The global streaming analytics market is driven by the increasing adoption of real-time data processing across industries such as healthcare, retail, and finance. The rise in IoT devices and connected technologies generates vast amounts of data, necessitating instant analysis for actionable insights. The number of connected Internet of Things (IoT) devices grew by 15% in 2023 to 16.6 billion. At the end of 2024, that number is expected to grow to 18.8 billion due to 13% growth, according to an industry report. Despite economic challenges and supply chain constraints, 51% of the companies plan to increase their IoT budget (22% predict more than 10% increase).

Real-time streaming analytics will grow as the Internet of Things technology increases as it enhances data-driven decision-making processes. Along with this, businesses are prioritizing data-driven decision-making to enhance operational efficiency and customer experiences. Additionally, the rise of cloud computing and advancements in AI and machine learning enable scalable and efficient streaming analytics solutions. Regulatory requirements for data security and compliance further propel the streaming analytics market growth. The demand for predictive analytics and the need to mitigate risks in dynamic environments also contribute significantly.

The United States stands out as a key regional market, primarily driven by the rapid digital transformation across industries, emphasizing the need for real-time data insights to stay competitive. The expansion of 5G networks and edge computing enhances data processing capabilities, enabling faster and more efficient analytics. The 5G global footprint through early 2024 was nearly 2 billion connections, with 185 million new connections since October 2023, with connections in North America reaching 220 million. The total number of 5G connections will increase to 7.7 billion globally by 2028, driven by widespread adoption, the rising popularity of the Internet of Things (IoT), and increasing network coverage.

Real-time streaming analytics plays an important role as 5G technology changes to optimize network performance and provide better data-driven insights. In addition, enterprises are increasingly focusing on personalized customer experiences, driving demand for real-time data analysis. Additionally, the rise of e-commerce and digital services necessitates immediate fraud detection and operational optimization. Government initiatives promoting smart cities and infrastructure development also contribute to market growth, as they rely heavily on real-time data for efficient management and decision-making.

Streaming Analytics Market Trends:

Growing Adoption Across Industry Verticals

The streaming analytics market demand is rising across various industries, including retail, media and entertainment, manufacturing, healthcare, and BFSI. Businesses are leveraging real-time data analysis to gain a competitive edge by identifying trends, monitoring consumer behavior, and optimizing operations. A significant factor propelling this trend is the increasing digital transformation across industries.For instance, the American Hospital Association reports that the United States has approximately 6,093 hospitals, many of which are incorporating streaming analytics for real-time patient monitoring and operational efficiency. As enterprises recognize the value of continuous data processing, the adoption of streaming analytics is expected to accelerate, enabling organizations to make faster, data-driven decisions.

Expansion of IoT and AI Integration

The rapid expansion of IoT and AI technologies is significantly acting as one of the key streaming analytics market trends. As businesses strive to process vast amounts of data in real time, integrating AI-powered analytics with IoT devices has become essential. The number of connected IoT devices has risen by 13%, reaching 18.8 billion globally. This surge enables companies to enhance decision-making by analyzing data streams from sensors, smart devices, and connected systems. Additionally, streaming analytics is being utilized in GPS-based applications, where real-time data from vehicles is merged with user location information. With AI-driven automation improving the efficiency of data analysis, businesses are increasingly investing in these technologies to gain deeper insights and optimize operations.Rising Demand for Cybersecurity and Fraud Detection

The growing prevalence of cyber threats and financial fraud requiring streaming analytics as an essential tool for real-time threat detection and response is creating a positive streaming analytics market outlook. Businesses are using this technology to automate cybersecurity processes, quickly identifying anomalies and mitigating potential risks. The increasing number of fraud cases worldwide has further fueled the demand for streaming analytics solutions, particularly in the BFSI sector, where real-time monitoring is crucial for fraud prevention.Banking fraud in India rose more than fourfold over five years to 36,075 in 2024, with a sharp rise in digital payment frauds, which comprised a total of 29,082, according to data from the Reserve Bank of India (RBI). However, the overall number of frauds fell to ₹14,000 Crore (approximately USD 1.70 billion) as compared to ₹1.85 Trillion (approximately USD 22.56 Billion) in 2020, with most of the frauds within loan portfolios.

With the proliferation of financial fraud, the value of streaming analytics for real-time detection and risk management of fraud in online transactions is increasing. By continuously analyzing transactional data, businesses can detect suspicious activities and respond proactively. As companies continue to prioritize data security, the adoption of real-time analytics for fraud detection and cybersecurity is expected to witness significant growth in the coming years.

Streaming Analytics Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global streaming analytics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, organization size, application, and industry vertical.Analysis by Component:

- Software

- Service

Additionally, the flexibility and scalability of software solutions, particularly cloud-based platforms, cater to diverse industry needs. The growing demand for predictive analytics, fraud detection, and operational optimization further drives software adoption. As organizations prioritize digital transformation, software remains essential for integrating streaming analytics into existing systems, ensuring seamless data flow and real-time responsiveness.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

Additionally, cloud services offer enhanced security, regular updates, and the ability to scale resources on demand, making them ideal for dynamic business environments. Industries such as healthcare, retail, and finance leverage cloud-based streaming analytics to improve decision-making, operational efficiency, and customer experiences, driving its dominance in the market.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Additionally, they prioritize scalability, security, and integration capabilities to streamline operations and enhance customer experiences. Industries such as banking, healthcare, and retail leverage streaming analytics to optimize processes, detect fraud, and improve forecasting, driving adoption among large enterprises. Their ability to implement and sustain sophisticated analytics infrastructure solidifies their dominance in this segment.

Analysis by Application:

- Fraud Detection

- Predictive Asset Management

- Risk Management

- Network Management and Optimization

- Sales and Marketing

- Supply Chain Management

- Location Intelligence

- Others

Predictive asset management utilizes streaming analytics to monitor equipment and infrastructure in real time, enabling proactive maintenance and reducing downtime. Industries such as manufacturing, energy, and transportation benefit from predictive insights that optimize asset performance and extend lifespan. By analyzing data from IoT sensors and other sources, businesses can improve operational efficiency, cut costs, and ensure reliability, driving demand for this application.

Risk management applications of streaming analytics help organizations identify, assess, and mitigate risks in real time. Sectors including finance, healthcare, and supply chain use these solutions to monitor market trends, operational vulnerabilities, and compliance issues. By providing actionable insights, streaming analytics enables businesses to make informed decisions, enhance resilience, and minimize potential disruptions, solidifying its importance in the market.

Analysis by Industry Vertical:

- IT and Telecom

- BFSI

- Manufacturing

- Government

- Retail and E-Commerce

- Media and Entertainment

- Healthcare

- Energy and Utilities

- Others

Streaming analytics enables them to monitor network performance, detect anomalies, and predict potential outages, ensuring seamless connectivity. Additionally, it supports personalized customer services, fraud detection, and dynamic pricing strategies. The sector's continuous technological advancements and the need for scalable, secure, and efficient data solutions drive the adoption of streaming analytics, making IT and telecom a dominant segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Additionally, stringent regulatory requirements for data security and compliance further propel market growth. The U.S., in particular, leads in innovation and investment in AI, machine learning, and big data technologies, solidifying North America's dominance in the global streaming analytics market. The region's focus on smart cities and connected devices also contributes significantly to its market leadership.

Key Regional Takeaways:

United States Streaming Analytics Market Analysis

The US accounted for around 88.30% of the total North America streaming analytics market in 2024. The growing streaming analytics adoption is largely driven by the expanding retail and e-commerce sector, where businesses increasingly rely on real-time data processing to optimize supply chains, enhance customer experiences, and improve fraud detection. According to reports, e-commerce sales in the United States have been steadily increasing for over a decade, hitting a record high of USD 1.12 Trillion in 2023. That is a 330% increase from USD 260.4 Billion in 2013.As digital transactions rise, companies are integrating streaming analytics into their operations to track consumer behavior, personalize marketing strategies, and automate inventory management. The proliferation of omnichannel shopping experiences further fuels demand for real-time insights, allowing businesses to seamlessly merge online and offline sales channels.

Additionally, with an increase in digital payment solutions, retailers leverage streaming analytics to monitor transactions, detect anomalies, and enhance security. Advanced recommendation engines powered by streaming analytics are transforming customer engagement, increasing conversion rates, and reducing cart abandonment. Retailers are also utilizing real-time data for dynamic pricing strategies, improving sales forecasting, and enhancing customer service through AI-driven chatbots.

Asia Pacific Streaming Analytics Market Analysis

The growing small and medium enterprises (SMEs) sector is a key driver for streaming analytics adoption, as businesses seek to harness real-time data for operational efficiency and competitive advantage. According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. SMEs are increasingly leveraging streaming analytics to optimize supply chains, monitor inventory, and enhance customer interactions through personalized recommendations. The expansion of digital payment solutions and mobile commerce necessitates real-time fraud detection and transaction monitoring, further accelerating demand.As SMEs integrate cloud computing and AI into their operations, streaming analytics becomes vital for predictive maintenance, demand forecasting, and workflow automation. Many SMEs are investing in real-time data-driven decision-making to improve resource allocation, minimize downtime, and enhance customer engagement. The rise of smart logistics and digital marketplaces also fuels the need for real-time insights to track shipments, manage vendors, and streamline order fulfilment. With increasing digital transformation, SMEs continue to invest in scalable and cost-effective streaming analytics solutions to enhance operational agility, enhance profitability, and strengthen their market position.

Europe Streaming Analytics Market Analysis

The growing streaming analytics adoption is being fuelled by the increasing demand for packaging solutions driven by the expansion of banking, financial services, and insurance (BFSI) facilities. According to reports, there were 784 foreign bank branches in the EU in 2021, of which 619 were from other EU Member States and 165 from third countries. With rising digital transactions and financial activities, BFSI institutions are relying on advanced analytics to monitor real-time transactions, detect fraudulent activities, and enhance risk management. As the financial sector expands, the need for secure, traceable, and intelligent packaging solutions for financial products grows, leading to the integration of streaming analytics.Packaging facilities are utilizing real-time data to improve production efficiency, monitor supply chains, and enhance quality control. The adoption of smart packaging with embedded sensors is further driving demand for real-time analytics, ensuring product integrity and compliance with changing industry regulations. The integration of AI-driven analytics in packaging operations enables predictive maintenance, reducing downtime and improving cost efficiency. As BFSI facilities continue to invest in digital transformation, packaging companies leverage streaming analytics to optimize production processes, track logistics, and enhance customer experience.

Latin America Streaming Analytics Market Analysis

The growing streaming analytics adoption is driven by the increasing expansion of healthcare facilities, where real-time data processing is crucial for patient care, operational efficiency, and predictive analytics. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. Hospitals and clinics are leveraging streaming analytics for real-time patient monitoring, enabling faster diagnosis and treatment decisions.The growing demand for telemedicine and remote healthcare services further accelerates adoption, allowing seamless data integration from wearable devices and medical sensors. Streaming analytics supports efficient resource allocation, helping healthcare providers optimize staffing and equipment utilization. With expanding healthcare infrastructure, real-time analytics enhances patient outcomes by detecting anomalies in medical data, improving diagnostics, and streamlining administrative processes.

Middle East and Africa Streaming Analytics Market Analysis

The growing streaming analytics adoption is driven by the rising preference for healthy snacks and drinks, which is influenced by increasing investment in IT and telecom infrastructure. For instance, overall spending on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) will top USD 238 Billion this year, an increase of 4.5% over 2023. Businesses in the food and beverage industry are leveraging real-time data to track consumer preferences, optimize supply chains, and improve product development.Streaming analytics enables companies to monitor purchasing trends, forecast demand, and enhance production efficiency. The integration of AI-powered analytics supports dynamic pricing strategies, personalized promotions, and inventory management. With greater IT and telecom investments, real-time data insights enhance market competitiveness, allowing businesses to meet evolving consumer demands.

Competitive Landscape:

The competitive landscape of the streaming analytics market is characterized by intense rivalry among key players, who are focusing on innovation, partnerships, and strategic expansions to strengthen their market position. Companies are investing heavily in research and development to enhance their analytics platforms with advanced AI and machine learning capabilities. Many are also expanding their cloud-based offerings to cater to the growing demand for scalable and flexible solutions.Strategic collaborations with technology providers and industry stakeholders are common, enabling integration with emerging technologies such as IoT and 5G. Additionally, players are targeting diverse industry verticals, such as healthcare, finance, and retail, to broaden their customer base. Competitive pricing, robust customer support, and compliance with data security regulations further differentiate leading providers in this dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the streaming analytics market with detailed profiles of all major companies, including:

- Cloudera Inc.

- Conviva Inc.

- Gathr

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Software AG

- SQLstream (Guavus Inc.)

- Striim Inc.

- TIBCO Software Inc.

Key Questions Answered in This Report

- How big is the streaming analytics market?

- What is the future outlook of the streaming analytics market?

- What are the key factors driving the streaming analytics market?

- Which region accounts for the largest streaming analytics market share?

- Which are the leading companies in the global streaming analytics market?

Table of Contents

Companies Mentioned

- Cloudera Inc.

- Conviva Inc.

- Gathr

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Software AG

- SQLstream (Guavus Inc.)

- Striim Inc.

- TIBCO Software Inc

Table Information

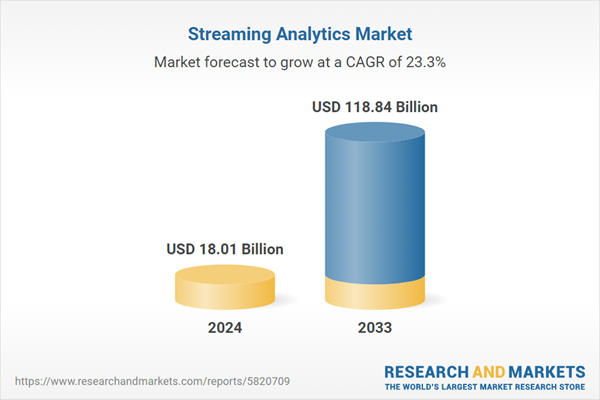

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 18.01 Billion |

| Forecasted Market Value ( USD | $ 118.84 Billion |

| Compound Annual Growth Rate | 23.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |