Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

What distinguishes this market is not just the growing consumption of plastic additives, but the escalating complexity of performance requirements. OEMs and material engineers are seeking additive formulations that enable polymers to withstand extreme operating environments, meet region-specific compliance standards, and support product differentiation through material functionality. As a result, the role of additives has shifted from secondary performance enhancers to strategic enablers of design and regulatory feasibility.

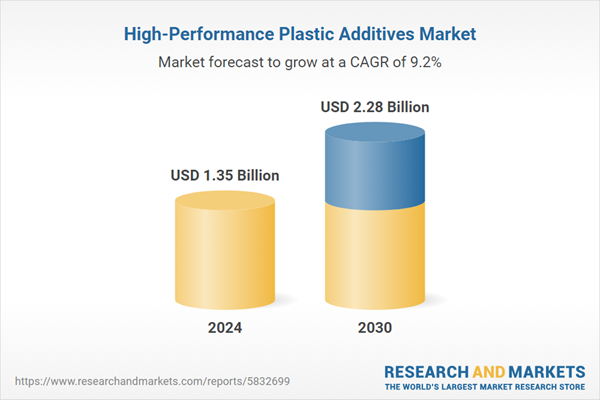

Positioned at the intersection of innovation and application-critical manufacturing, the high-performance plastic additives segment is now central to the competitive positioning of downstream industries. Backed by sustained R&D investment, shifts toward specialty formulations, and growing interdependence across advanced manufacturing ecosystems, the market is expected to maintain a structurally positive outlook over the long term.

Key Market Drivers

Rising Demand for Lightweight and Fuel-Efficient Materials

The most influential factors propelling the Global High-Performance Plastic Additives Market is the growing demand for lightweight and fuel-efficient materials, particularly across the automotive, aerospace, and transportation industries. As manufacturers seek to reduce energy consumption, meet environmental regulations, and enhance overall performance, high-performance plastics enhanced by specialized additives are increasingly replacing traditional heavy materials such as metals and glass.Governments and regulatory bodies worldwide have introduced stringent fuel efficiency and emission reduction mandates. Standards such as corporate Average Fuel Economy (CAFE) norms in the United States, EU CO₂ emission standards for passenger cars and commercial vehicles, and China VI emission norms are driving automakers and OEMs to significantly reduce vehicle weight. Lighter vehicles consume less fuel and emit fewer greenhouse gases. High-performance plastics offer the dual advantage of weight reduction and durability, and the inclusion of additives such as impact modifiers, heat stabilizers, and flame retardants ensures these materials maintain strength, safety, and performance under demanding conditions.

In both automotive and aerospace sectors, metals are increasingly being replaced with engineering plastics and polymer composites to achieve weight savings without compromising performance. Automotive manufacturers use reinforced polymers for parts like intake manifolds, fuel system components, dashboard panels, and under-hood applications. In aerospace, polymers are replacing aluminum and steel in interior panels, cable insulation, and structural parts to reduce overall aircraft weight. High-performance plastic additives play a critical role in enhancing thermal resistance, flame retardancy, chemical compatibility, and mechanical integrity, making this material transition technically viable and commercially scalable.

In 2024, the global electric car fleet expanded to nearly 58 million vehicles, accounting for approximately 4% of the total passenger car fleet worldwide. This marks a more than threefold increase compared to 2021, underscoring the accelerating pace of electric vehicle adoption within the global automotive landscape. The global shift toward electric mobility further amplifies the need for lightweight components.

Reducing the overall mass of an electric vehicle allows for smaller battery packs or extends the vehicle’s driving range both of which are crucial for consumer acceptance and regulatory compliance. In this context, high-performance plastic additives are essential in developing lightweight polymer solutions for battery enclosures, High-voltage wiring insulation, Charging connectors, Thermal management systems. Additives such as flame retardants, conductive fillers, and antioxidants are critical to ensuring these components remain safe and stable under high temperature and voltage loads.

Key Market Challenges

Stringent Environmental Regulations and Compliance Issues

One of the most pressing challenges is the growing regulatory scrutiny surrounding the environmental and health impact of certain plastic additives particularly those that are halogenated, toxic, or non-biodegradable. Regulatory frameworks such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the European Union, RoHS (Restriction of Hazardous Substances), and TSCA (Toxic Substances Control Act) in the U.S., are increasingly banning or restricting the use of specific additives such as phthalate plasticizers, brominated flame retardants, and certain antioxidants due to concerns over toxicity, bioaccumulation, and environmental persistence.This has several implications companies must invest heavily in reformulating products to meet evolving compliance standards. Regulatory uncertainty slows product development cycles and increases the cost of innovation. Adoption of newer, safer additives is often delayed due to lengthy approval processes and limited data on long-term performance. As a result, regulatory pressure creates significant barriers for both existing product portfolios and the introduction of next-generation additives.

Key Market Trends

Integration of Smart and Functional Additives for Next-Generation Applications

A significant trend is the rising integration of smart and multifunctional additives that go beyond enhancing mechanical or thermal properties. These next-generation additives are being engineered to deliver active, responsive, or intelligent functionalities, especially in high-tech applications.Self-healing additives that allow minor scratches or material damage to repair themselves in automotive coatings or medical devices. Color-changing additives used in temperature-sensitive materials or packaging to indicate freshness, spoilage, or environmental exposure. Conductive or antistatic additives tailored for use in electronic housings, battery components, and ESD-sensitive environments.

These smart additives add new dimensions of value, enabling high-performance plastics to not only endure harsh conditions but also interact with their environment, enhance user safety, or provide real-time feedback an essential capability in fields like electronics, defense, medical diagnostics, and automotive safety systems.

Key Market Players

- BASF SE

- Saudi Basic Industries Corp

- Arkema S.A.

- Solvay S.A.

- Evonik Industries AG

- 3M Co.

- L.Brueggemann GmbH & Co. KG

- Ensinger GmbH

- Colloids Ltd.

- Colortech Inc.

Report Scope:

In this report, the Global High-Performance Plastic Additives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:High-Performance Plastic Additives Market, By Plastic Type:

- Fluoropolymers

- High-performance Polyamides

- Sulfone Polymers

- Others

High-Performance Plastic Additives Market, By Additive Type:

- Plasticizers

- Flame Retardants

- Lubricants

- Antioxidants

- Others

High-Performance Plastic Additives Market, By End User:

- Transportation

- Medical

- Electrical & Electronics

- Packaging

- Others

High-Performance Plastic Additives Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global High-Performance Plastic Additives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- BASF SE

- Saudi Basic Industries Corp

- Arkema S.A.

- Solvay S.A.

- Evonik Industries AG

- 3M Co.

- L.Brueggemann GmbH & Co. KG

- Ensinger GmbH

- Colloids Ltd.

- Colortech Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.35 Billion |

| Forecasted Market Value ( USD | $ 2.28 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |