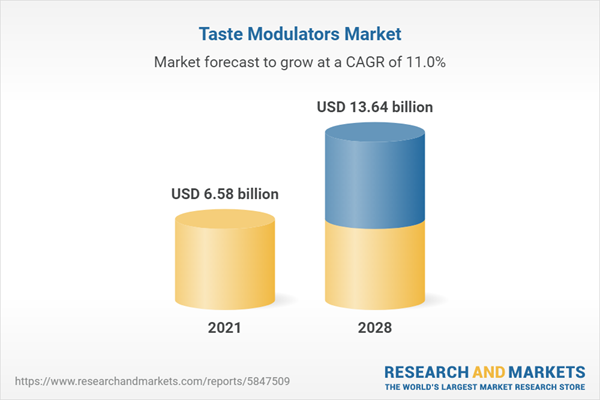

The taste modulators market is expected to grow at a CAGR of 10.97% from a market size of US$6.583 billion in 2021 to reach US$13.644 billion in 2028.

Taste modulators improve the flavor and taste of goods with lower calorie content. Sweetness boosters, salt reducers, and bitterness blockers are the most often used modulators. Tastemakers play a significant role in food formulation and flavor enhancement. They are also known as flavor enhancers, masking agents, bitterness blockers, sugar extenders, and salt replacers.Taste modulators are employed in various food and beverages such as snacks, baked goods, processed foods, drinks, ready-to-eat products, etc. Thus, growing consumer demand for processed and convenience foods is a major factor driving the global market during the analysis period. Rising demand for low-caloric, sugar-free, low-sodium products is driving the global taste modulator’s market expansion. Furthermore, growing consumer interest in clean-label products is projected to drive growth in the taste modulators market. Changing consumer preferences and rising disposable income are also significant drivers of the market for taste modulators.

However, complex laws, restrictions, possible side effects, high & volatile prices of raw materials, and a lack of knowledge obstruct the growth of the global market for taste modulators during the analysis period. Moreover, a continuous product launched by key market players with innovative flavors and textures is providing new opportunities to market participants during the forecast period.

The growing demand for food & beverage products is augmenting the demand for taste modulators.

One of the primary factors driving the growth of taste modulators is their high demand from the food and beverage industry. The food and beverage industry is constantly innovating to find clean-label low sugar, low-calorie, and low-sodium products while retaining the product's functionality, texture, and taste. Taste modulators are employed in various cuisine categories ranging from pastries and meats to soups, sauces, bakery goods, beverages, and dressings. Therefore growing demand for clean-label, shelf-stable, and delicious food products is driving the demand for taste modulators globally.According to a recent International Food Information Council poll, three out of ten consumers prioritize "Total Sugars" information on the Nutrition Facts label, while nearly one in five seek "Added Sugars" on product labels. As the number of individuals who avoid sugar rises, so will the need for low-sugar solutions. Since certain taste modulators can reduce sugar by 30% without affecting the taste of the product, the demand for low-sugar products will expand the market even further. Moreover, an increasing number of cases of obesity, diabetes, and metabolic syndrome, along with improved consumer awareness, has resulted in a positive expansion of taste modulators. Diabetes has affected 537 million people in 2021, according to the IDF. According to forecasts, this figure is expected to rise to 643 million by 2030 and 783 million by 2045. 541 million people are at risk of developing type 2 diabetes.

Asia Pacific is anticipated to hold a significant share of the global taste modulators market during the forecast period.

Asia Pacific region is anticipated to hold a significant market share in taste modulators. This region will experience rapid expansion throughout the projection period due to expanding consumer health consciousness, greater urbanization, and rising disposable income. Taste modulators are in high demand in rising markets such as India and China. This region's market is expanding due to the presence of a well-established food & beverage industry. This region's market is expanding due to changing eating habits and rising demand for low-calorie products and drinks. In addition, the prevalence of key market players such as IFF, Sensient, DSM Kerry Inc Synergy Flavors., is also spurring the growth of taste modulators in this region. Various product launches with innovative flavors are also spurring growth during the forecast period.Market Developments:

- In July 2022,Ohly, a German yeast manufacturing company, introduced three carbon-neutral components with plant-based food product functionality. The components are part of the Plant Protein Taste Toolbox solutions aimed toward vegan diets. Flav-R-Max, a novel carbon-neutral natural yeast flavor modifier, has a strong umami impact and hides the off-notes of plant proteins. It can also be used to reduce the salt content of meat substitutes.

- In May 2022,Flavorchem introduced Taste Mod Sweet. This taste modulator is formulated to enhance the sweetness in beverage applications without sacrificing taste or nutrition and enhancing the sweetness of their reduced-sugar drinks. Taste Mod Sweet is effective in various beverage applications and pH levels. It's vegan, kosher, and non-GMO and can be labeled "natural flavor."

- In November 2021,Kerry, the world's leading taste and nutrition firm, released TastesenseTM Sweet Organic Certified, the first organic-certified sweet modulator for the US beverage industry. This novel taste modulator has various uses for Organic Certified drinks, providing a clean, sweet taste with outstanding mouthfeel and a balanced flavor profile. This taste modulator can also be used in sparkling water, low- or no-sugar beverages, functional and energy drinks, and alcoholic beverages with high and low ABV.

Market Segmentation:

By Type

- Sweet Modulators

- Salt Modulators

- Fat Modulators

By Application

- Food

- Bakery and Confectionery Products

- Dairy Products

- Snacks & Savory Products

- Meat Products

- Others

- Beverage

- Alcoholic Beverages

- Non-Alcoholic Beverages

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- DSM N.V

- International Flavors & Fragrances Inc

- Sensient Technologies Corporation

- The Flavor Factory

- Kerry Inc

- Givaudan

- Ingredion Incorporated

- Flavorchem Corporation

- Firmenich

- Synergy Flavors

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | June 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 6.58 billion |

| Forecasted Market Value ( USD | $ 13.64 billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |