Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

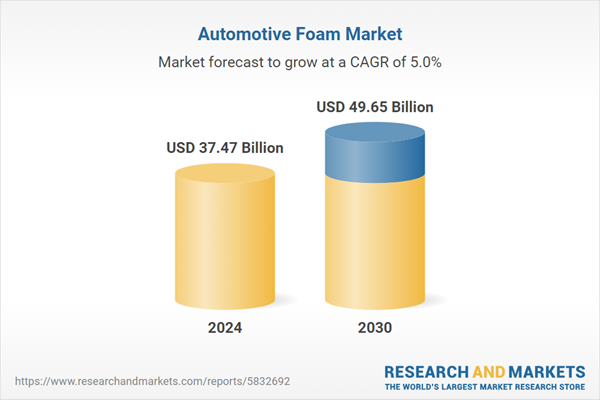

The global automotive foam market is a critical segment within the automotive industry, driven by the increasing demand for lightweight materials, enhanced vehicle comfort, and stringent environmental regulations. Automotive foams, including polyurethane (PU), polyolefin (PO), and other specialized types, are integral to applications such as seating, door panels, headliners, and insulation systems. These materials contribute to weight reduction, fuel efficiency, noise reduction, and passenger safety, aligning with global automotive trends toward sustainability and performance optimization.

The market is experiencing steady growth due to the expansion of automotive production in emerging economies, particularly in Asia-Pacific, and the rising adoption of electric vehicles (EVs), which require specialized foams for battery insulation and thermal management. In 2023, global automobile production reached approximately 94 million units, underscoring the substantial demand for automotive components such as foams. The global automotive components market was valued at around USD 2 trillion, with exports contributing approximately USD 700 billion, highlighting the industry's extensive global supply chain. Notably, India ranked as the fourth-largest vehicle producer worldwide, following China, the United States, and Japan, with an annual production of nearly 6 million vehicles, reinforcing the region’s growing role in the global automotive ecosystem and its increasing consumption of advanced materials, including automotive foams.

The automotive industry’s shift toward eco-friendly manufacturing practices has spurred innovation in foam production, with manufacturers investing in bio-based and recyclable foams to meet regulatory and consumer demands for sustainability. The growth of e-commerce, mobility services, and logistics has further bolstered vehicle production, increasing the need for automotive foams. For instance, the rise of ride-sharing platforms and last-mile delivery services has driven demand for light commercial vehicles (LCVs), which rely on foams for interior comfort and durability. Technological advancements in foam manufacturing, such as energy-efficient processes and high-performance formulations, are enhancing product quality and reducing production costs.

Despite challenges such as raw material price volatility and stringent environmental regulations, the market is poised for robust growth over the forecast period of 2020-2030F. The increasing penetration of EVs, supported by government incentives and infrastructure development, is a key growth driver. The focus on vehicle interior aesthetics and acoustic performance is elevating the role of foams in premium and mid-segment vehicles. The Asia-Pacific region dominates the market, fueled by high vehicle production in countries like China and India, while North America and Europe contribute significantly due to their advanced automotive manufacturing capabilities and emphasis on sustainability. The competitive landscape is characterized by strategic collaborations, product innovations, and capacity expansions by key players to cater to evolving industry needs.

Key Market Drivers

Growing Demand for Lightweight Materials to Enhance Fuel Efficiency

The automotive industry is under increasing pressure to improve fuel efficiency and reduce carbon emissions, driven by global environmental regulations and consumer demand for sustainable vehicles. Lightweight materials, such as automotive foams, play a pivotal role in achieving these objectives by reducing vehicle weight without compromising structural integrity or safety.Polyurethane and polyolefin foams are widely used in seating, insulation, and interior components due to their low density and high strength-to-weight ratio. These materials enable manufacturers to meet stringent emission standards, such as those set by the European Union’s CO2 reduction targets and the U.S. Corporate Average Fuel Economy (CAFE) standards. According to the recent studies, consumers spent USD 250 billion on electric vehicle purchases in 2021, a 65% increase over 2021. Furthermore, Global sales of electric cars kept rising strongly in 2022, with 2 million sold in the first quarter, up 75% from the same period in 2021

The rise of electric vehicles has further amplified the need for lightweight foams, as weight reduction directly enhances battery efficiency and extends driving range. For example, foams are used in EV battery packs for thermal insulation and impact absorption, ensuring safety and performance. According to the International Energy Agency (IEA), global EV sales are projected to grow significantly, supported by government policies like subsidies and tax incentives in countries such as China, the U.S., and Germany. This trend is driving demand for specialized foams tailored to EV applications. The expansion of automotive production in emerging markets, particularly in Asia-Pacific, is increasing the adoption of lightweight foams to meet local regulatory requirements and consumer preferences for fuel-efficient vehicles. Manufacturers are investing in R&D to develop advanced foam formulations that offer superior weight reduction and durability, further propelling market growth.

Key Market Challenges

Volatility in Raw Material Prices

The automotive foam market faces significant challenges due to fluctuations in the prices of raw materials, such as polyols, isocyanates, and additives, which are derived from petrochemicals. These price variations are influenced by global supply chain disruptions, geopolitical tensions, and changes in crude oil prices. For instance, supply chain constraints during the COVID-19 pandemic led to shortages of key raw materials, increasing production costs for foam manufacturers. Such volatility impacts profit margins and poses challenges for manufacturers in maintaining competitive pricing.The reliance on petrochemical-based materials also exposes the market to risks associated with supply chain uncertainties, such as trade restrictions and regional conflicts. Manufacturers are exploring alternatives, such as bio-based raw materials, but the transition requires significant R&D investment and may not be cost-competitive in the short term. Smaller players, in particular, struggle to absorb these cost fluctuations, limiting their ability to compete with established companies. Addressing this challenge necessitates strategic sourcing, regional supply chains, and investment in sustainable raw material alternatives.

Key Market Trends

Adoption of Bio-Based and Recyclable Foams

The automotive foam market is witnessing a shift toward bio-based and recyclable foams as manufacturers respond to environmental concerns and regulatory pressures. Bio-based foams, derived from renewable sources like soy and castor oil, offer a lower carbon footprint compared to traditional petrochemical-based foams. Companies are also developing recyclable polyurethane and polyolefin foams to align with circular economy principles. This trend is driven by consumer demand for sustainable vehicles and regulatory initiatives promoting eco-friendly materials.For instance, automakers in Europe and North America are increasingly incorporating bio-based foams in vehicle interiors to meet sustainability targets. This trend is expected to gain traction in Asia-Pacific, where environmental awareness is rising. Manufacturers are investing in R&D to enhance the performance and cost-effectiveness of these foams, ensuring they meet automotive standards for durability and safety. The adoption of sustainable foams is poised to reshape the market, offering opportunities for innovation and differentiation.

ey Market Players

- Meenakshi Polymers Pvt. Ltd.

- Lear Corporation

- Armacell LLC

- Premratan Concast Pvt Ltd.

- Saint-Gobain S.A.

- Rogers Corporation.

- Adient plc.

- BASF SE

- Woodbridge Foam Corporation

- Recticel SA

Report Scope:

In this report, global automotive foam market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Automotive Foam Market, By Type:

- Polyurethane (PU) Foam

- Polyolefin (PO) Foam

- Others

Automotive Foam Market, By Application:

- Interior

- Exterior

Automotive Foam Market, By End-Use Industry:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive Foam Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive landscape

Company Profiles: Detailed analysis of the major companies present in global automotive foam market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Meenakshi Polymers Pvt. Ltd.

- Lear Corporation

- Armacell LLC

- Premratan Concast Pvt Ltd.

- Saint-Gobain S.A.

- Rogers Corporation.

- Adient plc.

- BASF SE

- Woodbridge Foam Corporation

- Recticel SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 37.47 Billion |

| Forecasted Market Value ( USD | $ 49.65 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |