Automotive Lightweight Materials Market Analysis:

- Major Market Drivers: The expanding consumer demand for fuel-efficient vehicles is one of the primary factors boosting the market growth. This is further supported by stricter government regulations that mandates a significant reduction in carbon emissions. Moreover, the burgeoning preference for electric vehicles (EVs) and advancements in materials science and engineering to produce stronger, lighter materials, which helps with dynamic control of a vehicle, is another factor supporting the automotive lightweight materials market growth. In line with this, growing demand for high-performance vehicles along with better handling and acceleration is driving the market growth. Another stimulating factor is the drive among the key players to move the automotive industry towards more sustainable methods, which includes recycling and using environmentally friendly materials. Apart from this, the increasing use of composite materials, like carbon fiber and fiberglass, which provide a better strength-to-weight ratio further fuels the automotive lightweight materials market share.

- Key Market Trends: Some of the emerging trends in the market include the development of advanced composites and high-strength alloys and integration of nanotechnology to improve the properties of materials. This is further supported by the growing use of three-dimensional (3D) printing to construct complexed structures with ease. In line with this, the increasing emphasis on multi-material solutions, creating combinations of complimentary lightweight materials that work together for optimal performance, which is further providing a positive automotive lightweight materials market outlook. Furthermore, the key market manufacturers are investing in research and development (R&D) to introduce new and advanced lightweight materials, which is further fostering the market growth. Apart from this, material suppliers are increasingly working with automotive companies to promote the adoption of new materials through partnerships and collaborations, which is facilitating the market growth.

- Geographical Trends: North America is the largest market for automotive lightweight materials, primarily driven by stringent U.S. fuel economy standards and emissions regulations. Apart from this, the presence of key automotive manufacturers and technological advancements are further accelerating the automotive lightweight materials demand in the region. Europe is rapidly following suit, due to the presence of well-enforced environmental policies and a strong automotive industry. In the Asia-Pacific, countries such as China and Japan have huge automotive production capacities, which is supporting the regional market growth.

- Competitive Landscape: Some of the major market players in the automotive lightweight materials industry include BASF SE, Magna International, Toray Industries, Covestro AG, ArcelorMittal, thyssenkrupp AG, Alcoa Corporation, Bayer AG, Saudi Arabia Basic Industries Corporation (SABIC), PPG Industries, LyondellBasell, Novelis, Owens Corning Corporation, and Grupo Antolin, among many others.

- Challenges and Opportunities: Challenges to overcome within the automotive lightweight materials market include high production costs, technical constraints in integrating new material into existing manufacturing processes, and extensive testing and validation. Furthermore, the massive balance issue between cost, weight minimization, and performance scales are hindering the market growth. Nevertheless, these challenges also represent opportunities for innovation and growth. The increasing interest in electric and hybrid vehicles presents a significant market growth opportunity, given that lightweight materials are vital for enhancing vehicle economy per charge.

Automotive Lightweight Materials Market Trends:

Increasing Demand for Fuel Efficiency and Reduction in Carbon Emissions

The stringent regulations across the globe to enhance fuel efficiency and reduce carbon footprints are further uplifting the demand of automotive lightweight materials. Recently, India announced plans to implement stringent BS-VII and CAFE-III emission norms to combat vehicle pollution, aligning with Euro-7 standards. Additionally, automakers are under pressure from consumers and regulators to deliver more fuel-efficient vehicles, which is further fueling the market growth. Moreover, the growing need to improve efficiency to make the vehicles lighter and meet the global emissions targets set through international agreements, such as the Paris Accord, are creating a positive outlook for the market growth. With global fuel prices changing constantly and environmental consciousness expanding, consumers are leaning towards vehicles that offer better mileage, which is stimulating the market growth.Regulatory Pressures and Environmental Standards

The key driver for the global automotive lightweight materials market is the regulatory pressures and imposition of stringent environmental standards. Stricter emission norms and the focus on average vehicle fuel consumption are exerting extreme pressure on the governments globally to lay down stringent standards for vehicles, which is further accelerating the market growth. For instance, in the US, the final rule on CO2 emissions will require automakers to meet an estimated industry-wide target of 161 grams per mile (g/mi) carbon dioxide obligation in 2026 which escalates in stringency by 9.8% from 2022-2023. These standards routinely call for reductions in CO2 emissions and fuel consumption that require automakers to find ways of using lighter materials in their car designs. The European Union has also established stringent CO2-emission reduction goals for new cars, which is compelling manufacturers to consider newer and lighter materials.Advancements in Material Science and Technology

The automotive lightweight materials market continues to be reinforced as an integral component in the field of manufacturing and construction. Advancements in this domain have enabled scientists to develop newer and lighter materials, which are stronger and more durable. Moreover, the advent of advanced high-strength steels (AHSS), which provide automakers with materials that have better strength-to-weight ratios than traditional steel is creating a positive outlook for the market growth. In addition to this, breakthroughs in manufacturing processes, such as additive manufacturing (3D printing), are enabling more complex and lightweight designs that were previously unattainable, further fueling the market growth.Automotive Lightweight Materials Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on material type, propulsion type, component, application, and vehicle type.Breakup by Material Type:

- Metal

- High Strength Steel (HSS)

- Aluminum

- Magnesium & Titanium

- Composite

- Carbon Fiber Reinforced Polymer (CFRP)

- Glass Fiber Reinforced Polymer (GFRP)

- Natural Fiber Reinforced Polymer (NFRP)

- Other Composites

- Plastic

- Elastomer

Metal accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the material type. This includes metal (high strength steel (HSS), aluminum, and magnesium & titanium), composite (carbon fiber reinforced polymer (CFRP), glass fiber reinforced polymer (GFRP), natural fiber reinforced polymer (NFRP), and other composites), plastic, and elastomer. According to the report, metal represented the largest segment.The metal segment is driven by the increasing demand for materials that combine strength, durability, and cost-effectiveness in automotive manufacturing. Automakers are leveraging advanced high-strength steels (AHSS), aluminum, and magnesium alloys to meet stringent safety standards while reducing vehicle weight. AHSS is particularly valued for its ability to provide enhanced crash protection without adding significant weight, making it a preferred choice for structural components. Aluminum, known for its excellent strength-to-weight ratio, is extensively used in body panels, engine components, and wheels, contributing to improved fuel efficiency and performance. Magnesium alloys are gaining traction due to their ultra-lightweight properties and ability to withstand high stress, ideal for reducing the overall weight of electric and conventional vehicles. Additionally, the recyclability of metals aligns with the growing focus on sustainable manufacturing practices, making metal components an environmentally favorable choice.

Breakup by Propulsion Type:

- IC Engine Powered

- Electric Powered

- Others

IC engine powered holds the largest share of the industry

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes IC engine powered, electric powered, and others. According to the report, IC engine powered accounted for the largest market share.The IC engine powered segment is driven by the increasing focus on improving fuel efficiency and reducing emissions in traditional combustion engines. Automakers are investing in advanced technologies such as turbocharging, direct fuel injection, and variable valve timing to enhance engine performance while minimizing environmental impact. The need to comply with stringent emission regulations set by governments worldwide, particularly in regions like Europe and North America, is pushing manufacturers to innovate continuously. Additionally, the rising demand for hybrid vehicles, which combine IC engines with electric powertrains, is also contributing to advancements in this segment. Lightweight materials such as aluminum and high-strength steel are being used to reduce engine weight, thereby improving overall vehicle efficiency.

Breakup by Component:

- Frame

- Wheel

- Bumper

- Door and Seat

- Instrument Panel

- Others

The frame segment is driven by the increasing demand for robust yet lightweight structures that enhance vehicle safety and fuel efficiency. Automakers are focusing on using high-strength steel, aluminum, and carbon fiber composites to build frames that can withstand high impact while reducing the overall weight of the vehicle. This shift is crucial for improving fuel economy and reducing emissions, aligning with stringent environmental regulations. Additionally, the rise of electric vehicles (EVs) has intensified the need for lightweight frames to offset the weight of batteries and improve overall range.

The wheel segment is driven by the increasing emphasis on reducing unsprung mass to enhance vehicle performance, handling, and fuel efficiency. Lightweight materials such as aluminum and magnesium alloys are increasingly being used in wheel manufacturing due to their strength-to-weight advantages. These materials help reduce the overall weight of the vehicle, leading to better acceleration, braking, and fuel economy. Additionally, the growing popularity of electric vehicles (EVs) has spurred the demand for lightweight wheels to improve battery efficiency and vehicle range.

The bumper segment is driven by the increasing focus on vehicle safety, weight reduction, and aesthetic appeal. Automakers are adopting lightweight materials such as thermoplastics, aluminum, and composite materials to manufacture bumpers and doors that provide high impact resistance while minimizing weight. These materials help meet stringent safety regulations and improve fuel efficiency by reducing the vehicle's overall weight. The integration of advanced manufacturing techniques, such as injection molding and bonding technologies, allows for the production of complex shapes and enhanced structural integrity.

The door and seat segment is driven by the increasing emphasis on vehicle safety, comfort, and efficiency. Automakers are adopting lightweight materials such as aluminum, magnesium alloys, and advanced high-strength steels to reduce the overall vehicle weight while maintaining structural integrity and crashworthiness. Additionally, the rise in electric vehicles (EVs) necessitates weight reduction to maximize battery efficiency and range. Comfort and customization trends also drive innovation in this segment, with seats incorporating advanced materials like memory foam, lightweight composites, and ergonomic designs to enhance passenger comfort and support.

The instrument panel segment is driven by the increasing integration of advanced technologies, aesthetic appeal, and the need for weight reduction in modern vehicles. Automakers are incorporating lightweight materials such as thermoplastics, composites, and carbon fiber to reduce the weight of instrument panels, contributing to overall vehicle efficiency and performance. The surge in demand for advanced infotainment systems, digital displays, and integrated control interfaces has led to the development of sophisticated, lightweight instrument panels that can house these technologies without compromising on durability or design.

The others segment, encompassing various smaller but critical automotive components, is driven by the increasing need for lightweight, durable, and high-performance materials across diverse applications. This segment includes parts such as brackets, fasteners, fuel tanks, and other structural components where weight reduction can significantly impact overall vehicle efficiency and performance.

Breakup by Application:

- Structural

- Interior

- Exterior

- Powertrain

- Others

The structural segment is driven by the increasing emphasis on vehicle safety, fuel efficiency, and overall performance. Automakers are focusing on reducing the weight of the structural components without compromising strength and durability. Advanced high-strength steel (AHSS), aluminum, and carbon fiber composites are increasingly used in chassis and body structures to meet stringent safety regulations and improve fuel economy. The integration of these materials helps in achieving a balanced trade-off between weight reduction and crashworthiness, making vehicles safer and more efficient.

The interior segment is driven by the increasing demand for comfort, aesthetics, and advanced functionality. Consumers are looking for vehicles with modern, stylish interiors equipped with the latest technology and features. Lightweight materials such as plastics, composites, and eco-friendly fabrics are used to create high-quality, comfortable, and aesthetically pleasing interiors while reducing overall vehicle weight.

The exterior segment is driven by the increasing focus on vehicle aesthetics, aerodynamics, and fuel efficiency. Automakers are using lightweight materials such as aluminum, thermoplastics, and composites for exterior panels and components to reduce weight and improve fuel efficiency. These materials offer design flexibility, allowing for innovative shapes and features that enhance the vehicle's aerodynamic performance.

The powertrain segment is driven by the increasing demand for efficient and high-performance engines and transmission systems. Lightweight materials such as magnesium alloys, aluminum, and advanced composites are being used in engine blocks, transmission housings, and other powertrain components to reduce weight and improve performance. The adoption of these materials helps in enhancing the vehicle's fuel efficiency, acceleration, and handling characteristics.

The other segments are driven by the increasing need for overall vehicle weight reduction and performance enhancement. This includes a wide range of components such as fuel systems, suspension parts, and electrical components. The use of lightweight materials in these areas helps in achieving better fuel efficiency, improved handling, and enhanced durability.

Breakup by Vehicle Type:

- Passenger Vehicle

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

Passenger vehicle dominates the market

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicle, light commercial vehicle (LCV), and heavy commercial vehicle (HCV). According to the report, passenger vehicle represented the largest segment.The passenger vehicle segment is driven by the increasing consumer demand for fuel-efficient, environmentally friendly, and technologically advanced vehicles. Rising fuel costs and stringent emission regulations are pushing automakers to adopt lightweight materials that enhance fuel efficiency and reduce carbon emissions. Additionally, the growing popularity of electric vehicles (EVs) necessitates the use of lightweight materials to improve battery performance and extend driving range. Consumer preferences for high-performance, comfortable, and safe vehicles further influence the adoption of advanced materials in passenger cars. Innovations in material science, such as high-strength steel, aluminum, and composite materials, enable manufacturers to design safer, more efficient, and aesthetically appealing vehicles.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Europe leads the market, accounting for the largest automotive lightweight materials market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Europe represents the largest regional market for automotive lightweight materials.The Europe regional market is driven by the increasing stringency of environmental regulations and emission standards, compelling automakers to adopt lightweight materials to enhance fuel efficiency and reduce CO2 emissions. The European Union's rigorous CO2 targets and the push for sustainability have made lightweight materials essential for vehicle manufacturers. Additionally, the region's strong focus on innovation and advanced automotive technologies supports the development and integration of high-performance materials such as carbon fiber, aluminum, and high-strength steel. The rising popularity of electric vehicles (EVs) in Europe further drives the demand for lightweight materials to improve range and performance. Moreover, European consumers' growing preference for high-quality, efficient, and environmentally friendly vehicles encourages automakers to continually innovate in lightweight design.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the automotive lightweight materials industry include BASF SE, Magna International, Toray Industries, Covestro AG, ArcelorMittal, thyssenkrupp AG, Alcoa Corporation, Bayer AG, Saudi Arabia Basic Industries Corporation (SABIC), PPG Industries, LyondellBasell, Novelis, Owens Corning Corporation, Grupo Antolin, etc.

Key players in the automotive lightweight materials market are strategically enhancing their product portfolios and expanding their production capacities to meet the rising demand. They are heavily investing in research and development (R&D) to innovate and improve material properties, such as strength-to-weight ratios, durability, and recyclability. Collaborative ventures with automotive manufacturers and technology providers are common, aiming to streamline the integration of advanced materials into vehicle design and production. Companies are also focusing on sustainable practices, developing eco-friendly materials and processes to align with global environmental goals. Additionally, they are expanding their geographic presence, setting up manufacturing facilities and R&D centers in key automotive hubs worldwide to better serve regional markets. These players are leveraging advanced technologies like additive manufacturing and artificial intelligence to optimize material usage and reduce costs.

Key Questions Answered in This Report

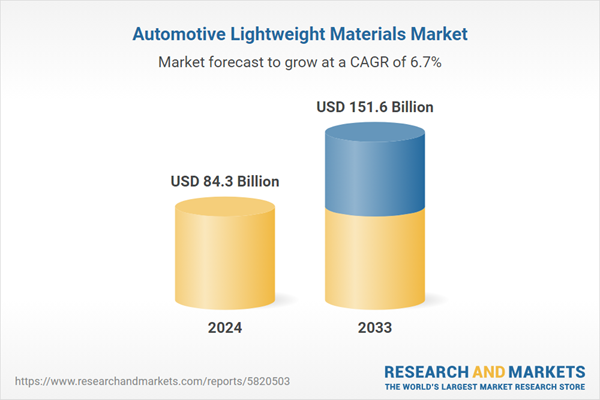

1. What was the size of the global automotive lightweight materials market in 2024?2. What is the expected growth rate of the global automotive lightweight materials market during 2025-2033?

3. What has been the impact of COVID-19 on the global automotive lightweight materials market?

4. What are the key factors driving the global automotive lightweight materials market?

5. What is the breakup of the global automotive lightweight materials market based on the material type?

6. What is the breakup of the global automotive lightweight materials market based on propulsion type?

7. What is the breakup of the global automotive lightweight materials market based on the application?

8. What is the breakup of the global automotive lightweight materials market based on the vehicle type?

9. What are the key regions in the global automotive lightweight materials market?

10. Who are the key players/companies in the global automotive lightweight materials market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Automotive Lightweight Materials Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Material Type

5.5 Market Breakup by Propulsion Type

5.6 Market Breakup by Component

5.7 Market Breakup by Application

5.8 Market Breakup by Vehicle Type

5.9 Market Breakup by Region

5.10 Market Forecast

6 Market Breakup by Material Type

6.1 Metal

6.1.1 Market Trends

6.1.2 Market Breakup by Type

6.1.2.1 High Strength Steel (HSS)

6.1.2.2 Aluminum

6.1.2.3 Magnesium and Titanium

6.1.3 Market Forecast

6.2 Composite

6.2.1 Market Trends

6.2.2 Market Breakup by Type

6.2.2.1 Carbon Fiber Reinforced Polymer (CFPR)

6.2.2.2 Glass Fiber Reinforced Polymer (GFRP)

6.2.2.3 Natural Fiber Reinforced Polymer (NFRP)

6.2.2.4 Others

6.2.3 Market Forecast

6.3 Plastic

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Elastomer

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Propulsion Type

7.1 IC Engine Powered

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Electric Powered

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Others

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Component

8.1 Frame

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Wheel

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Bumper

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Door and Seat

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Instrument Panel

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Others

8.6.1 Market Trends

8.6.2 Market Forecast

9 Market Breakup by Application

9.1 Structural

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Interior

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Exterior

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Powertrain

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Others

9.5.1 Market Trends

9.5.2 Market Forecast

10 Market Breakup by Vehicle Type

10.1 Passenger Vehicle

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Light Commercial Vehicle (LCVs)

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Heavy Commercial Vehicle (HCVs)

10.3.1 Market Trends

10.3.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 Market Trends

11.1.2 Market Forecast

11.2 Europe

11.2.1 Market Trends

11.2.2 Market Forecast

11.3 Asia Pacific

11.3.1 Market Trends

11.3.2 Market Forecast

11.4 Middle East and Africa

11.4.1 Market Trends

11.4.2 Market Forecast

11.5 Latin America

11.5.1 Market Trends

11.5.2 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porter’s Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 BASF SE

16.3.2 Magna International

16.3.3 Toray Industries

16.3.4 Covestro AG

16.3.5 ArcelorMittal

16.3.6 thyssenkrupp AG

16.3.7 Alcoa Corporation

16.3.8 Bayer AG

16.3.9 Saudi Arabia Basic Industries Corporation (SABIC)

16.3.10 PPG Industries

16.3.11 LyondellBasell

16.3.12 Novelis

16.3.13 Owens Corning Corporation

16.3.14 Grupo Antolin

List of Figures

Figure 1: Global: Automotive Lightweight Materials Market: Major Drivers and Challenges

Figure 2: Global: Automotive Lightweight Materials Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Automotive Lightweight Materials Market: Breakup by Material Type (in %), 2024

Figure 4: Global: Automotive Lightweight Materials Market: Breakup by Propulsion Type (in %), 2024

Figure 5: Global: Automotive Lightweight Materials Market: Breakup by Component (in %), 2024

Figure 6: Global: Automotive Lightweight Materials Market: Breakup by Application (in %), 2024

Figure 7: Global: Automotive Lightweight Materials Market: Breakup by Vehicle Type (in %), 2024

Figure 8: Global: Automotive Lightweight Materials Market: Breakup by Region (in %), 2024

Figure 9: Global: Automotive Lightweight Materials Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Automotive Lightweight Materials Industry: SWOT Analysis

Figure 11: Global: Automotive Lightweight Materials Industry: Value Chain Analysis

Figure 12: Global: Automotive Lightweight Materials Industry: Porter’s Five Forces Analysis

Figure 13: Global: Automotive Lightweight Materials (Metal) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 14: Global: Automotive Lightweight Materials (Metal) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 15: Global: Automotive Lightweight Materials (Composite) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 16: Global: Automotive Lightweight Materials (Composite) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 17: Global: Automotive Lightweight Materials (Plastic) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 18: Global: Automotive Lightweight Materials (Plastic) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 19: Global: Automotive Lightweight Materials (Elastomer) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 20: Global: Automotive Lightweight Materials (Elastomer) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 21: Global: Automotive Lightweight Materials (IC Engine Powered) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 22: Global: Automotive Lightweight Materials (IC Engine Powered) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 23: Global: Automotive Lightweight Materials (Electric Powered) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 24: Global: Automotive Lightweight Materials (Electric Powered) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 25: Global: Automotive Lightweight Materials (Other Propulsion Types) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 26: Global: Automotive Lightweight Materials (Other Propulsion Types) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 27: Global: Automotive Lightweight Materials (Frame) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 28: Global: Automotive Lightweight Materials (Frame) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 29: Global: Automotive Lightweight Materials (Wheel) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 30: Global: Automotive Lightweight Materials (Wheel) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 31: Global: Automotive Lightweight Materials (Bumper) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 32: Global: Automotive Lightweight Materials (Bumper) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 33: Global: Automotive Lightweight Materials (Door and Seat) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 34: Global: Automotive Lightweight Materials (Door and Seat) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 35: Global: Automotive Lightweight Materials (Instrument Panel) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 36: Global: Automotive Lightweight Materials (Instrument Panel) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 37: Global: Automotive Lightweight Materials (Other Components) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 38: Global: Automotive Lightweight Materials (Other Components) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 39: Global: Automotive Lightweight Materials (Structural) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 40: Global: Automotive Lightweight Materials (Structural) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 41: Global: Automotive Lightweight Materials (Interior) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 42: Global: Automotive Lightweight Materials (Interior) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 43: Global: Automotive Lightweight Materials (Exterior) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 44: Global: Automotive Lightweight Materials (Exterior) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 45: Global: Automotive Lightweight Materials (Powertrain) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 46: Global: Automotive Lightweight Materials (Powertrain) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 47: Global: Automotive Lightweight Materials (Other Applications) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 48: Global: Automotive Lightweight Materials (Other Applications) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 49: Global: Automotive Lightweight Materials (Passenger Vehicle) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 50: Global: Automotive Lightweight Materials (Passenger Vehicle) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 51: Global: Automotive Lightweight Materials (Light Commercial Vehicle) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 52: Global: Automotive Lightweight Materials (Light Commercial Vehicle) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 53: Global: Automotive Lightweight Materials (Heavy Commercial Vehicle) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 54: Global: Automotive Lightweight Materials (Heavy Commercial Vehicle) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 55: North America: Automotive Lightweight Materials Market: Sales Value (in Billion USD), 2019 & 2024

Figure 56: North America: Automotive Lightweight Materials Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 57: Europe: Automotive Lightweight Materials Market: Sales Value (in Billion USD), 2019 & 2024

Figure 58: Europe: Automotive Lightweight Materials Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 59: Asia Pacific: Automotive Lightweight Materials Market: Sales Value (in Billion USD), 2019 & 2024

Figure 60: Asia Pacific: Automotive Lightweight Materials Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 61: Middle East and Africa: Automotive Lightweight Materials Market: Sales Value (in Billion USD), 2019 & 2024

Figure 62: Middle East and Africa: Automotive Lightweight Materials Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 63: Latin America: Automotive Lightweight Materials Market: Sales Value (in Billion USD), 2019 & 2024

Figure 64: Latin America: Automotive Lightweight Materials Market Forecast: Sales Value (in Billion USD), 2025-2033

List of Tables

Table 1: Global: Automotive Lightweight Materials Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Automotive Lightweight Materials Market Forecast: Breakup by Material Type (in Billion USD), 2025-2033

Table 3: Global: Automotive Lightweight Materials Market Forecast: Breakup by Propulsion Type (in Billion USD), 2025-2033

Table 4: Global: Automotive Lightweight Materials Market Forecast: Breakup by Component (in Billion USD), 2025-2033

Table 5: Global: Automotive Lightweight Materials Market Forecast: Breakup by Application (in Billion USD), 2025-2033

Table 6: Global: Automotive Lightweight Materials Market Forecast: Breakup by Vehicle Type (in Billion USD), 2025-2033

Table 7: Global: Automotive Lightweight Materials Market Forecast: Breakup by Region (in Billion USD), 2025-2033

Table 8: Global: Automotive Lightweight Materials Market: Competitive Structure

Table 9: Global: Automotive Lightweight Materials Market: Key Players

Companies Mentioned

- BASF SE

- Magna International

- Toray Industries

- Covestro AG

- ArcelorMittal

- thyssenkrupp AG

- Alcoa Corporation

- Bayer AG

- Saudi Arabia Basic Industries Corporation (SABIC)

- PPG Industries

- LyondellBasell

- Novelis

- Owens Corning Corporation

- Grupo Antolin

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 84.3 Billion |

| Forecasted Market Value ( USD | $ 151.6 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |