Bio agriculture, popularly known as organic farming, primarily employs natural inputs and sustainable practices to produce crops and livestock. It helps reduce the negative impact of conventional agriculture on the environment by promoting biodiversity, conserving natural resources, and avoiding the use of synthetic chemicals and genetically modified organisms (GMOs).

In addition to this, it relies on a combination of techniques and practices, such as crop rotation, intercropping, green manure, composting, and biological pest control, to maintain soil fertility and regulate various pests and diseases. Bio agriculture maintains a balance between agriculture and the environment, preserves natural habitats, reduces soil erosion, and minimizes air and water pollution. Currently, there is an expanding adoption of bio agriculture in India as it relies on renewable energy resources and helps decrease global warming levels.

Indian Bio Agriculture Market Trends:

The introduction of favorable initiatives, such as the National Programme on Organic Farming and the Paramparagat Krishi Vikas Yojana, by the Government of India (GoI) to promote bio-agriculture in the country through financial assistance to farmers represents the prime factor driving the market growth. Besides this, the rising population, rapid urbanization, inflating disposable income of individuals, and the growing demand for organic food on account of its numerous health benefits are creating a favorable outlook for the market.Moreover, the depleting levels of soil fertility in the country are fueling the adoption of bio-agriculture practices, leading to the development of agricultural biologicals, which include microorganisms, enzymes, biochemicals, biofertilizers, biopesticides, and biostimulants. This, in confluence with changing climate conditions and increasing scarcity of water resources, is contributing to the market growth. Concurrent with this, the escalating consumer awareness about the advantages of sustainable agriculture and the surging demand for breeding nutritious, high-yielding, and less resource-input-demanding crops are acting as significant growth-inducing factors.

In addition to this, continuous technological advancements in bio agriculture technology, such as the development of bio-fertilizers and bio-pesticides, are presenting remunerative growth opportunities for the market. Furthermore, the widespread product adoption for promoting crop diversification and agroforestry, supportive non-governmental organizations (NGOs) activities, and the extensive export opportunities for organic food in the international market are aiding in market expansion.

Key Market Segmentation:

The research provides an analysis of the key trends in each segment of the Indian bio agriculture market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on segment.Segment Insights:

- Transgenic Crops

- Biofertilizers

- Biopesticides

Regional Insights:

- North India

- South India

- East India

- West India

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global bio agriculture market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. For each of the companies covered, the report provides business overview, services offered, business strategies, financials, SWOT analysis, and major news and events.Key Questions Answered in This Report

- How big is the bio agriculture market in India?

- What factors are driving the growth of Indian bio agriculture market?

- What is the forecast for the bio agriculture market in India?

- Which segment accounts for the largest Indian bio agriculture segment market share?

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | June 2025 |

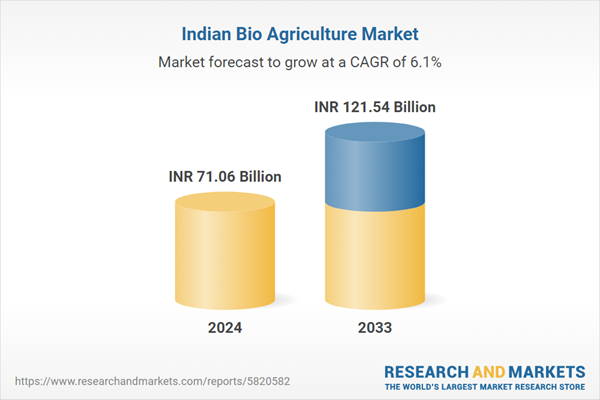

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( INR | INR 71.06 Billion |

| Forecasted Market Value ( INR | INR 121.54 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | India |