holdings PLC, Epinex Diagnostics Inc., Erba Diagnostics Inc., ARKRAY Inc., Beckman Coulter Diagnostics Ltd., Diazyme Laboratories Inc., Radiometer A/S, Sysmex Corporation, BioMedomics Inc., Hemosure Inc., Humasis Co. Ltd., Immunostics Inc., LifeSign LLC, Medix Biochemica Oy AB, NanoenTek Inc., Nova Biomedical Corp., Siemens Healthcare GmbH, Mindray Medical International Limited, Nihon Kohden Corporation, Tosoh Corporation.

Asia-Pacific and North America were the largest region in the hemoglobin testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global hemoglobin testing market report during the forecast period. The regions covered in the hemoglobin testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hemoglobin testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Hemoglobin testing is a medical procedure designed to measure the concentration of hemoglobin in the blood. Hemoglobin, a protein found in red blood cells, plays a crucial role in transporting oxygen from the lungs to the tissues and organs of the body.

The primary types of products in hemoglobin testing include reagents and consumables, as well as equipment. The reagents and consumables segment in the hemoglobin testing market encompasses various chemical reagents and consumable products utilized in the process of hemoglobin testing. Various technologies are employed for hemoglobin testing, including chromatography, immunoassay, spectrophotometry, and others. These testing products find application in diverse settings such as hospitals, clinics, laboratories, home care settings, blood banks, and others.

The hemoglobin testing market research report is one of a series of new reports that provides hemoglobin testing market statistics, including hemoglobin testing industry global market size, regional shares, competitors with a hemoglobin testing market share, detailed hemoglobin testing market segments, market trends and opportunities, and any further data you may need to thrive in the hemoglobin testing industry. This hemoglobin testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The hemoglobin testing market consists of revenues earned by entities by providing services such as hemoglobin-cyanide, vanzetti's azide methemoglobin, reagent-less, non-invasive methods, and hemoglobin electrophoresis. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Hemoglobin Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hemoglobin testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hemoglobin testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hemoglobin testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Reagents and Consumables; Equipment2) By Technology: Chromatography; Immunoassay; Spectrophotometry; Other Technologies

3) By End User: Hospitals; Clinics; Laboratories; Home Care Settings; Blood Banks; Other End Users

Subsegments:

1) By Reagents and Consumables: Hemoglobin Testing Kits; Control Solutions; Test Strips; Quality Control Products2) By Equipment: Hemoglobin Meters; Analyzers; Point-of-Care Devices; Laboratory Equipment

Key Companies Mentioned: Abbott Laboratories Inc.; Bayer Medical Care Inc.; Danaher Corporation; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Hemoglobin Testing market report include:- Abbott Laboratories Inc.

- Bayer Medical Care Inc.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories Inc.

- Daiichi Sankyo Inc.

- ACON Laboratories Inc.

- DiaSys Diagnostic Systems GmbH

- EKF Diagnostics Holdings PLC

- Epinex Diagnostics Inc.

- Erba Diagnostics Inc.

- ARKRAY Inc.

- Beckman Coulter Diagnostics Ltd.

- Diazyme Laboratories Inc.

- Radiometer A/S

- Sysmex Corporation

- BioMedomics Inc.

- Hemosure Inc.

- Humasis Co. Ltd.

- Immunostics Inc.

- LifeSign LLC

- Medix Biochemica Oy AB

- NanoenTek Inc.

- Nova Biomedical Corp.

- Siemens Healthcare GmbH

- Mindray Medical International Limited

- Nihon Kohden Corporation

- Tosoh Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.81 Billion |

| Forecasted Market Value ( USD | $ 3.96 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |