Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Urbanization, industrial emissions, and sandstorms contribute to poor air quality, prompting demand for air purification solutions in homes, offices, and healthcare facilities. Additionally, the post-pandemic emphasis on hygiene and air cleanliness has further boosted adoption. Technological advancements like HEPA filtration, UV-C light purification, and smart connectivity are enhancing product appeal. Rising disposable incomes and the expanding middle class are also encouraging consumer spending on health-oriented appliances.

Key Market Drivers

Rising Air Pollution and Environmental Concerns

One of the primary drivers of the air purifiers market in Egypt is the increasing level of air pollution, especially in urban centers like Cairo, Giza, and Alexandria. In 2024, Egypt’s population-weighted annual average PM₂.₅ concentration stood at 42.2 µg/m³, ranking 9th highest globally, though this indicated a slight improvement from 46.5 µg/m³ in 2022. Egypt frequently faces air quality challenges due to a combination of factors such as industrial emissions, vehicular exhaust, construction dust, and natural elements like sandstorms. According to reports from the World Health Organization (WHO), air pollution levels in many parts of Egypt often exceed safe limits, putting residents at risk of respiratory and cardiovascular diseases.Moreover, agricultural burning practices and the widespread use of diesel generators exacerbate the issue, particularly during the autumn season when the “Black Cloud” smog phenomenon occurs. These environmental concerns have heightened awareness among the public and policymakers about the need for clean indoor air, thereby driving the demand for air purifiers across residential, commercial, and institutional settings. Consumers are becoming more conscious about the long-term health implications of poor air quality, making air purifiers a practical investment for both prevention and relief.

Key Market Challenges

Limited Consumer Awareness and Misconceptions

One of the most significant challenges hindering the growth of the air purifiers market in Egypt is the low level of consumer awareness regarding the importance and benefits of indoor air purification. Many Egyptians are still unfamiliar with how air purifiers work and the specific health advantages they offer. In rural and semi-urban areas, air purifiers are often perceived as non-essential or luxury appliances, rather than health-improving necessities.Even in urban regions, there are widespread misconceptions that air pollution is primarily an outdoor issue, overlooking the reality that indoor air quality can be just as harmful - if not worse - due to pollutants from cooking, household chemicals, and insufficient ventilation. The lack of education around particulate matter (PM2.5), allergens, and volatile organic compounds (VOCs) leads to underestimation of health risks, particularly among vulnerable populations such as children, the elderly, and individuals with respiratory conditions. Without targeted awareness campaigns from both the government and private sector, demand for air purifiers will remain limited to a niche segment of highly informed and health-conscious consumers.

Key Market Trends

Rising Demand for Smart and Connected Air Purifiers

A prominent trend shaping the Egypt air purifiers market is the increasing demand for smart and connected devices. As internet penetration and smartphone usage continue to rise, especially among the urban population, consumers are gravitating towards appliances that offer convenience, automation, and real-time monitoring. Modern air purifiers now come equipped with Wi-Fi connectivity, mobile app integration, voice assistant compatibility (like Alexa and Google Assistant), and features such as automatic air quality adjustment based on indoor pollution levels.These smart features allow users to monitor indoor air quality remotely and receive timely alerts for filter replacement or maintenance. With Egypt’s younger population becoming increasingly tech-savvy, there is a growing preference for solutions that combine health benefits with digital ease. The availability of these features at competitive prices is also expanding the appeal of air purifiers beyond premium buyers. As smart home ecosystems become more common in Egypt, integration of air purifiers into these systems is expected to become standard, pushing both local and international brands to invest in innovation and IoT-based solutions tailored for the Egyptian consumer.

Key Market Players

- Samsung Electronics Egypt S.A.E (SEEG)

- Philips Egypt (Limited Liability Company)

- Sharp Middle East FZE

- ACCO Brands Corporation

- LG Electronics Egypt S.A.E(LGEEG)

- Xiaomi Group

- Blueair AB

- Daikin Middle East & Africa FZE

- Panasonic Marketing Middle East & Africa FZE

- HabTech Smart Solutions

Report Scope:

In this report, the Egypt Air Purifiers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Egypt Air Purifiers Market, By Filter Type:

- Splits

- Pre + HEPA

- Pre + HEPA + Activated Carbon

- HEPA

- Others

- Egypt Air Purifiers Market, By Distribution Channel

- Supermarket/Hypermarket

- Multi-branded Stores

- Online

- Others

Egypt Air Purifiers Market, By Region:

- Cairo

- Alexandria

- Giza

- Dakahlia

- Sharqiya

- Rest of Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Egypt Air Purifiers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Samsung Electronics Egypt S.A.E (SEEG)

- Philips Egypt (Limited Liability Company)

- Sharp Middle East FZE

- ACCO Brands Corporation

- LG Electronics Egypt S.A.E(LGEEG)

- Xiaomi Group

- Blueair AB

- Daikin Middle East & Africa FZE

- Panasonic Marketing Middle East & Africa FZE

- HabTech Smart Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2025 |

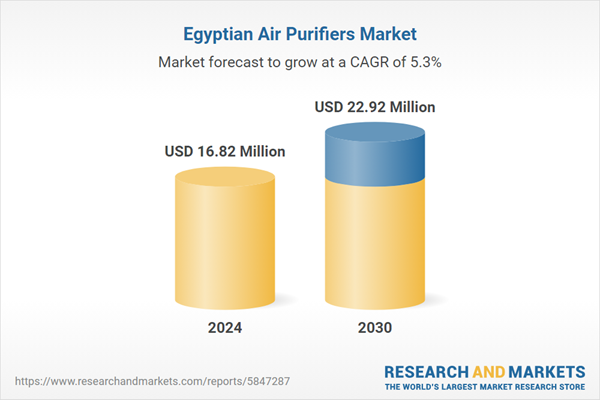

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.82 Million |

| Forecasted Market Value ( USD | $ 22.92 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Egypt |

| No. of Companies Mentioned | 10 |