Key Highlights

- The air freight sector is defined as consisting of revenues generated from freight transportation by air.

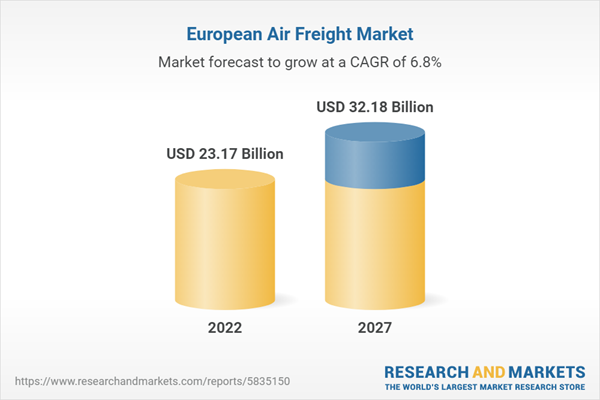

- The European air freight sector had total revenues of $23.2 billion in 2022, representing a negative compound annual growth rate (CAGR) of 3% between 2017 and 2022.

- Sector consumption volumes declined with a negative CAGR of 2.6% between 2017 and 2022, reaching a total of 38.2 billion FTK in 2022.

- The European air freight sector has declined recently owing to several factors such as increasing interest rates and rising inflation. High-interest rates reduce access to credit for the companies involved, thereby reducing the volume of investment which negatively impacts air freight. For instance, according to the OECD, the long-term interest rates in Norway grew from 1.3% in December 2017 to 3.5% in December 2022.

Scope

- Save time carrying out entry-level research by identifying the size, growth, major segments, and leading players in the air freight market in Europe

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the air freight market in Europe

- Leading company profiles reveal details of key air freight market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the Europe air freight market with five year forecasts by both value and volume

Reasons to Buy

- What was the size of the Europe air freight market by value in 2022?

- What will be the size of the Europe air freight market in 2027?

- What factors are affecting the strength of competition in the Europe air freight market?

- How has the market performed over the last five years?

- Who are the top competitors in Europe's air freight market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Deutsche Post AG

- Volga-Dnepr Group

- International Consolidated Airlines Group SA

- Deutsche Bahn AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 39 |

| Published | March 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 23.17 Billion |

| Forecasted Market Value ( USD | $ 32.18 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Europe |