At present, there is a rise in the demand for low battery drainage equipment across the globe. This, along with the increasing adoption of mobile consumer units, represents one of the key factors driving the market. It is expected that the market for smartphones will reach 1.99 billion units by 2033. It is growing rapidly at a rate of 3.08% during 2025-2033. Moreover, there is a rise in the demand for primary batteries because of their efficient voltage deliverability and longer shelf life. Coupled with this, the rising utilization of alkaline primary batteries owing to their operational capabilities over a variety of temperatures and high energy density, is boosting the growth of the market.

The United States stands out as a key market disruptor with a share of 83.20% in North America. The growing production of medical devices, such as hearing aids, surgical tools, medical defibrillators, robots, infusion pumps, monitors, and meters, is positively influencing the market. A total of 153 deals have been made in the medical device sector of the country since 2020, reaching over $4.5 billion in capital investment. Exports of medical devices from the country have also increased in the past few years, reaching $13.9 billion, and they are projected to rise to about $16.6 billion by 2027.

Besides this, the increasing defense budget for the development of weapons and missiles that use primary batteries is offering lucrative growth opportunities to industry investors. Over the last decade, the Department of Defense’s (DoD) budget for the procurement and research and development (R&D) activities related to missiles and munitions have increased by 340%, thus reaching US$30.6 billion in fiscal 2024. This has also heightened the need for primary batteries in these devices.

Primary Battery Market Trends:

Growing Demand for Portable and Consumer Electronics

Portable devices such as smartphones, laptops, wearables, and other consumer electronics have mainly driven the growth in the global primary battery market. These devices require reliable, long-lasting power solutions; hence, primary batteries are preferred, especially lithium-based ones, for their high energy density, compactness, and ability to offer consistent power over time. In another report from IDC, a 3.6 percent growth has been reported within the smartphone market globally to 314.6 million shipments within the third quarter of 2024. In wearable devices, its shipment growth is also foreseen at 6.1 percent year over year in 2024 for 537.9 million units.Further to this, growth is enhanced through an improving global economy and a refresh cycle in mature markets, with further growth coming from adoption in emerging regions. The increase in demand for efficient, long-lasting power solutions accelerates. The increase in numbers and usage of portable devices have been viewed as being the drivers for continued demand for primary batteries that are efficient and reliable in use.

Heightened Adoption of Smart Home Devices and IoT Applications

The Internet of Things (IoT) devices and smart home technologies have increased the demand for primary batteries to a great extent. As of 2023, there were 16.6 billion connected IoT devices in the world, up by 15% from 2022, according to an industrial report. Smart thermostats, security cameras, sensors, and connected appliances require small, reliable power sources to function efficiently for longer durations.This further increases the requirement of primary batteries, particularly in wireless and low-power devices. With the growing implementation of IoT, primary cells are going to be necessary to power the devices because their time for long, interrupted run time is still relevant. The growing IoT field further emphasizes the need for more energy-efficient, more environmentally friendly power.

Increased Usage in Healthcare and Industrial Applications

Primary batteries are widely used in healthcare devices, such as hearing aids, pacemakers, and medical sensors, due to their reliability and long shelf life. The medical device market is expected to grow steadily, with annual sales increasing by more than 5 percent, reaching nearly USD 800 Billion by 2030, as per an industrial report data. This growth in the healthcare sector drives the demand for secure and reliable power sources, making primary batteries essential for these devices. In industrial sectors, primary batteries power remote sensors, tracking equipment, and backup systems for machinery. As the demand for medical and industrial equipment continues to rise, the need for primary batteries is expected to increase significantly in the near future.Primary Battery Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global primary battery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end use industry.Analysis by Type:

- Primary Alkaline Battery

- Primary Lithium Battery

- Others

Additionally, advancements in alkaline battery technology enhance energy efficiency, further solidifying its position as the largest segment. The segment benefits from continuous innovations aimed at reducing environmental impact through recyclable designs. Increasing demand for portable energy solutions in emerging economies also contributes to its sustained growth.

Analysis by End Use Industry:

- Defense

- Aerospace

- Medical

- Aviation

- Others

Primary batteries are widely utilized in the aerospace sector as backup power for electronic equipment, emergency illumination, and navigation systems during crucial missions. They are essential for space exploration and aviation applications owing to their lightweight design, high energy density, and dependability in harsh environments. Demand in this market is also fueled by rising investments in commercial space projects and satellite launches.

In the medical sector, primary batteries are widely used to power devices such as pacemakers, hearing aids, and portable diagnostic devices. These batteries offer the dependability and longevity required for life-saving and precise medical applications. The increasing usage of wearable medical technology and advancements in portable medical technology are the leading drivers of this market's demand for primary batteries.

Primary batteries are vital to the aviation industry because they power vital electronics including communication devices, emergency systems, and cockpit instruments. They are essential for maintaining operational effectiveness and safety because of their dependability in high-altitude and temperature-changing environments. Demand in this market segment is being supported by the growing emphasis on improving airplane safety and dependability systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Increasing urbanization, expanding healthcare infrastructure, and rising military investments further boost the demand for primary batteries, solidifying Asia Pacific's leadership in the market. Additionally, government initiatives supporting industrial growth and advancements in battery technology are fueling regional market expansion. The growing adoption of portable devices and rising disposable income levels also contribute significantly to the region’s dominance.

Key Regional Takeaways:

North America Primary Battery Market Analysis

Primary batteries account for a substantial share of the North America market. It is driven by a high demand from defense, medical, and consumer electronics sectors. This region enjoys well-developed technological infrastructure, high consumer purchasing power, and massive investments in R&D. As the need for portable medical devices grows and military modernization progresses, the demand for more reliable and longer-lasting batteries also rises. Additionally, the heightened trend toward sustainability and recycling endeavors has encouraged innovations toward a more eco-friendly solution to battery products, further accelerating North America's market growth.United States Primary Battery Market Analysis

In 2024, United States is leading the market with a share of 83.20% in North America. Robust growth has been noted in the primary battery market in the United States primarily due to advancement in medical devices and defence technologies. The FDA estimated that almost 30 million adults in the U.S. were reported to have some degree of hearing loss in 2023, thus providing a significant driving force behind the demand for hearing aids that rely strongly on primary batteries, such as zinc-air. The aging population, projected to increase to 82 million by 2050 in Americans aged 65 and older, is significantly increasing the need for medical devices such as pacemakers and glucose monitors that depend on reliable primary power sources.The defence sector is growing in terms of adoption of drones and unmanned aerial systems. As reported by the industries, procurement funding for drones would grow from USD 14 Billion in 2024 to USD 23.1 Billion in 2033, piling up an overall expenditure of USD 186.8 Billion. The use of primary batteries which can sustain even the most extreme environment will prove to be critical to powering devices such as communicators, sensors, and independent systems within these growing industries. This dual demand from the healthcare and defence industries underpins the strong growth trajectory of the U.S. primary battery market.

Europe Primary Battery Market Analysis

The Europe primary battery market is expected to grow dramatically with two major factors. Firstly, defence spending, and secondly, the population is aging. European NATO members have increased their defence budgets, with a commitment to 32% being spent on procurement and R&D in 2024, up from 15% a decade ago. This increase in funding allows for the development of more advanced battery technologies required for UAVs, communication systems, and surveillance equipment, among other military applications, to support high-performance, reliable power sources.According to an industrial report, Europe's population is aging, with nearly one in five Europeans aged 65 or older, reaching nearly 30% by 2050. Aged people are driving the demand for portable medical devices. Batteries are of utmost importance to power equipment such as pacemakers, hearing aids, and wearable health monitors, for which long-lasting and stable energy sources are required. This demographic shift further intensifies the need for primary batteries, thus becoming a key driver for the market in coming years.

Asia Pacific Primary Battery Market Analysis

The Asia Pacific primary battery market is expected to see an immense growth rate due to high defence spending, an upsurge in the aviation sector, and the increased need for advanced technologies. For 2024, China has increased its defence budget by 7.2%, which will aid the development of high-performance primary batteries needed for many different military applications, including communications devices, UAVs, and surveillance equipment. These military systems often utilize primary batteries because they have long shelf lives, reliability, and can be operated in harsh environments.Similarly, the aviation sector of India is also going to expand at a very rapid pace. The country is estimated to become the world's third-largest air passenger market until 2030. Currently, the region is projected to have reached 1,100 airplanes operation by 2027, as per an industry report. Increasing the demand of primary batteries shall be highly felt as these are implemented in aircraft in emergency backup systems, ELTs, and communicating equipment. Lightweight, durable, and dependable primary power sources, like lithium-thionyl chloride and alkaline batteries, play a significant role in the safety and operational readiness of an aircraft.

Latin America Primary Battery Market Analysis

The Latin American aviation industry is also expanding. These expansions have been driven by local economic growth and high demand for air travel. According to Official Airline Guide (OAG) stats, by September 2024, the region was hosting 151 airlines and 531 airports offering scheduled services, a tremendous growth in aviation infrastructure. This growth is creating an increasing demand for reliable, long-lasting primary batteries used in aircraft emergency systems, communication devices, flight data recorders, and backup power systems.With the rise in airlines and airports, the need for lightweight, high-performance batteries is a must to ensure safe and efficient air travel. Primary batteries, including lithium-thionyl chloride and alkaline, are highly valued for their long-lasting power delivery in critical aviation systems. Growth in the aviation industry in Brazil, Mexico, Argentina, and other Latin American countries will further fuel the demand for primary batteries, thus becoming a significant growth driver for the region's primary battery market.

Middle East and Africa Primary Battery Market Analysis

The MEA primary battery market is likely to register high growth, primarily because of the rapidly growing healthcare sector in the region. According to the World Economic Forum, the healthcare expenditure of the Gulf Cooperation Council will reach USD 135.5 Billion by 2027. This growth is because emphasis on preventative care and the usage of emerging healthcare technologies on an enormous scale are increasing. Increased spending on healthcare is one of the major factors driving higher demand for primary battery-powered medical devices, including pacemakers, insulin pumps, and wearable health monitors.The increasing healthcare infrastructure and availability of advanced medical technologies have also led to increased demand for efficient, long-lasting primary batteries. This trend supports the healthcare industry and fosters innovation in battery technology, which again raises demand for primary batteries in medical applications. Therefore, this booming healthcare industry is an important growth driver to the MEA primary battery market.

Competitive Landscape:

To increase their market position, major firms are concentrating on expansion, sustainability, and innovation initiatives. Leading businesses are making investments in cutting-edge battery technology to improve energy density, shelf life, and dependability in order to meet the rising demand from sectors such as consumer electronics, medical, and defense. Sustainability is also a major priority, and companies are creating recyclable and environmentally friendly batteries that comply with strict laws and address environmental issues. They are expanding their worldwide reach and tapping into new markets, especially in Asia Pacific, by establishing strategic alliances and partnerships.Most firms are also diversifying the products they offer with the introduction of specialty batteries tailored for specific markets, including healthcare and aerospace. With increased competition, the leading players are placing increasing importance on after-sale support services and aftermarket solutions as they seek to improve customer retention and maintain market dominance globally.

The report provides a comprehensive analysis of the competitive landscape in the primary battery market with detailed profiles of all major companies, including:

- Camelion Batterien GmbH

- Duracell Inc.

- EaglePicher Technologies

- Energizer Holdings Inc.

- FDK Corporation (Fujitsu Limited)

- GP Industries Limited (Gold Peak Industries Limited)

- Integer Holdings Corporation

- Maxell Ltd. (Hitachi Ltd.)

- Panasonic Holdings Corporation

- Saft (TotalEnergies SE)

- Ultralife Corporatio.

Key Questions Answered in This Report

- What is a primary battery?

- How big is the global primary battery market?

- What is the expected growth rate of the global primary battery market during 2025-2033?

- What are the key factors driving the global primary battery market?

- What is the leading segment of the global primary battery market based on the type?

- What are the key regions in the global primary battery market?

- Who are the key players/companies in the global primary battery market?

Table of Contents

Companies Mentioned

- Camelion Batterien GmbH

- Duracell Inc.

- EaglePicher Technologies

- Energizer Holdings Inc.

- FDK Corporation (Fujitsu Limited)

- GP Industries Limited (Gold Peak Industries Limited)

- Integer Holdings Corporation

- Maxell Ltd. (Hitachi Ltd.)

- Panasonic Holdings Corporation

- Saft (TotalEnergies SE)

- Ultralife Corporation

Table Information

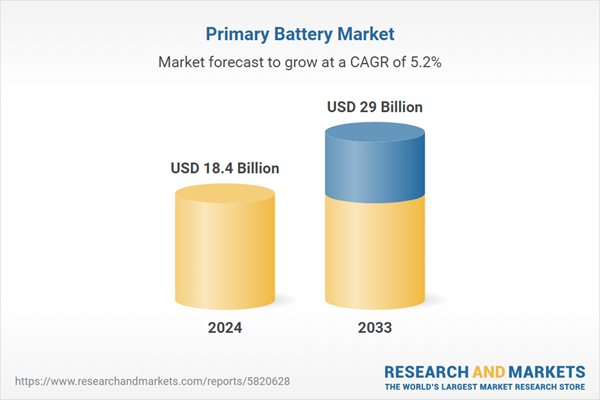

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 18.4 Billion |

| Forecasted Market Value ( USD | $ 29 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |