Wireless fidelity (wi-fi) is a technological solution that allows devices like smartphones, laptops, and other electronics to connect over the internet and communicate with each other wirelessly using radio waves. It works on the 2.4 GHz and 5 GHz radio frequency bands, which provides high-speed data transmission between devices within its range. Its networks are created through wireless access points, such as routers, which transmit data between devices and the internet and enable convenient and flexible internet connectivity without the need for physical cables. It is widely used in homes, offices, public places, and various industries to connect devices to the internet and local networks.

The increasing adoption of bring your own device (BYOD) policies in workplaces encourages employees to use their personal devices, like smartphones and laptops, for work tasks, which is strengthening the growth of the market. Moreover, the rising need to share experiences and content on social media platforms is driving the demand for Wi-Fi in public places and events. In addition, the emergence of contemporary and smart homes with digital and electronic devices is favoring the growth of the market. Apart from this, the growing popularity of online gaming and esports that requires stable and high-speed Wi-Fi connections to ensure smooth gameplay is influencing the market positively. Furthermore, the increasing number of hotels, restaurants, and cafes that provide Wi-Fi to enhance guest experiences, facilitate online bookings, and enable digital services within their premises is propelling the growth of the market.

Wi-Fi Market Trends/Drivers:

Increase use of connected devices

The exponential increase in connected devices, such as smartphones, tablets, laptops, smart home appliances, and IoT devices, is fueling the demand for Wi-Fi connectivity. These devices rely on wireless networks to access the internet and communicate with each other seamlessly. As the adoption of these devices continues to surge globally, individuals and businesses seek reliable and high-speed Wi-Fi networks to support their diverse needs. The convenience of Wi-Fi enables users to access information, conduct transactions, and stay connected on-the-go, which makes it an essential feature in the digital landscape.Rise in the development of smart cities

Rapid urbanization and the development of smart cities is catalyzing the demand for Wi-Fi infrastructure. In smart city initiatives, Wi-Fi forms the backbone of various interconnected systems, such as smart transportation, public safety, and municipal services. Citizens and businesses increasingly rely on Wi-Fi hotspots in public spaces, shopping centers, airports, and cafes for internet access while on the move. Wi-Fi-enabled technologies, like location-based services and indoor navigation, enhance user experiences and streamline operations in urban environments. As cities continue to embrace digital transformation, the demand for Wi-Fi is expected to grow, fostering innovation and improving overall quality of life for residents.Expansion of Internet of Things (IoT)

The rapid expansion of IoT devices across various industries is a significant driver for Wi-Fi demand. IoT devices are embedded with sensors and connected to the internet, allowing them to exchange data and perform automated tasks. From smart homes and industrial automation to healthcare and agriculture, the proliferation of IoT applications relies heavily on Wi-Fi connectivity. These devices require seamless and secure wireless networks to function effectively. As businesses and individuals integrate more IoT devices into their daily operations and lifestyles, the need for robust Wi-Fi infrastructure becomes even more pronounced.

Wi-Fi Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global Wi-Fi market report, along with forecasts at the global, regional and country levels from 2025-2033. The report categorizes the market based on component, density, location type, organization size and industry vertical.Breakup by Component:

- Hardware

- Solutions

- Services

Hardware dominates the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, solutions, and services. According to the report, hardware represented the largest segment.Wi-Fi hardware refers to the physical devices and equipment that enable wireless communication. It includes wireless routers, access points, network interface cards (NICs) in devices like laptops and smartphones, and Wi-Fi extenders. Routers and access points create Wi-Fi networks, while devices with Wi-Fi NICs can connect to these networks wirelessly. Wi-Fi hardware is designed to transmit and receive data using radio waves, which allows devices to communicate with each other and access the internet without the need for cables.

Wi-Fi solutions encompass the software and configurations used to manage and optimize Wi-Fi networks. It involves firmware and software in routers and access points that control network settings and security features. Wi-Fi solutions may also involve network management software that allows administrators to monitor and control the network, which ensures smooth performance and security. Wi-Fi solutions can vary based on the needs of the environment, such as home networks, enterprise networks, or public Wi-Fi hotspots.

Breakup by Density:

- High-Density Wi-Fi

- Enterprise-Class Wi-Fi

High-density Wi-Fi refers to a network setup designed to handle many Wi-Fi devices in a confined area. It is typically implemented in locations with a high concentration of users, such as stadiums, convention centers, airports, shopping malls, and other crowded public spaces.

On the other hand, enterprise-class Wi-Fi refers to Wi-Fi solutions specifically designed for businesses and organizations. It is usually deployed in corporate offices, campuses, hospitals, hotels, and other enterprise environments. Enterprise Wi-Fi systems feature more robust hardware, advanced security protocols, and sophisticated management tools compared to consumer-grade Wi-Fi routers.

Breakup by Location Type:

- Indoor

- Outdoor

Indoor dominates the market

The report has provided a detailed breakup and analysis of the market based on the location type. This includes indoor and outdoor. According to the report, indoor represented the largest segment.Indoor Wi-Fi refers to wireless networks that are designed and deployed to provide internet connectivity and local network access within enclosed spaces or buildings. It is commonly found in homes, offices, schools, shopping malls, hospitals, airports, and other indoor environments. Its access points are usually installed on ceilings or walls to ensure optimal signal propagation that can be connected to a wired network or router, which acts as the internet gateway. Indoor Wi-Fi networks are essential for providing seamless internet access and connectivity to Wi-Fi-enabled devices like laptops, smartphones, tablets, and IoT devices within the building.

Outdoor Wi-Fi refers to wireless networks specifically designed for providing internet connectivity and coverage in outdoor spaces. It is commonly deployed in public parks, outdoor stadiums, city centers, outdoor cafes, and other open-air areas. Outdoor Wi-Fi access points are designed to withstand environmental factors like weather conditions and temperature fluctuations.

Breakup by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Wi-Fi networks in large enterprises cater to a substantial number of users and devices and support various applications and services. Large enterprise Wi-Fi networks require robust and scalable solutions. They consist of multiple access points deployed strategically throughout the premises to ensure comprehensive coverage. The network design can incorporate advanced features like virtual LANs (VLANs), Quality of Service (QoS), and centralized management platforms for better control and security. Security is of paramount importance in large enterprises, as these networks may hold sensitive business data and require protection against potential threats.

Wi-Fi solutions for SMEs are generally more straightforward and cost-effective compared to those for large enterprises. They can involve a single wireless router or access point that provides internet connectivity and local network access for employees' devices.

Breakup by Industry Vertical:

- IT and Telecommunication

- Education

- BFSI

- Healthcare

- Logistics and Transportation

- Retail

- Government

- Others

IT and telecommunication dominate the market

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes IT and telecommunication, education, BFSI, healthcare, logistics and transportation, retail, government, and others. According to the report, IT and telecommunication represented the largest segment.Wi-Fi plays a crucial role in the IT and telecommunication industry to provide seamless internet access to their employees and facilitate communication and collaboration. Telecommunication service providers also use Wi-Fi technology to offer public Wi-Fi hotspots to their customers, enabling internet connectivity in various public areas and enhancing customer satisfaction.

Wi-Fi has become an integral part of the education sectors as schools, colleges, and universities utilize Wi-Fi networks to provide internet access to students, teachers, and staff. Wi-Fi in educational settings supports online learning, research, and collaboration among students and educators. It also enables the use of educational technology and digital resources within the campus.

Wi-Fi is increasingly used in the BFSI sector to provide reliable and secure internet connectivity for both employees and customers. It facilitates day-to-day operations, communication, and data sharing among employees. It can be available for customers, which enables them to access banking services and information while visiting the bank premises.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest Wi-Fi market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and Others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and Others); Latin America (Brazil, Mexico, and Others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The increasing penetration of the internet and a considerable reliance on smartphones represents one of the primary factors driving the demand for Wi-Fi in the Asia Pacific region. Moreover, the rising development of smart cities with easy access to Wi-Fi for supporting the healthcare and education sectors is favoring the growth of the market in the region. Apart from this, the growing investment on transportation, public safety, utilities, and education-related projects is influencing the market positively in the region.

Europe is estimated to witness stable growth, owing to the preference for autonomous vehicles, integration of advanced technologies, government initiatives, etc.

Competitive Landscape:

The leading companies are incorporating the use of beamforming and beam steering technologies, which enable access points to dynamically focus and direct signals to connected devices and ensure a stable and optimized connection. Moreover, key players are introducing Wi-Fi 6 that is designed to address the increasing demand for faster and more reliable connections. It introduces various improvements over its predecessor, Wi-Fi 5 (802.11ac), including increased data rates, higher capacity, and improved efficiency in handling multiple devices simultaneously. These technologies enable low-power connections and extended battery life for IoT devices while maintaining seamless connectivity. Besides this, the integration of multi-user, multiple-input, multiple-output (MU-MIMO) that allows access points to communicate with multiple devices simultaneously, improving network efficiency in crowded environments. Wi-Fi networks can better support multiple users and devices without sacrificing performance with MU-MIMO.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AT&T Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Extreme Networks

- Fortinet Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- Motorola Solutions Inc.

- Panasonic Corporation

- Singapore Telecommunications Limited

- Telefonaktiebolaget LM Ericsson

- Telstra Corporation Limited

- Ubiquiti Inc

Key Questions Answered in This Report

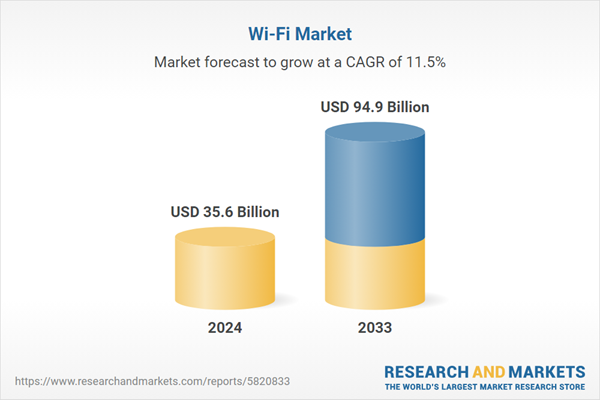

1. What was the size of the global Wi-Fi market in 2024?2. What is the expected growth rate of the global Wi-Fi market during 2025-2033?

3. What are the key factors driving the global Wi-Fi market?

4. What has been the impact of COVID-19 on the global Wi-Fi market?

5. What is the breakup of the global Wi-Fi market based on the component?

6. What is the breakup of the global Wi-Fi market based on the location type?

7. What is the breakup of the global Wi-Fi market based on industry vertical?

8. What are the key regions in the global Wi-Fi market?

9. Who are the key players/companies in the global Wi-Fi market?

Table of Contents

Companies Mentioned

- AT&T Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Extreme Networks

- Fortinet Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- Motorola Solutions Inc.

- Panasonic Corporation

- Singapore Telecommunications Limited

- Telefonaktiebolaget LM Ericsson

- Telstra Corporation Limited

- Ubiquiti Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 35.6 Billion |

| Forecasted Market Value ( USD | $ 94.9 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |