Chemicals play a crucial role in formulating cosmetics and toiletries, enabling the creation of products that enhance beauty and personal care routines. These chemicals are carefully synthesized using various processes to ensure their safety and efficacy. They work by interacting with the skin, hair, or nails to produce desired effects. The components of these chemicals vary depending on their purpose, but they often include emollients, surfactants, preservatives, and fragrances. Among these, emollients help moisturize and soften the skin, while surfactants aid in cleansing and foaming. On the other hand, preservatives prevent the growth of harmful bacteria and extend the shelf life of the product, and fragrances provide a pleasant scent. The advantages of using chemicals in cosmetics and toiletries are numerous, including creating products tailored to specific needs, such as moisturizers for dry skin or shampoos for oily hair. Chemicals also enable the development of innovative formulations, incorporating advanced technologies, such as anti-aging compounds or ultraviolet (UV) filters for sun protection.

Chemicals for Cosmetics and Toiletries Market Trends:

The global chemicals for cosmetics and toiletries market is primarily boosted by the increasing demand for cosmetic and personal care products. The growing population, rising disposable incomes, and changing consumer preferences towards personal grooming and appearance enhancement are contributing to the market growth. Moreover, advancements in technology and innovation in the cosmetics and toiletries industry are supporting the market growth. In line with this, key manufacturers are continuously developing new and improved formulations to meet evolving consumer needs, further fueling the market growth. Besides this, the surging demand for plant-based and environmentally friendly chemicals, shifting consumer preference toward clean and sustainable beauty products, and the rising influence of social media are creating a positive outlook for the market. Other factors, including the growing popularity of beauty influencers and bloggers, the expansion of distribution channels, such as e-commerce platforms, and the burgeoning geriatric population, are providing an impetus to the market growth.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global chemicals for cosmetics and toiletries market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type and application.Type Insights:

- Cosmetics Chemicals

- Toiletries Chemicals

Application Insights:

- Skin Care Products

- Hair Care Products

- Oral Hygiene Products

- Bath and Shower Products

- Personal Hygiene Products

- Others

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global chemicals for cosmetics and toiletries market. Detailed profiles of all major companies have been provided. Some of the companies covered include Arkema S.A., Ashland Inc., BASF SE, Biosil Technologies Inc., Croda International plc, Dow Inc., Eastman Chemical Company, Evonik Industries AG (RAG-Stiftung), Fenchem, Hallstar Company, Koninklijke DSM N.V., Lanxess AG, Merck KGaA, Stepan Company, The Lubrizol Corporation (Berkshire Hathaway Inc.), etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global chemicals for cosmetics and toiletries market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global chemicals for cosmetics and toiletries market?

- What is the impact of each driver, restraint, and opportunity on the global chemicals for cosmetics and toiletries market?

- What are the key regional markets?

- Which countries represent the most attractive chemicals for cosmetics and toiletries market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the chemicals for cosmetics and toiletries market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the chemicals for cosmetics and toiletries market?

- What is the competitive structure of the global chemicals for cosmetics and toiletries market?

- Who are the key players/companies in the global chemicals for cosmetics and toiletries market?

Table of Contents

Companies Mentioned

- Arkema S.A.

- Ashland Inc.

- BASF SE

- Biosil Technologies Inc.

- Croda International plc

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG (RAG-Stiftung)

- Fenchem

- Hallstar Company

- Koninklijke DSM N.V.

- Lanxess AG

- Merck KGaA

- Stepan Company

- The Lubrizol Corporation (Berkshire Hathaway Inc.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | March 2025 |

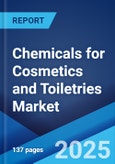

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 25.95 Billion |

| Forecasted Market Value ( USD | $ 35.36 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |