A DC-DC converter is an electronic circuit that converts one DC voltage level to another. It is widely used to provide a stable and regulated output voltage, even when the input voltage changes. A DC-DC converter is efficient, compact, and lightweight, which makes them ideal for many applications like automotive, utilities, medical & healthcare, and electrical & electronics. The DC-DC converter has low and high-power options, which can be linear or switched.

The surging demand forelectric vehicles, data devices, and technological advancements is pushing the market for DC-DC converter growth. Converters are increasingly used in portable electronic devices such as cell phones,laptops, and computers. The high demand for these portable devices will boost the DC-DC converter market growth. Several manufacturers are developing the DC-DC converter market for various industry applications such as aerospace & defense, automotive, and manufacturing.

This demand for the global DC-DC converter is in line with the production of consumer electronic equipment. According to the Ministry of Economy, Trade and Industry, Japan (METI), the production of consumer electronic equipment was 418,200 (million yen), in December 2023 total to date, which was 368,816 (million yen), in December 2022. during the same period.

Global DC-DC converter market drivers

The increasing use of electronic devices and medical equipment will boost the growth of the global DC-DC converter market.DC-DC converters play a critical role in portable electronic devices, such as smartphones, tablets, and laptops, that require efficient power management solutions by converting the battery voltage to the voltage level needed for the various components, such as the display, processor, and memory. Portable electronic devices are becoming smaller and lighter, which requires compact and lightweight power management solutions, which DC-DC converters can provide. The global DC-DC converter market in the electronics industry is expected to be driven by the increasing demand for portable electronic devices and the trend toward miniaturization and lightweight design.

According to the Indian Brand Equity Foundation (IBEF), shipments of 5G smartphone devices in India are anticipated to rise from 28 million in CY 2021 to around 64 million in CY 2022, a 129% YoY increase. Per the Consumer Technology Association (CTA), in 2021, the total sales revenue for laptops and tablets in the United States alone was $47 billion, representing a 7% increase from the previous year. The global tablet market is expected to reach 160 million units by 2024, with most of the growth coming from emerging markets. DC-DC converters are widely used in medical equipment and devices like CT scanners, MRI machines, and X-ray machines to convert power from one voltage level to another, as these devices need a stable and reliable power supply to operate effectively. DC-DC converters are also used in portable medical devices such as glucose meters, blood pressure monitors, and respiratory devices to function reliably and efficiently by converting power from the battery to the required voltage.

According to the Indian Brand Equity Foundation (IBEF), in FY2,021, India's exports of medical devices totaled $2.53 billion; by 2025, this is anticipated to reach $10 billion. According to the International Electrotechnical Commission (IEC), the global market for medical electrical equipment was valued at $35.5 billion in 2019 and is expected to grow up to 6.2% from 2020 to 2025 due to an increase in the prevalence of chronic diseases, rising healthcare expenditure, and technological advancements in medical devices. This demonstrates that the DC-DC converter holds significant growth potential.

Global DC-DC converter market geographical

By geography, the DC-DC converter market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific.The increasing adoption of DC-DC converters in various end-user industries such as automotive production, medical & healthcare, and consumer electronics in countries such as China, Japan, and India is expected to boost the demand for DC-DC converters in the Asia-Pacific region. The Chinese government has been providing support for domestic companies in 2020 in the portable electronics industry through policies such as tax incentives and subsidies to increase the production of electronics, and parallelly this increases the need for DC-DC converters as it converts the battery voltage to the required voltage level in electronics.

In 2020, the Japanese government provided funding to a project called "Development of a Wearable Vital Signs Monitor System," which aims to develop a portable device that can monitor a patient's vital signs, such as blood pressure and heart rate in real-time and this development will boost the demand for DC-DC converters in devices as they are required to convert power from the battery to the required voltage. The Ministry of Electronics and Information Technology of India has been granted Rs. 16,549 crores (US$ 2 billion) in the Union Budget 2023-24, which is an increase of about 40% from the previous year for the growth of the electronic industry in India and demand for DC-DC converters in electronic devices increases parallelly as it is required to convert the battery voltage to the desired voltage level. These factors all add to the DC-DC converter market growth in the Asia-Pacific region.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Global DC-DC Converter Market is analyzed into the following segments:

By Type

- Linear

- Switched

By Power

- Low

- High

By End-user

- Automotive

- Utilities

- Medical & Healthcare

- Electrical & Electronics

- Others

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- ABB Ltd.

- General Electric

- Infineon Technologies

- Murata Manufacturing Co., Ltd.

- RECOM Power GmbH

- TDK Corporation

- Texas Instrument Incorporated

- Traco Electronic AG

- Vicor Corporation

- XP Power

- Advanced Energy

- PICO Electronics, Inc.

- ROHM Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | December 2024 |

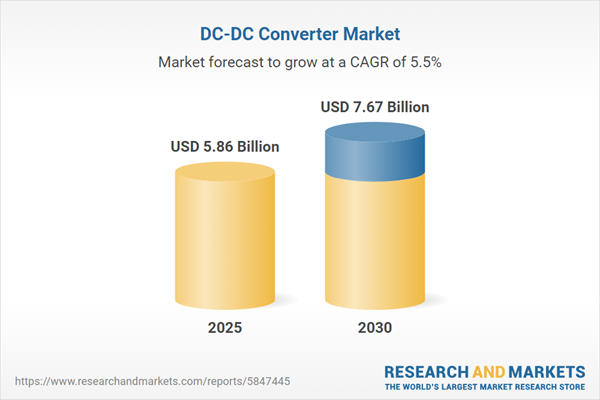

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 5.86 Billion |

| Forecasted Market Value ( USD | $ 7.67 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |