India's mobile component manufacturing and assembly industry has made significant traction with continued support from government policy and focused incentive schemes. Initiatives focused on boosting domestic production capacity have promoted a favorable investment environment and have invited large-scale participation throughout the electronics manufacturing value chain. According to the reports, in April 2025, Hosur's new factory of Tata Electronics started manufacturing older iPhone models, and Foxconn's \\$2.6 billion plant at Bengaluru is ready to go into production, making iPhone 16. Moreover, by providing output-based financial incentives based on local value addition, output, and export performance, such programs have spurred new as well as existing participants to scale up operations. Moreover, the emergence of specialized electronic manufacturing clusters, the enhancement of infrastructure, and the simplification of regulations have largely lowered barriers to entry. Government-sponsored initiatives aimed at boosting skill development and technical training have further enhanced the ability of the sector to serve industry needs. With these initiatives ongoing in keeping with national priorities for electronics self-reliance, they are promoting a culture favorable to technological growth and further localization. These initiatives combined go towards making India a globally competitive destination for the manufacture of mobile components and high-volume assembly processes.

The quick growth of India's digital economy, coupled with a huge and growing population increasingly connected to the internet, is a key driving force behind demand for mobile components and assembly processes. As per the sources, in December 2024, India's mobile production grew from 26% domestic production in 2014 to 99.2% with exports growing from ₹1,566 crore in FY 2014-15 to ₹1.2 lakh crore in 2023-24. Furthermore, with smartphone penetration increasing steadily, driven by low-cost access to data and devices, the demand for high-performance and diverse mobile components amplifies in proportion. Consumers are looking for devices with increased functionality, such as improved cameras, higher-speed processors, and better power efficiency, and manufacturers are responding by upgrading components and innovating product design constantly. This phenomenon, combined with the spread of digital services, online learning, mobile banking, and digital entertainment platforms, is speeding up device replacement cycles. In addition, evolution in technologies like 5G, artificial intelligence (AI), and Internet of Things (IoT) is accelerating mobile device performance standards, with more advanced components required. The resulting market dynamics are forcing producers to implement flexible, high-capacity production facilities to keep pace with changing consumer demands, and thus solidify India's status as a strategic hub for the manufacturing and development of mobile technology.

Indian Mobile Components Manufacturing and Assembly Market Trends:

Increase in Domestic Production and Smartphone Penetration

India has become the world's second-largest mobile phone manufacturer with its growing internet base, rising disposable incomes, and huge, technology-embracing population. According to estimates, India will soon cross 900 million internet users, of which 886 million were in 2024 alone, an 8% year-on-year increase. The growth in internet penetration has boosted the need for smartphones, driving local manufacturing and assembly facilities. The arrival of smartphones subsequently fueled this demand, particularly with urban and internet-savvy consumers. Today, India boasts around 650 million smartphone users, representing 46% smartphone penetration. This expansion has resulted in a large demand for components like printed circuit boards (PCBs), connectors, and acoustic components, facilitating the growth of the mobile device supply chain. With an expanding domestic consumer market and government support for local production, India's mobile manufacturing industry is transforming into a globally competitive, high-output sector.Demographic Advantage and Cost-Efficient Labor

India's positive demographic landscape offers a sound basis for expansion in mobile phone adoption and manufacturing. India has a large and youthful population, an emerging middle class, and an amplifying number of working women and men. These socio-economic forces have shifted consumption patterns and widened demand for digital connectivity. As the youth population becomes increasingly connected digitally, mobile phones become tools for communication, learning, and employment. Further, India has a large source of unskilled, semi-skilled, and skilled labor concentrated in big manufacturing states. The presence of cheap labor has been a significant factor in positioning India as an attractive location for electronics manufacturing. This competitive labor advantage lowers manufacturing costs and attracts both local and global companies to set up or increase business in the nation. The convergence of demographic power and affordability of labor makes India able to ramp up its mobile manufacturing ecosystem without losing its attractiveness for investments to come.Technological Evolution and Policy-Driven Growth

Continuous technological evolution is revolutionizing Indian mobile components manufacturing and assembly market growth. As consumer demands evolve and product lifecycles shorten, manufacturers are under pressure to innovate repeatedly and introduce new models as frequently as possible. Such a trend kindles the demand for mobile parts such as plastics, metals, connectors, and PCBs. In addition, the Indian government has launched friendly policies and programs such as "Make in India," which have greatly enhanced the business environment for mobile phone producers. Foreign direct investment (FDI) inflows are growing, and projects like Samsung's Noida mega-factory highlight India's manufacturing potential. Other international brands, especially Chinese producers, are also expanding their local production base. Although numerous companies continue to remain assembly-centric, a trend toward in-house value addition and R&D is taking root, encouraged by government schemes. These advancements are progressively transforming India into a complete mobile manufacturing center, ranging from design and component production to end assembly and innovation.Indian Mobile Components Manufacturing and Assembly Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Indian mobile components manufacturing and assembly market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on mobile type, mobile components, and assembly and domestic manufacturing.Analysis by Mobile Type:

- Smartphones

- Feature Phones

- Other Phones

Analysis by Mobile Components:

- Main Board and Sensor Flex

- Display/Touchscreen

- Camera (Primary/Secondary)

- Battery Pack

- Others

Analysis by Assembly and Domestic Manufacturing:

- Assembly

- Domestic Manufacturing

Regional Analysis:

- Uttar Pradesh

- Andhra Pradesh

- Telangana

- Others

Competitive Landscape:

India mobile components manufacturing and assembly market outlook is becoming more competitive, driven by robust policy support, rising domestic demand, and technology integration. The segment is witnessing heightened participation from both incumbents and new entrants, all looking to ride the burgeoning smartphone market and supportive production-linked incentive schemes. The most significant manufacturing bases are found in states such as Uttar Pradesh, Tamil Nadu, and Andhra Pradesh, wherein infrastructure and accessibility of labor suit scalability. Backward integration of the value chain is increasing by producing critical parts like PCBs, batteries, displays, connectors, and plastics to minimize dependency on imports. Firms also diversify the offerings by undertaking automation and precision engineering to boost quality and the efficiency of production. This dynamic environment represents a shift from core assembly towards an integrated manufacturing practice, consistent with national aspirations towards technological independence and increased local content in the electronic industry.The report provides a comprehensive analysis of the competitive landscape in the Indian mobile components manufacturing and assembly market with detailed profiles of all major companies, including:

- Samsung Electronics Co. Ltd.

- Xiaomi Corporation

- Lenovo Group Ltd.

- Micromax Informatics Limited

- Oppo Guangdong Mobile Communications Co. Ltd.

- Vivo Mobile Communications Co. Ltd.

- Lava International Limited

- Karbonn Mobiles

- Intex Technologies

Key Questions Answered in This Report

1. How big is the mobile components manufacturing and assembly market in the India?2. What is the future outlook of the mobile components manufacturing and assembly market in India?

3. What are the key factors driving the Indian mobile components manufacturing and assembly market?

4. Which segment accounts for the largest Indian mobile components manufacturing and assembly market share?

5. Which are the leading companies in the Indian mobile components manufacturing and assembly market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Mobile Components Manufacturing and Assembly Market

5.1 Market Overview

5.2 Market Performance

5.2.1 Volume Trends

5.2.2 Value Trends

5.3 Market Breakup by Mobile Type

5.4 Market Breakup by Region

5.5 Market Breakup by Key Players

5.6 Market Forecast

6 Indian Mobile Components Manufacturing and Assembly Market

6.1 Market Overview

6.2 Market Performance

6.2.1 Volume Trends

6.2.2 Value Trends

6.3 Impact of COVID-19

6.4 Price Trends

6.4.1 Key Price Indicators

6.4.2 Price Structure

6.4.3 Price Trends

6.5 Market Breakup by Assembly and Domestic Manufacturing

6.6 Market Breakup by Mobile Type

6.7 Market Breakup by Mobile Components

6.8 Market Breakup by State

6.9 Market Forecast

6.10 SWOT Analysis

6.10.1 Overview

6.10.2 Strengths

6.10.3 Weaknesses

6.10.4 Opportunities

6.10.5 Threats

6.11 Value Chain Analysis

6.11.1 Overview

6.11.2 Research & Development

6.11.3 Design Services

6.11.4 Sourcing & Fabrication

6.11.5 Manufacture/System Assembly

6.11.6 Configuration & Testing

6.11.7 Marketing

6.11.8 Distribution

6.11.9 Post-Sales Services

6.12 Porter’s Five Forces Analysis

6.12.1 Overview

6.12.2 Bargaining Power of Buyers

6.12.3 Bargaining Power of Suppliers

6.12.4 Degree of Rivalry

6.12.5 Threat of New Entrants

6.12.6 Threat of Substitutes

6.13 Government Initiatives

7 Market Breakup by Mobile Components

7.1 Main Board and Sensor Flex

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Display/Touchscreen

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Camera (Primary/Secondary)

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Battery Pack

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others (Non-Electronics Parts, Accessories, etc.)

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by Assembly and Domestic Manufacturing

8.1 Assembly

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Domestic Manufacturing

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Mobile Type

9.1 Smartphones

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Feature Phones

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Other Phones

9.3.1 Market Trends

9.3.2 Market Forecast

10 Competitive Landscape

10.1 Market Structure

10.2 Key Players

11 Mobile Manufacturing Process

11.1 Product Overview

11.2 Detailed Process Flow

11.3 Manufacturing Process

11.4 Key Market Drivers and Success Factors

12 Profile of Key Players

12.1 Samsung Electronics Co. Ltd.

12.2 Xiaomi Corporation

12.3 Lenovo Group Ltd.

12.4 Micromax Informatics Limited

12.5 Oppo Guangdong Mobile Communications Co. Ltd.

12.6 Vivo Mobile Communications Co. Ltd.

12.7 Lava International Limited

12.8 Karbonn Mobiles

12.9 Intex Technologies

List of Figures

Figure 1: India: Mobile Components Manufacturing and Assembly Market: Major Drivers and Challenges

Figure 2: Global: Mobile Components Manufacturing and Assembly Market: Volume Trends (in Million Units), 2019-2024

Figure 3: Global: Mobile Components Manufacturing and Assembly Market: Value Trends (in Billion USD), 2019-2024

Figure 4: Global: Mobile Components Manufacturing and Assembly Market: Breakup by Mobile Type (in %), 2024

Figure 5: Global: Mobile Components Manufacturing and Assembly Market: Breakup by Region (in %), 2024

Figure 6: Global: Mobile Components Manufacturing and Assembly Market: Breakup by Key Players (in %), 2024

Figure 7: Global: Mobile Components Manufacturing and Assembly Market Forecast: Volume Trends (in Million Units), 2025-2033

Figure 8: Global: Mobile Components Manufacturing and Assembly Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 9: India: Mobile Components Manufacturing and Assembly Market: Volume Trends (in Million Units), 2019-2024

Figure 10: India: Mobile Components Manufacturing and Assembly Market: Value Trends (in Billion USD), 2019-2024

Figure 11: India: Mobile Components Manufacturing and Assembly: Total Production Cost Breakup (in %)

Figure 12: India: Mobile Components Manufacturing and Assembly Market: Average Price Trends (in USD/Unit), 2019-2024

Figure 13: India: Mobile Components Manufacturing and Assembly Market Forecast: Average Price Trends (in USD/Unit), 2025-2033

Figure 14: India: Mobile Components Manufacturing and Assembly Market: Breakup by Assembly and Domestic Manufacturing (in %), 2024

Figure 15: India: Mobile Components Manufacturing and Assembly Market: Breakup by Mobile Type (in %), 2024

Figure 16: India: Mobile Components Manufacturing and Assembly Market: Breakup by Mobile Components (in %), 2024

Figure 17: India: Mobile Components Manufacturing and Assembly Market: Breakup by State (in %), 2024

Figure 18: India: Mobile Components Manufacturing and Assembly Market Forecast: Volume Trends (in Million Units), 2025-2033

Figure 19: India: Mobile Components Manufacturing and Assembly Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 20: India: Mobile Components Manufacturing and Assembly Industry: SWOT Analysis

Figure 21: India: Mobile Components Manufacturing and Assembly Industry: Value Chain Analysis

Figure 22: India: Mobile Components Manufacturing and Assembly Industry: Porter’s Five Forces Analysis

Figure 23: India: Mobile Components Manufacturing and Assembly (Main Board and Sensor Flex) Market: Value Trends (in Million USD), 2019 & 2024

Figure 24: India: Mobile Components Manufacturing and Assembly (Main Board and Sensor Flex) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 25: India: Mobile Components Manufacturing and Assembly (Display/Touchscreen) Market: Value Trends (in Million USD), 2019 & 2024

Figure 26: India: Mobile Components Manufacturing and Assembly (Display/Touchscreen) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 27: India: Mobile Components Manufacturing and Assembly (Camera-Primary/Secondary) Market: Value Trends (in Million USD), 2019 & 2024

Figure 28: India: Mobile Components Manufacturing and Assembly (Camera-Primary/Secondary) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 29: India: Mobile Components Manufacturing and Assembly (Battery Pack) Market: Value Trends (in Million USD), 2019 & 2024

Figure 30: India: Mobile Components Manufacturing and Assembly (Battery Pack) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 31: India: Mobile Components Manufacturing and Assembly (Others) Market: Value Trends (in Million USD), 2019 & 2024

Figure 32: India: Mobile Components Manufacturing and Assembly (Others) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 33: India: Mobile Components Manufacturing and Assembly (Assembly) Market: Value Trends (in Million USD), 2019 & 2024

Figure 34: India: Mobile Components Manufacturing and Assembly (Assembly) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 35: India: Mobile Components Manufacturing and Assembly (Domestic Manufacturing) Market: Value Trends (in Million USD), 2019 & 2024

Figure 36: India: Mobile Components Manufacturing and Assembly (Domestic Manufacturing) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 37: India: Mobile Components Manufacturing and Assembly (Smartphones) Market: Value Trends (in Million USD), 2019 & 2024

Figure 38: India: Mobile Components Manufacturing and Assembly (Smartphones) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 39: India: Mobile Components Manufacturing and Assembly (Feature Phones) Market: Value Trends (in Million USD), 2019 & 2024

Figure 40: India: Mobile Components Manufacturing and Assembly (Feature Phones) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 41: India: Mobile Components Manufacturing and Assembly (Other Phones) Market: Value Trends (in Million USD), 2019 & 2024

Figure 42: India: Mobile Components Manufacturing and Assembly (Other Phones) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 43: Smartphones : Major Components

Figure 44: Mobile Components Manufacturing and Assembly: Detailed Process Flow

List of Tables

Table 1: Global: Mobile Components Manufacturing and Assembly Market: Key Industry Highlights, 2024 and 2033

Table 2: India: Mobile Components Manufacturing and Assembly Market: Key Industry Highlights, 2024 and 2033

Table 3: India: Duty Structure for Mobile Phone Industry

Table 4: India: Illustration of Duty Differential Under the Current Duty Structure

Table 5: India: Mobile Components Manufacturing and Assembly Market Forecast: Breakup by Mobile Component (in Million USD), 2025-2033

Table 6: India: Mobile Components Manufacturing and Assembly Market Forecast: Breakup by Assembly and Domestic Manufacturing (in Million USD), 2025-2033

Table 7: India: Mobile Components Manufacturing and Assembly Market Forecast: Breakup by Mobile Type (in Million USD), 2025-2033

Table 8: India: Mobile Components Manufacturing and Assembly Industry: Competitive Structure

Table 9: India: Mobile Components Manufacturing and Assembly Market: Key Players and their Share in Total Production Volume (in %)

Companies Mentioned

- Samsung Electronics Co. Ltd.

- Xiaomi Corporation

- Lenovo Group Ltd.

- Micromax Informatics Limited

- Oppo Guangdong Mobile Communications Co. Ltd.

- Vivo Mobile Communications Co. Ltd.

- Lava International Limited

- Karbonn Mobiles and Intex Technologies

Table Information

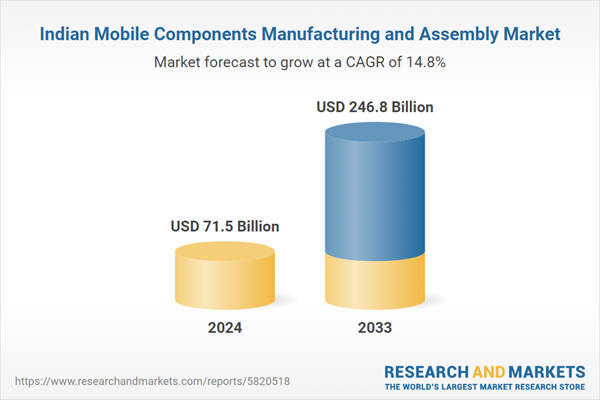

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 71.5 Billion |

| Forecasted Market Value ( USD | $ 246.8 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |