Emerging mental health devices and platforms cover a broad spectrum of applications and digital platforms offering teletherapy and artificial intelligence (AI)-powered self-help tools. They are intended to enhance mental health care by facilitating diagnosis, providing new treatment avenues, improving patient engagement, and promoting mental wellness. They help in early detection and intervention to prevent mental health crises through continuous monitoring and data analysis. They can supplement traditional therapy, extending support beyond scheduled sessions. They enable users to gain a sense of empowerment and autonomy in managing their mental health, fostering a positive outlook on recovery.

At present, the increasing awareness about mental health conditions and the importance of seeking help among the masses is impelling the growth of the market. Besides this, the rising acceptance of telehealth and virtual care services providing professional help and monitoring mental health is contributing to the growth of the market. In addition, the growing integration of gamification techniques into mental health platforms to enhance engagement and motivation among users and enable them to track their progress, set goals, and participate in interactive activities that promote positive mental health is offering a favorable market outlook. Apart from this, the increasing integration of wearable sensors, artificial intelligence (AI) algorithms, and data analytics to enable more accurate and personalized mental health interventions is supporting the growth of the market. Additionally, the rising number of mental health startups offering comprehensive solutions to individuals is bolstering the growth of the market.

Emerging Mental Health Devices and Platforms Market Trends/Drivers:

Rising demand for digital therapeutics and remote care

At present, the rising demand for digital therapeutics and remote care is exerting a positive influence on the growing mental health devices and platforms market. Traditional in-person therapy sessions often present barriers, such as geographical distance, limited availability of mental health professionals, and potential stigma associated with seeking help. However, digital therapeutics and remote care solutions eliminate these hurdles by providing individuals with the flexibility to access mental health services and support from the comfort and privacy of their homes. This increased accessibility empowers more people to seek the help they need, promoting early intervention and potentially preventing the exacerbation of mental health conditions.Increasing utilization of AI-driven mental health solutions

The increasing utilization of AI-driven mental health solutions is positively influencing the emerging mental health devices and platforms market. As AI technology is advancing, it is revolutionizing the way mental health services are delivered, enhancing the effectiveness, accessibility, and personalization of care. This paradigm shift in mental health solutions is creating a fertile ground for growth and innovation in the market, driving the development and adoption of cutting-edge devices and platforms. The incorporation of natural language processing (NLP) in AI-driven mental health devices is also facilitating effective communication between individuals and their digital mental health companions. NLP algorithms can understand and respond to human language, enabling a more empathetic and conversational interaction. This fosters a sense of trust and rapport, making individuals more comfortable sharing their thoughts and emotions with the AI-powered platform.Growing occurrence of various mental health conditions

The increasing prevalence of various mental health conditions globally is contributing to the growth of the emerging mental health devices and platforms market. As the prevalence of mental health disorders is rising globally, there is a heightened demand for innovative solutions capable of addressing these challenges. This rise in demand is fueling the growth of the market, creating opportunities for companies to develop and offer cutting-edge devices and platforms that cater to the needs of individuals seeking mental health support. Moreover, advancements in technology are playing a pivotal role in propelling the growth of the market. The widespread adoption of smartphones and the accessibility of high-speed internet is facilitating the integration of mental health solutions into daily lives. Mobile applications and wearable devices are also emerging as popular tools for self-monitoring, offering personalized insights into mental health conditions and encouraging proactive self-care.Emerging Mental Health Devices and Platforms Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global emerging mental health devices and platforms market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type and application.Breakup by Type:

- Platforms

- Devices

- EEG and ECG head bands

- Wearable Trackers

- Others

Platforms dominate the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes platforms and devices (EEG and ECG head bands, wearable trackers, and others). According to the report, platforms represented the largest segment. Mental health platforms refer to online or mobile applications that provide a range of mental health-related services and resources. These platforms typically connect users with licensed mental health professionals, offer self-help tools, and provide educational content on various mental health topics. These platforms often offer self-guided resources and tools, such as mood tracking, relaxation exercises, and mindfulness techniques. Users can proactively manage their mental health by engaging in evidence-based practices that promote emotional well-being. Mental health platforms bridge the accessibility gap in mental healthcare by offering round-the-clock services and remote consultations. This convenience encourages more individuals to seek help, especially those who may have hesitated due to social stigma or logistical challenges.Breakup by Application:

- Stress

- Anxiety

- Depression

- Bipolar Disorder

- Others

Depressions hold the largest share in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes stress, anxiety, depression, bipolar disorder, and others. According to the report, depression accounted for the largest market share. Depression is a common and serious mood complication that is characterized by persistent feelings of discomfort, sadness, loss of interest in various activities once enjoyed, and a range of emotional and physical symptoms. Mental health platforms and tools offer a convenient and accessible method for individuals dealing with depression to seek help and support from the comfort of their homes. They break down geographical barriers and provide assistance to people who may have limited access to mental health services in their local areas. Online mental health platforms often allow users to seek help anonymously, which can be particularly valuable for those who may feel hesitant or embarrassed about discussing their mental health concerns in person. Furthermore, mental health platforms and tools can serve as early intervention resources, helping individuals recognize the signs of depression and seek help before the condition worsens.Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest emerging mental health devices and platforms market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America held the biggest market share due to the rising mental health awareness among the masses. Besides this, the growing number of individuals seeking help and support for their mental well-being is positively influencing the market. Apart from this, the increasing development of sophisticated devices and platforms that cater to diverse mental health needs is contributing to the growth of the market. Additionally, the rising demand for remote access to healthcare facilities among patients is supporting the growth of the market in the region.

Asia Pacific is estimated to expand further in this domain due to the increasing occurrence of various mental disorders caused by work-life stress and loneliness among individuals.

Competitive Landscape:

Key market players are innovating and enhancing their existing devices and platforms by incorporating the latest technologies, improving user experience, and ensuring their products align with the evolving needs of users and mental health professionals. They are also diversifying their product portfolios to cater to a broader range of mental health issues and user demographics. Top companies are collaborating with mental health professionals, such as psychologists, therapists, and counselors, to ensure the effectiveness and credibility of their solutions. They are also emphasizing data security and privacy by implementing robust data protection measures to maintain compliance with relevant regulations. Leading companies are planning to create intuitive interfaces that allow users to navigate their devices or platforms effortlessly.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- AbleTo Inc.

- Amelia Virtual Care

- Clarigent Corporation

- Electromedical Products International Inc

- Feel Therapeutics

- Flow Neuroscience

- Happify Inc.

- Headspace Inc.

- Pear Therapeutics, Inc.

- Quartet Health Inc.

- Talkspace Inc.

- Teladoc Health Inc.

- Woebot Labs, Inc.

Recent Developments:

In June 2021, AbleTo Inc. announced the launch of AbleTo Connect and AbleTo app, which provides clinically guided, fully integrated digital experiences across all programs to assist members in getting the most appropriate care that suits their needs.In April 2023, Amelia Virtual Care and XRHealth announced their plan to merge into one company which will aim to present an XR therapeutic powerhouse capable of addressing physical and mental health complications in patients.

In November 2021, Headspace Inc announced its partnership with Bring Change to Mind and Peer Health Exchange to launch a social impact initiative called Headspace for Teens, which aims to help tends to be kind to their minds. They are also providing free access to the headspace app for all teens in the United States, ages 13-18.

Key Questions Answered in This Report:

- How has the global emerging mental health devices and platforms market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global emerging mental health devices and platforms market?

- What is the impact of each driver, restraint, and opportunity on the global emerging mental health devices and platforms market?

- What are the key regional markets?

- Which countries represent the most attractive emerging mental health devices and platforms market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the emerging mental health devices and platforms market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the emerging mental health devices and platforms market?

- What is the competitive structure of the global emerging mental health devices and platforms market?

- Who are the key players/companies in the global emerging mental health devices and platforms market?

Table of Contents

Companies Mentioned

- AbleTo Inc.

- Amelia Virtual Care

- Clarigent Corporation

- Electromedical Products International Inc

- Feel Therapeutics

- Flow Neuroscience

- Happify Inc.

- Headspace Inc.

- Pear Therapeutics Inc.

- Quartet Health Inc.

- Talkspace Inc.

- Teladoc Health Inc.

- Woebot Labs Inc.

Table Information

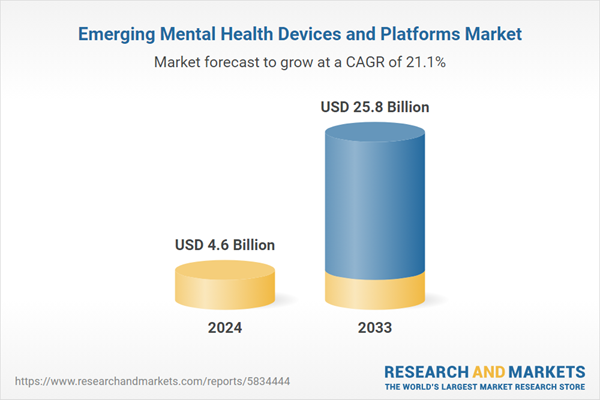

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.6 Billion |

| Forecasted Market Value ( USD | $ 25.8 Billion |

| Compound Annual Growth Rate | 21.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |