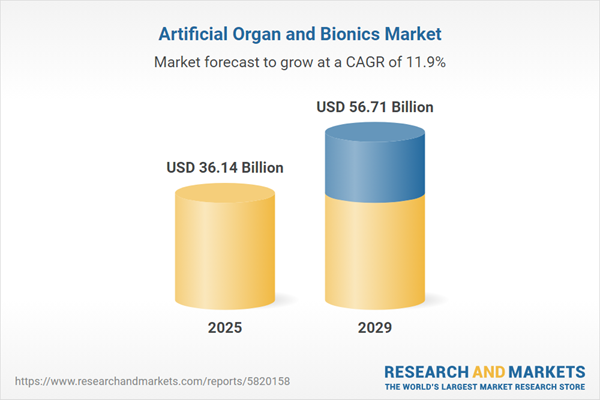

The artificial organ and bionics market size is expected to see rapid growth in the next few years. It will grow to $56.71 billion in 2029 at a compound annual growth rate (CAGR) of 11.9%. The growth in the forecast period can be attributed to increasing healthcare expenditure, personalized medicine, regulatory support and streamlined approvals, rapid advancements in 3d printing, collaborations and partnerships. Major trends in the forecast period include miniaturization and wearable technology, technological advancements, advanced materials integration, ai and machine learning in design, 3d printing and bioprinting advancements.

Increasing healthcare expenditure is anticipated to drive the growth of the artificial organ and bionics market in the future. Healthcare expenditure encompasses the total spending on health care and related activities, including both private and public health insurance, health research, and public health initiatives. Investments in healthcare facilitate technological innovations, leading to the development of more advanced and efficient artificial organs. This may involve enhancements in materials, design, and manufacturing processes. For example, in December 2023, the Centers for Medicare and Medicaid Services, a U.S. federal agency, reported that national health expenditures in the United States grew by 4.3% in 2022, up from a 2.7% increase in 2021. Consequently, rising healthcare expenditure is propelling the artificial organ and bionics market forward.

An increasing number of transplants is projected to drive the growth of the artificial organ and bionics market in the future. A transplant involves the surgical procedure where a tissue or organ is transferred from a donor to a recipient, or from one part of the body to another. Artificial organs are devices implanted in the body to replace damaged organs and replicate their specific functions, enabling patients to lead a normal life. For example, in January 2024, the Organ Procurement and Transplantation Network (OPTN), a U.S.-based organization, reported that in 2023, there were a total of 46,632 organ transplants performed using both living and deceased donors. This marked an 8.7% increase compared to 2022 and a 12.7% rise from 2021, the first year to surpass 40,000 transplants. Among these, 39,679 transplants were from deceased donors, reflecting an 8.9% increase from the previous year and setting a record for the eleventh consecutive year. Thus, the growing number of transplants is expected to significantly boost the artificial organ and bionics market.

Major corporate investments are steering the transformation of organ transplantation within the artificial organs and bionics market. These investments play a pivotal role in fostering the development of artificial organs, addressing the scarcity of donor organs by creating functional and biocompatible replacements. This not only offers hope to patients awaiting organ transplants but also holds the potential to revolutionize the landscape of transplantation medicine. An exemplar is the Government of Canada's investment of $2 million in April 2022 towards innovative organ and tissue donation projects, aimed at enhancing organ donation and transplantation efficacy in Canada. This funding aligns with the Networks of Centres of Excellence Program, dedicated to supporting organ donation and transplantation research.

Leading companies in the artificial organ and bionics market are advancing technologies like hearing devices to enhance connectivity, improve user experiences, and enable seamless integration between various devices. Hearing technology includes devices and solutions aimed at assisting individuals with hearing impairments, such as hearing aids and cochlear implants. For example, in November 2022, Cochlear Limited, an Australia-based medical device company, received approval from the U.S. Food and Drug Administration (FDA) for the Nucleus 8 Sound Processor. This device is designed to offer improved sound quality, enhanced connectivity, and user-friendly features, including compatibility with Bluetooth LE Audio technology. This innovation allows users to connect wirelessly to multiple devices, such as smartphones and televisions, creating a more integrated and streamlined listening experience.

In December 2022, Johnson & Johnson, a prominent healthcare products company based in the US, successfully acquired Abiomed Inc. for an undisclosed sum. This strategic acquisition is poised to expedite Johnson & Johnson's progress in providing cutting-edge medical technologies and advancing its MedTech business on a global scale. Abiomed Inc., also based in the US, operates within the sphere of artificial organs and bionics, making its acquisition a significant move for Johnson & Johnson as it aims to further its presence and innovation within this specialized domain.

Major companies operating in the artificial organ and bionics market include Abiomed Inc., Asahi Kasei Medical Co., Ltd, Baxter, Berlin Heart GmbH, Boston Scientific Corporation, Cyberonics Inc., Ekso Bionics Holdings Inc., Getinge AB, Medtronic PLC, Bornlife Prosthetic and Orthotic Inc., Sonova, LifeNet Health, Terumo Corporation, Nano Retina Ltd, Edwards Lifesciences Corporation, Orthofix Medical Inc, Cochlear Limited, Advanced Bionics AG, Ottobock SE & Co. KGaA, Second Sight Medical Products Inc., iWalk Inc., Jarvik Heart Inc, St. Jude Medical Inc., Harmonic Bionics Inc., Open Bionics, Beta Bionics Inc., Bionic Prosthetics and Orthotics, Mobius Bionics, Touch Bionics Ltd, Phytowelt GreenTechnologies GmbH.

North America was the largest region in the artificial organ and bionics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global artificial organ and bionics market report during the forecast period. The regions covered in the artificial organ and bionics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the artificial organ and bionics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Artificial organs and bionics encompass machines or devices designed to substitute the functions of a deficient or absent human organ, while bionics involves constructing artificial systems mirroring certain characteristics of living organisms. Their primary objective is to enhance an individual's lifespan and functionality.

Within this domain, the main products include artificial organs and artificial bionics. Artificial organs are devices utilized to replicate the functions of missing or impaired human organs or body parts. These can be categorized based on fixation types as either implantable or externally-worn, and further segmented into cardiac bionics and brain bionics. The technologies encompassed within this field encompass mechanical bionics and electronic bionics.

The artificial organ and bionics market research report is one of a series of new reports that provides artificial organ and bionics market statistics, including artificial organ and bionics industry global market size, regional shares, competitors with an artificial organ and bionics market share, detailed artificial organ and bionics market segments, market trends and opportunities, and any further data you may need to thrive in the artificial organ and bionics industry. This artificial organ and bionics market research report deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The artificial organs and bionics market consists of sales of artificial hearts, total artificial hearts (TAH), artificial kidneys, artificial livers, ear bionics, vision bionics, orthopaedic bionics, and heart bionics. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Artificial Organ and Bionics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on artificial organ and bionics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for artificial organ and bionics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The artificial organ and bionics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Artificial Organs; Artificial Bionics2) By Fixation Type: Implantable and Externally-Worn; Cardiac Bionics and Brain Bionics

3) By Technology: Mechanical Bionics; Electronic Bionics

Subsegments:

1) By Artificial Organs: Artificial Heart; Artificial Kidney; Artificial Liver; Artificial Pancreas; Artificial Lungs2) By Artificial Bionics: Bionic Limbs; Bionic Eyes; Exoskeletons; Neural Prosthetics

Key Companies Mentioned: Abiomed Inc.; Asahi Kasei Medical Co., Ltd; Baxter; Berlin Heart GmbH; Boston Scientific Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Abiomed Inc.

- Asahi Kasei Medical Co., Ltd

- Baxter

- Berlin Heart GmbH

- Boston Scientific Corporation

- Cyberonics Inc.

- Ekso Bionics Holdings Inc.

- Getinge AB

- Medtronic PLC

- Bornlife Prosthetic and Orthotic Inc.

- Sonova

- LifeNet Health

- Terumo Corporation

- Nano Retina Ltd

- Edwards Lifesciences Corporation

- Orthofix Medical Inc

- Cochlear Limited

- Advanced Bionics AG

- Ottobock SE & Co. KGaA

- Second Sight Medical Products Inc.

- iWalk Inc.

- Jarvik Heart Inc

- St. Jude Medical Inc.

- Harmonic Bionics Inc.

- Open Bionics

- Beta Bionics Inc.

- Bionic Prosthetics and Orthotics

- Mobius Bionics

- Touch Bionics Ltd

- Phytowelt GreenTechnologies GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 36.14 Billion |

| Forecasted Market Value ( USD | $ 56.71 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |