Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

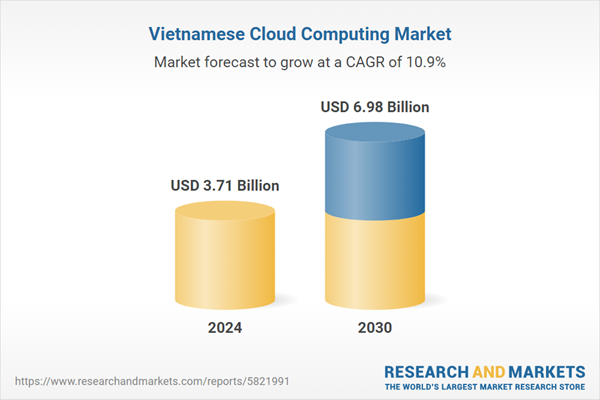

The Vietnam cloud computing market has witnessed significant growth in recent years, driven by the country's rapid digital transformation, growing internet penetration, and government support for Industry 4.0 initiatives. As organizations across sectors embrace digitalization, cloud adoption has become a strategic priority for businesses looking to enhance operational efficiency, scalability, and innovation. Factors such as the rise of e-commerce, fintech, and remote work culture have accelerated the demand for public, private, and hybrid cloud models, with a strong emphasis on data security, agility, and cost-effectiveness.

Vietnam’s cloud ecosystem is characterized by a mix of global players and strong domestic providers. International giants such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud maintain a significant presence, particularly in servicing multinational companies and large-scale projects. AWS, for example, leads the market in terms of infrastructure and localized services, with edge zones already established in Hanoi and Ho Chi Minh City. Meanwhile, Google is reportedly planning a hyperscale data center in Vietnam to cater to growing demand. These international firms are also partnering with local enterprises to support cloud migration and infrastructure development.

Key Market Drivers

Government-Led Digital Transformation & Cloud Migration

Vietnam’s government has positioned digital transformation as a national priority, catalyzing the adoption of cloud computing across public and private sectors. As of 2023, approximately 47% of public services had been digitalized, doubling from previous years. The government aims for 100% of government agencies to use cloud computing by 2025. In addition, the digital economy already contributes 16.5% of Vietnam’s GDP, with a target of 30% by 2030.Financial backing is also growing, with around USD 128 million allocated toward digital infrastructure development in 2023 alone. For small businesses, the state offered USD 75 million in cloud-focused SME digitalization support. These policies, paired with data localization laws, are pushing ministries and provincial departments to adopt domestic cloud platforms for hosting critical public service platforms. Regulatory mandates and funding are driving demand for public cloud solutions, especially Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS), at both national and provincial levels.

Key Market Challenges

Talent Shortage & Skills Gap

Vietnam’s cloud ambitions are held back by a serious shortage of qualified professionals. As of 2024, the nation had approximately 3 certified cloud engineers per 10,000 IT workers, far below the 15 per 10,000 seen in mature markets. University cloud curriculum slots number fewer than 50 nationally, though total IT graduates rose from 65,000 in 2022 to 72,000 in 2024 (+10.8%), only a fraction receive cloud-specific training.Approximately 42% of local tech firms report unmet demand for cloud skills, while 60% of startups cite recruitment issues as a top barrier. Average salaries for cloud architects in Vietnam have risen 25% year over year, reaching VND 720 million (~USD 30,000), compared to VND 480 million two years ago. High attrition - about 18% annually in cloud-related roles - further destabilizes teams. Only 12 of 64 provinces have formal cloud education programs. With 48% of projects delayed due to skills issues (per industry survey), the talent deficit remains a top drag on market growth.

Key Market Trends

Hybrid & Multi-Cloud Strategies Going Mainstream

Vietnamese firms are increasingly adopting hybrid and multi-cloud architectures to balance flexibility, cost, and compliance. A 2024 survey shows over 65% of large enterprises now use at least two cloud environments. Hybrid setups, combining public and private clouds, currently represent ~60% of cloud deployments, particularly in regulated sectors like banking and healthcare.This shift aligns with demand: ~55% of workloads now reside in hybrid environments. Multi-cloud adoption - using multiple public providers like AWS, Azure, and Google Cloud - is practiced by ~18% of businesses, driven by efforts to avoid vendor lock-in and leverage best-in-class services. The strategy is accelerating edge/hyperscalar builds as bandwidth-intensive apps emerge. In fact, ~45% of companies now report hybrid cloud performance goals as their top IT priority, emphasizing seamless data portability and orchestration across clouds.

Key Market Players

- Viettel IDC / Viettel Cloud

- VNG Cloud

- FPT Cloud / FPT Corporation

- CMC Cloud

- VNPT Group

- Mat Bao Corporation

- HPT Vietnam Corporation

- NextTech Group

- VCCloud

- Vietnam National Television Corporation

Report Scope:

In this report, the Vietnam Cloud Computing Market has been segmented into the following categories, in addition to the Application trends which have also been detailed below:Vietnam Cloud Computing Market, By Service:

- Infrastructure as a Service

- Software as a Service

- Platform as a Service

Vietnam Cloud Computing Market, By Deployment:

- Private

- Hybrid

- Public

Vietnam Cloud Computing Market, By Application:

- Large Enterprises

- Small and Medium Sized Enterprises

- Government

Vietnam Cloud Computing Market, By End User:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Healthcare

- Others

Vietnam Cloud Computing Market, By Region:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Cloud Computing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Viettel IDC / Viettel Cloud

- VNG Cloud

- FPT Cloud / FPT Corporation

- CMC Cloud

- VNPT Group

- Mat Bao Corporation

- HPT Vietnam Corporation

- NextTech Group

- VCCloud

- Vietnam National Television Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.71 Billion |

| Forecasted Market Value ( USD | $ 6.98 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |