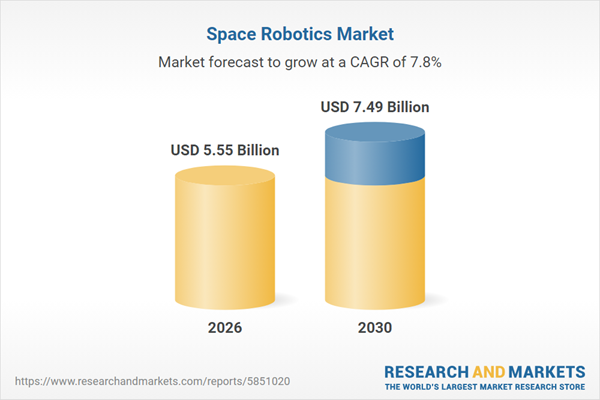

The space robotics market size is expected to see strong growth in the next few years. It will grow to $7.49 billion in 2030 at a compound annual growth rate (CAGR) of 7.8%. The growth in the forecast period can be attributed to expansion of lunar and mars exploration programs requiring advanced autonomous robots, rising use of robotics for in-orbit servicing assembly and debris removal, increasing commercial space activities driving demand for multipurpose robotic platforms, integration of artificial intelligence to enhance autonomous decision-making in space robots, growing development of lightweight energy-efficient robotic systems for long-duration missions. Major trends in the forecast period include growth in autonomous robotic servicing for satellites, increasing deployment of humanoid and floating robots for complex missions, rising demand for precision robotic arms for extra-vehicular tasks, expansion of robotic systems for high-temperature and vacuum-intense environments, advancements in mission-specific robotic mobility platforms.

The increasing level of investment in space missions is expected to drive the growth of the space robotics market in the coming years. Growth in investments in space missions refers to the rising amount of funding being allocated toward space exploration and development activities. This rise in funding is expected to result in greater investments in space robotics, leading to significant technological advancements. For instance, in August 2025, according to the UK Space Agency, a UK-based government organization responsible for civil space policy and programs, UK space organizations invested approximately $1.25 billion in research and development during the 2022/23 fiscal year, accounting for 5.7% of the industry’s total revenue, up from 5.1% in 2021/22. Therefore, the growth in investments in space missions is driving the expansion of the space robotics market.

Major companies in the space robotics market are focusing on developing advanced solutions such as robotic lunar landers to enhance exploration capabilities, facilitate payload delivery to the moon, and support an expanding range of commercial and scientific missions. Robotic lunar landers are automated spacecraft designed to deliver payloads to the lunar surface, enabling scientific research, technology demonstrations, and commercial activities without direct human intervention. For example, in January 2024, Astrobotic, a US-based space robotics company, launched the Peregrine Lunar Lander. The lander featured advanced autonomous landing systems for precise lunar touchdown, a robust propulsion system for reliable orbital maneuvers, and a flexible payload integration platform supporting a variety of scientific instruments and technology demonstrations. This launch advanced the space robotics market by improving payload delivery capabilities and enabling new lunar exploration experiments.

In April 2025, Katalyst Space Technologies, a US-based provider of satellite servicing and on-orbit logistics solutions, acquired Atomos Space for an undisclosed amount. Through this acquisition, Katalyst Space Technologies aims to enhance its in-space mobility, refueling, and satellite life-extension capabilities. Atomos Space is a US-based company specializing in space robotics and orbital transfer vehicle technologies, including robotic systems for satellite repositioning, servicing, and debris management operations.

Major companies operating in the space robotics market are Northrop Grumman Corporation, Altius Space Machines Inc., Astrobotic Technology Inc., Honeybee Robotics Ltd., Maxar Technologies Inc., Motiv Space Systems Inc., Oceaneering International Inc., Olis Robotics, Intuitive Machines LLC, Effective Space Solutions Ltd., Stinger Ghaffarian Technologies Inc. (SGT), GITAI Inc., Ispace Inc., Lockheed Martin Corporation, ABB Ltd., NVIDIA Corporation, Blue Origin LLC, Boeing Company, Space Exploration Technologies Corp. (SpaceX), IHI Corporation.

North America was the largest region in the space robotics market in 2025. Asia-Pacific is expected to be the fastest-growing region in the global space robotics market during the forecast period. The regions covered in the space robotics market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs are influencing the space robotics market by increasing the cost of importing high-precision components such as actuators, sensors, semiconductors, and specialized alloys required for robotic arms, rovers, and navigation systems. These added costs particularly affect segments like remotely operated vehicles, manipulator systems, and robotics software integration, with major manufacturing and assembly regions in North America, Europe, and Asia-Pacific being impacted. While tariffs create delays and raise expenses for commercial and government end users, they also encourage domestic manufacturing investments, supply-chain localization, and long-term technological innovation within the space robotics ecosystem.

The space robotics market research report is one of a series of new reports that provides space robotics optical components market statistics, including space robotics optical components industry global market size, regional shares, competitors with a space robotics optical components market share, detailed space robotics optical components market segments, market trends and opportunities, and any further data you may need to thrive in the space robotics optical components industry. This space robotics optical components market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Space robotics has emerged as a cutting-edge field in science and engineering, specifically tailored for space exploration and missions. The unique challenges of space environments, characterized by hostility, microgravity, and extreme temperatures, necessitate the development of specialized robotic systems.

The primary categories of space robotics encompass remotely operated vehicles (ROVs), remote manipulator systems, and associated software and services. Remotely operated vehicles, or ROVs, represent unmanned and highly maneuverable vehicles that are remotely controlled. These vehicles serve a crucial role in investigating locations that are otherwise inaccessible. Their applications extend to diverse environments, including deep space, near space, and planetary surfaces. Both commercial and government entities benefit from the versatility of ROVs in fulfilling various mission objectives, making them integral components of space exploration endeavors.

The countries covered in the space robotics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The space robotics market consists of sales of manipulators, mobile, humanoid, and flying or floating robots. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Space Robotics Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses space robotics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for space robotics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The space robotics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Report Scope

Markets Covered:

1) By Solution: Remotely Operated Vehicles; Remote Manipulator System; Software; Services2) By Application: Deep Space; Near Space; Ground

3) By End-User: Commercial; Government

Subsegments:

1) By Remotely Operated Vehicles: Rovers; Landers2) By Remote Manipulator System: Robotic Arms; Grippers; End-Effectors

3) By Software: Autonomous Navigation Software; Communication Software; Control System Software

4) By Services: Mission Support Services; Maintenance and Repair Services; Data Analytics Services

Companies Mentioned: Northrop Grumman Corporation; Altius Space Machines Inc.; Astrobotic Technology Inc.; Honeybee Robotics Ltd.; Maxar Technologies Inc.; Motiv Space Systems Inc.; Oceaneering International Inc.; Olis Robotics; Intuitive Machines LLC; Effective Space Solutions Ltd.; Stinger Ghaffarian Technologies Inc. (SGT); GITAI Inc.; Ispace Inc.; Lockheed Martin Corporation; ABB Ltd.; NVIDIA Corporation; Blue Origin LLC; Boeing Company; Space Exploration Technologies Corp. (SpaceX); IHI Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Space Robotics market report include:- Northrop Grumman Corporation

- Altius Space Machines Inc.

- Astrobotic Technology Inc.

- Honeybee Robotics Ltd.

- Maxar Technologies Inc.

- Motiv Space Systems Inc.

- Oceaneering International Inc.

- Olis Robotics

- Intuitive Machines LLC

- Effective Space Solutions Ltd.

- Stinger Ghaffarian Technologies Inc. (SGT)

- GITAI Inc.

- Ispace Inc.

- Lockheed Martin Corporation

- ABB Ltd.

- NVIDIA Corporation

- Blue Origin LLC

- Boeing Company

- Space Exploration Technologies Corp. (SpaceX)

- IHI Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 5.55 Billion |

| Forecasted Market Value ( USD | $ 7.49 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |