Synthetic Leather Market Analysis:

Major Market Drivers: The rising consumer awareness towards environmental issues and animal welfare concerns are primarily driving the demand for sustainable and cruelty-free alternatives, which is catalyzing the synthetic leather market outlook. Moreover, the continuous advancements in manufacturing materials and technologies to improve the durability, quality, and aesthetics of synthetic leather are also catalyzing the market growth.Key Market Trends: According to the synthetic leather market overview, the expanding e-commerce and direct-to-consumer channels provide manufacturers and retailers with opportunities to reach a wider customer base. In addition to this, the extensive utilization of synthetic leather in the automotive industry for interior applications, including seats, dashboard covers, and door panels, is also stimulating the synthetic leather market statistics.

Competitive Landscape: Some of the major market players in the synthetic leather industry include Asahi Kasei Corporation, DuPont Tate & Lyle Bio Products Company LLC, FILWEL Co. Ltd. (Air Water Inc.), H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mayur Uniquoters Limited, Nan Ya Plastics Corporation, San Fang Chemical Industry Co. Ltd., Teijin Limited, Zhejiang Hexin Holdings Co. Ltd., among many others.

Geographical Trends: Asia Pacific accounted for the largest market share, owing to the inflating disposable income levels of individuals and the emerging trend of urbanization. Apart from this, APAC countries, including China, Japan, South Korea, and Taiwan are among the major manufacturing hubs for synthetic leather, which is positively influencing the market growth. Moreover, the expanding fashion apparel industry and the elevating requirement for synthetic leather materials in clothing, footwear, handbags, and accessories are also catalyzing the market growth in the region.

Challenges and Opportunities: One of the major challenges facing the synthetic leather market statistics is its perception as a lower quality material compared to the natural variant. Moreover, its production incorporates the use of petroleum-based materials and chemicals, which can cause environmental pollution, if not handled properly. However, the ongoing advancements in materials science and manufacturing technology and the emerging trend of digitalization for innovation and product improvement present significant growth opportunities for market players.

Synthetic Leather Market Trends:

Rising Demand for Sustainable Alternatives

The escalating demand for sustainable and animal-friendly alternatives to traditional leather is among the primary factors driving the synthetic leather market. Besides this, the shifting consumer preferences towards eco-friendly variants, on account of the increasing environmental concerns, are acting as a significant growth-inducing factor. Moreover, the inflating investments in bio-based materials, recycled content, and closed-loop processes are positively influencing the synthetic leather market statistics. For instance, in India, 100% FDI is allowed for the manufacturing of leather products through an automatic route. Between April and September, the cumulative foreign direct investment (FDI) inflow in the case of the leather, leather goods, and pickers industries was USD 218.69 million.Advancements in Manufacturing Technologies

The continuous innovations and advancements in manufacturing technologies to improve the durability, texture, and overall quality of synthetic leather are positively influencing the market growth. Moreover, the growing popularity of digital printing, 3D modeling, and computer-aided design (CAD) to create customizable, high-performance materials is also stimulating the synthetic leather industry. For instance, BASF Southeast Asia has joined the ZDHC Foundation as a “Contributor” in its Chemical Industry category. The partnership with the Foundation and its extensive pool of experts from organizations in the textile, apparel, leather and footwear industry underlines BASF’s commitment to being an industry leader in driving sustainable chemistry, innovation and best practices. Additionally, Haptex is the first BASF material solution that has received the ECO PASSPORT by OEKO-TEX certification for the production of synthetic leather.Cost-effectiveness and Versatility

The extensive utilization of synthetic leather in clothing, footwear, and automotive sectors, owing to its versatility and cost-effectiveness, is primarily driving the market growth. For example, the world population is increasing annually, leading to a rise in the textile industry. The global population is anticipated to reach US$ 8.1 Billion by 2025, impacting the textiles market's growth. China is the world's leading producer and exporter of raw textiles and garments. Moreover, the growing popularity of synthetic leather in the automotive sector for seating, dashboard covers, door panels, and trim components to provide durability, aesthetic appeal, and cost advantages is further propelling the synthetic leather market demand. For instance, In October, Pecca Group Bhd, located in Malaysia, announced the purchase of PT Gemilang Maju Kencana, an Indonesian upholstery leather wrapping and car seat cover manufacturer. GMK is also looking for commercial and marketing cooperation from MPI's founder in order to increase its footprint in Indonesia. Although Indonesia sells more automobiles than any other Southeast Asian market, the country is projected to be a major development engine for Pecca as it expands its overseas footprint in the upholstery seat covers in the automotive sector.Synthetic Leather Market Segmentation:

This report provides an analysis of the key trends in each segment of the global synthetic leather market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use industry.Breakup by Type:

- Bio-Based

- Polyvinylchloride (PVC) Based

- Polyurethane (PU) Based

Breakup by Application:

- Clothing

- Bags

- Shoes

- Purses and Wallets

- Accessories

- Car Interiors

- Belts

- Sports Goods

- Others

Breakup by End Use Industry:

- Footwear

- Furniture

- Automotive

- Textile

- Sports

- Electronics

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the major market players in Synthetic Leather industry include Asahi Kasei Corporation, DuPont Tate & Lyle Bio Products Company LLC, FILWEL Co. Ltd. (Air Water Inc.), H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mayur Uniquoters Limited, Nan Ya Plastics Corporation, San Fang Chemical Industry Co. Ltd., Teijin Limited, Zhejiang Hexin Holdings Co. Ltd., among many others.Key Questions Answered in This Report

1. What is synthetic leathers?2. How big is the global synthetic leather market?

3. What is the expected growth rate of the global synthetic leather market during 2025-2033?

4. What are the key factors driving the global synthetic leather market?

5. What is the leading segment of the global synthetic leather market based on the type?

6. What is the leading segment of the global synthetic leather market based on the application?

7. What is the leading segment of the global synthetic leather market based on the end use industry?

8. What are the key regions in the global synthetic leather market?

9. Who are the key players/companies in the global synthetic leather market?

Table of Contents

Companies Mentioned

- Asahi Kasei Corporation

- DuPont Tate & Lyle Bio Products Company LLC

- FILWEL Co. Ltd. (Air Water Inc.)

- H.R. Polycoats Pvt. Ltd.

- Kuraray Co. Ltd.

- Mayur Uniquoters Limited

- Nan Ya Plastics Corporation

- San Fang Chemical Industry Co. Ltd.

- Teijin Limited

- Zhejiang Hexin Holdings Co. Ltd.

Table Information

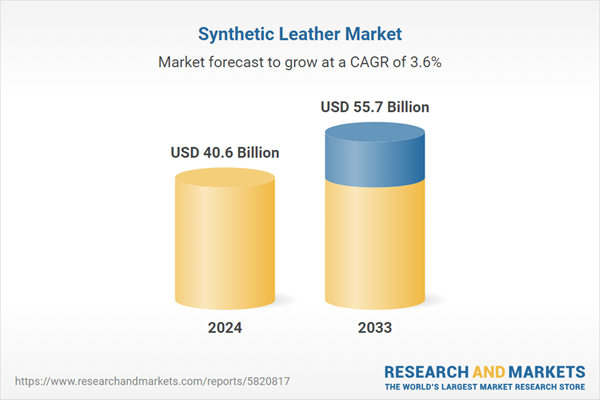

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 40.6 Billion |

| Forecasted Market Value ( USD | $ 55.7 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |