Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Compliance with stringent environmental regulations is essential in both production and usage; improper handling can result in pollution, necessitating investments in sustainable practices. Additionally, fluctuations in raw material prices, particularly aluminum, can impact production costs and pricing strategies. Rapid urban development in states like Maharashtra, Gujarat, and the Delhi NCR is fueling demand for water treatment solutions. Stakeholders who adeptly navigate these challenges and capitalize on emerging opportunities in water treatment and related sectors are poised for success. Ongoing investments in research and development, along with responsiveness to market trends, will be crucial for sustaining a competitive edge. With an emphasis on sustainability and addressing environmental issues, the market is expected to maintain its growth trajectory, driven by robust industrial demand and continued infrastructure development.

Key Market Drivers

Expanding Paper and Pulp Industry

As consumer demand for packaging materials, writing paper, and specialty papers continues to grow, the paper and pulp industry is experiencing significant expansion. This development leads to an increased need for coagulants and additives, particularly aluminum chloride. In paper manufacturing, aluminum chloride serves as a retention aid, enhancing fiber retention efficiency and ultimately improving product quality while minimizing material waste. It facilitates effective bonding between fibers and fillers, resulting in stronger, more durable paper products that meet market standards.Additionally, the paper industry is increasingly focused on complying with environmental regulations regarding wastewater discharge. Aluminum chloride is effective in treating effluents, assisting companies in meeting regulatory requirements and reducing their environmental impact. As the industry evolves, there is a heightened emphasis on developing innovative paper products, such as recycled paper, where aluminum chloride plays a crucial role in enhancing the recycling process, thus supporting sustainable practices.

Government initiatives aimed at promoting manufacturing and sustainability have led to increased investments in paper mills and processing facilities. For instance, according to IBEF, foreign direct investment in the paper and pulp sector (including paper products) from April 2000 to March 2024 has reached US$ 1.71 billion. With an annual growth rate of 22-25%, this industry has established itself as a key hub for packaging solutions, supported by advancements in technology and infrastructure. The sector is also well-structured, comprising over 900 paper units with an installed capacity of nearly 4.99 million tons. This expansion creates a broader market for aluminum chloride, as these facilities require coagulants for various applications.

The rise of e-commerce has driven a significant demand for packaging solutions, prompting the paper and pulp industry to adapt and increase its reliance on aluminum chloride as an essential component in packaging production. Innovations in paper production technology frequently involve advanced chemical treatments, with aluminum chloride remaining a preferred choice due to its effectiveness in the pulp and paper sector. As this industry continues to expand, fueled by consumer demand, regulatory pressures, and technological innovations, the demand for aluminum chloride is expected to grow, creating opportunities for manufacturers and suppliers in the market.

Technological Advancements

Modern production methods, including advanced chemical synthesis and process optimization, have significantly improved the yield and purity of aluminum chloride. Continuous flow production techniques and enhanced reactor designs help reduce energy consumption and waste. These technological advancements lower production costs, making aluminum chloride more economically viable for manufacturers and encouraging broader adoption across various sectors. Innovations in coagulation and flocculation processes enhance the effectiveness of aluminum chloride in water treatment. Techniques like microfiltration and membrane technologies contribute to improved water clarity and quality. Additionally, the integration of smart technologies in water treatment facilities enables real-time monitoring and adjustment of chemical dosing, optimizing the use of aluminum chloride and minimizing chemical waste.Heightened awareness of environmental concerns has spurred research into greener manufacturing processes for aluminum chloride, which aim to reduce environmental impact and ensure compliance with regulatory standards. There are also efforts to develop biodegradable or less harmful alternatives to traditional chemicals, enhancing the appeal of aluminum chloride in eco-conscious markets.

Technological advancements facilitate the creation of customized formulations of aluminum chloride tailored to specific applications, allowing for better market penetration. For instance, in August 2023, a research team led by Prof. Dr. Birgit Esser from the University of Ulm and Prof. Dr. Ingo Krossing and Prof. Dr. Anna Fischer from the University of Freiburg developed aluminum-ion batteries with improved storage capacity, utilizing a positive electrode material made from an organic redox polymer based on phenothiazine, along with ethylmethylimidazolium chloride and added aluminum chloride as an electrolyte.

Further innovations in chemical formulations result in products with enhanced performance metrics, such as greater efficacy in coagulation and better compatibility with other industrial materials. Advances in recycling technologies also boost the effectiveness of aluminum chloride in paper production, particularly in processing recycled fibers, leading to higher-quality recycled paper with superior performance characteristics.

Technological advancements are transforming the aluminum chloride market in India by enhancing manufacturing processes, improving application effectiveness, and promoting sustainable practices. These innovations not only support existing applications but also create new growth opportunities, positioning aluminum chloride as an increasingly essential component across diverse industries. As technology continues to progress, the market is poised to benefit from greater efficiency, reduced environmental impact, and an expanded range of product offerings.

Key Market Challenges

Raw Material Price Fluctuations

The price of aluminum, a key raw material for producing aluminum chloride, can fluctuate significantly due to factors such as global demand, mining output, and geopolitical tensions. These price changes directly impact production costs and can erode profit margins. Many manufacturers implement cost-plus pricing models, which means that any increase in raw material costs is typically passed on to consumers, potentially resulting in higher prices for end products and a decrease in demand.Volatile prices can lead to instability within the supply chain, making it challenging for suppliers to provide consistent pricing. This uncertainty complicates procurement strategies for manufacturers, as fluctuating prices hinder their ability to maintain optimal inventory levels. Companies might overstock when prices are low or encounter shortages when prices unexpectedly rise.

In a competitive landscape, firms may be reluctant to increase prices in response to rising raw material costs for fear of losing market share, which can lead to compressed profit margins and financial difficulties. Price volatility further complicates long-term financial planning and budgeting, as unpredictable costs can deter investment in new projects or technologies, limiting growth potential.

As manufacturers grapple with higher raw material costs, these expenses are likely to be transferred to end-users, affecting industries like water treatment, paper production, and pharmaceuticals, potentially leading to reduced consumption and slower market growth. To address these challenges, companies should adopt strategic sourcing practices, diversify their supplier networks, and invest in technology to improve operational efficiency. Those that effectively manage price fluctuations will be better positioned to maintain their market presence and seize growth opportunities.

Competition from Alternatives

The aluminum chloride market in India faces considerable challenges from competing materials and coagulants. Biodegradable organic coagulants are becoming increasingly popular due to their environmental advantages, as they are viewed as safer and more sustainable options for industries looking to minimize their ecological impact. These alternatives often deliver better performance in certain applications, such as lower sludge generation and enhanced clarity in treated water, leading customers to prefer them over traditional aluminum chloride. Some alternatives can present lower overall costs when factoring in performance and disposal considerations, prompting industries to consider a shift away from aluminum chloride. Heightened regulatory scrutiny regarding chemical usage and wastewater management is also encouraging sectors to adopt more environmentally friendly options, potentially reducing demand for aluminum chloride, especially in sensitive industries.As consumer awareness of the environmental effects of conventional chemical products grows, alternatives that emphasize sustainability can capitalize on this trend to gain market share. Ongoing research and development aimed at new materials and formulations mean that competitors are consistently enhancing their offerings. Innovations in chemical treatments that surpass the efficacy of aluminum chloride can quickly gain popularity in the market.

The existence of these viable alternatives compels aluminum chloride manufacturers to reevaluate their pricing strategies. To remain competitive, they may need to reduce prices, which can further compress profit margins. Consequently, developing strategies to improve sustainability and adapt to market trends will be essential for maintaining market share in this dynamic environment.

Key Market Trends

Rising Use in Wastewater Treatment

The Indian government is implementing strict regulations concerning wastewater treatment and effluent discharge standards. As a result, industries are compelled to comply with these standards, leading to a greater reliance on effective treatment solutions like aluminum chloride. Initiatives such as the Jal Jeevan Mission aim to provide safe drinking water to all households, thereby encouraging investment in water treatment facilities.Rapid industrialization in sectors such as textiles, pharmaceuticals, food and beverage, and chemicals is generating large quantities of wastewater, which necessitates efficient treatment methods. As these industries expand, the demand for coagulants like aluminum chloride is increasing, ensuring both compliance and operational sustainability.

Cities are making substantial investments to modernize existing water treatment plants and build new ones to manage greater volumes of wastewater. Aluminum chloride is increasingly utilized in advanced treatment methods due to its effectiveness in removing impurities from water. Its integration with technologies such as membrane filtration is further enhancing the efficiency of water treatment processes. Poly Aluminium Chloride is specifically used to eliminate anionic colloidal impurities and facilitate the settling of suspended materials during the clarification of drinking water. Aluminum chloride excels in coagulating and flocculating suspended solids, heavy metals, and organic matter in wastewater, significantly improving the quality of treated water.

The push for sustainable water management practices is encouraging industries to recycle treated wastewater, with aluminum chloride playing a key role in making this water suitable for various applications. Advances in coagulation and flocculation technologies are improving the effectiveness of aluminum chloride in wastewater treatment. As the need for efficient wastewater treatment solutions continues to rise, aluminum chloride is set to become essential for industries and municipalities striving to meet their environmental objectives. This trend not only supports regulatory compliance but also enhances the sustainability of water resources in India.

Segmental Insights

End Use Insights

Based on End Use, the Chemicals emerged as the dominating segment in the Indian market for Aluminium Chloride during the forecast period. Aluminum chloride is extensively utilized as a catalyst in a variety of chemical reactions, particularly in the production of organic compounds. Its efficiency in facilitating chemical transformations makes it essential in chemical manufacturing. Additionally, aluminum chloride acts as a key intermediate in the production of various aluminum salts and compounds, which are utilized in applications ranging from water treatment to industrial processes.It has diverse applications across multiple sub-sectors, including specialty chemicals, agrochemicals, and pharmaceuticals, thereby driving overall demand within the chemicals industry. In chemical manufacturing, aluminum chloride is frequently used as a coagulant in wastewater treatment, helping to eliminate impurities and enhance effluent quality, thereby ensuring regulatory compliance.

The growth of the chemicals industry in India, spurred by rising domestic and global demand, further increases the consumption of aluminum chloride as manufacturers seek efficient processing solutions. Compared to other catalysts, aluminum chloride is often more cost-effective, making it a preferred option for manufacturers looking to optimize production costs.

With the chemicals sector placing greater emphasis on sustainable practices, aluminum chloride’s effectiveness in minimizing waste and improving product quality aligns with these objectives. As industrial activities continue to expand and evolve, the demand for aluminum chloride in this sector is expected to remain robust.

Application Insights

Based on Application, Wastewater treatment emerged as the fastest growing segment in the Indian market for Aluminium Chloride in 2024. The Indian government is implementing stricter regulations concerning water quality and effluent discharge, prompting industries to increase their investment in wastewater treatment solutions. Rapid urbanization and population growth are contributing to a rise in wastewater generation, necessitating the expansion of treatment facilities. Significant investments in water treatment infrastructure, including municipal and industrial plants, are driving the demand for aluminum chloride.As industries adopt more sustainable practices, there is a growing focus on recycling treated wastewater for reuse, further boosting the need for effective coagulants like aluminum chloride. Its effectiveness in removing impurities, suspended solids, and heavy metals from wastewater makes it a preferred option in treatment processes.

The requirement for wastewater treatment spans various sectors, including textiles, pharmaceuticals, food and beverage, and chemicals, all of which are increasingly utilizing aluminum chloride for effective solutions. With industries and municipalities prioritizing efficient and compliant wastewater management, the demand for aluminum chloride is expected to grow significantly.

Regional Insights

Based on Region, West India emerged as the dominant region in the Indian market for Aluminium Chloride in 2024. Maharashtra and Gujarat are prominent industrial states with a substantial number of chemical manufacturing facilities, pharmaceuticals, and textile industries. This concentration creates a high demand for aluminum chloride, which is crucial for various applications. The western region features well-developed transportation networks, including roads, railways, and ports, which facilitate efficient logistics and support the supply chain for aluminum chloride and related products.The presence of numerous industrial parks and clusters in this area fosters a favorable environment for manufacturing and processing industries, further increasing the demand for aluminum chloride. Cities such as Mumbai, Ahmedabad, and Pune are experiencing rapid urbanization, resulting in higher wastewater generation. This growth necessitates investments in water treatment facilities, thereby boosting the demand for effective coagulants like aluminum chloride.

Additionally, the rising population in urban areas puts more pressure on water resources, heightening the need for efficient wastewater treatment solutions. The government has implemented various initiatives to stimulate industrial development in these western states, including financial incentives, subsidies, and infrastructure improvements. Such support attracts further investments in industries that utilize aluminum chloride.

There is also significant capital inflow into the chemical sector from both domestic and international companies, leading to the expansion and modernization of facilities that rely on aluminum chloride for a range of applications. Its usage spans multiple sectors, including water treatment, pharmaceuticals, and textiles, all of which are well-represented in the west, ensuring consistent demand. Furthermore, the established supply chains and local production capabilities allow manufacturers in the region to procure aluminum chloride more cost-effectively, enhancing their competitive advantage in the market.

Key Market Players

- Anmol Chloro Chem

- Nike Chemical India

- Prakash Chemicals Agencies Private Limited

- Gujarat Alkalies and Chemicals Limited

- Joshi Agrochem Pharma Pvt. Ltd.

- Acuro Organics Limited

- EMCO Dyestuff Pvt Ltd.

- DCM Shriram Ltd.

- Umiya Chemical Industries

Report Scope:

In this report, the India Aluminium Chloride Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Aluminium Chloride Market, By Grade:

- Pharmaceutical

- Industrial

India Aluminium Chloride Market, By End Use:

- Chemicals

- Pharmaceuticals

- Agrochemicals

- Metal Production

- Pulp and Paper

- Others

India Aluminium Chloride Market, By Application:

- Wastewater treatment

- Inks

- Synthetic rubber

- Lubricants

- Wood Preservatives

- Others

India Aluminium Chloride Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Aluminium Chloride Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Anmol Chloro Chem

- Nike Chemical India

- Prakash Chemicals Agencies Private Limited

- Gujarat Alkalies and Chemicals Limited

- Joshi Agrochem Pharma Pvt. Ltd.

- Acuro Organics Limited

- EMCO Dyestuff Pvt Ltd.

- DCM Shriram Ltd.

- Umiya Chemical Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | November 2024 |

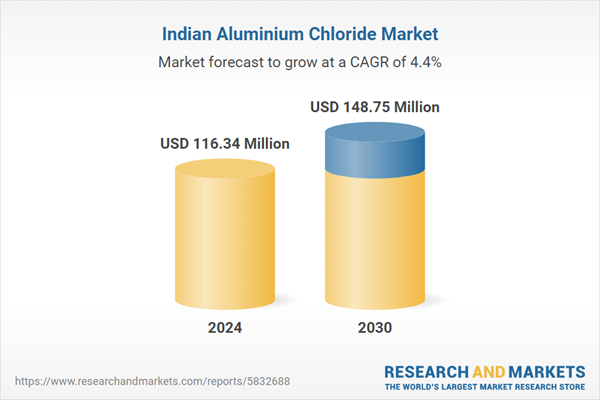

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 116.34 Million |

| Forecasted Market Value ( USD | $ 148.75 Million |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |