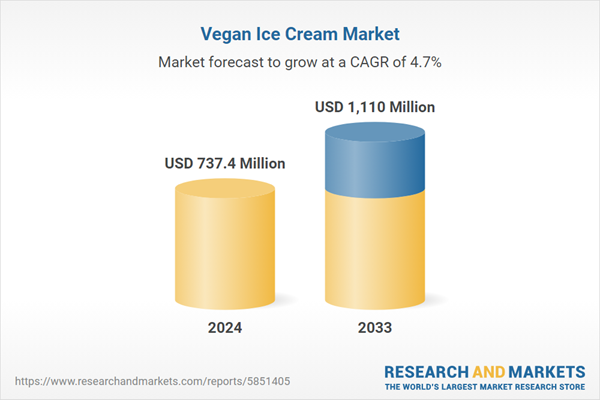

Vegan Ice Cream Global Market Report by Source (Coconut Milk, Soy Milk, Almond Milk, Cashew Milk), Flavor (Chocolate, Caramel, Coconut, Vanilla, Coffee, Fruit), Sales Type (Impulse, Take Home, Artisanal), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others), Countries and Company Analysis 2025-2033.

Global Vegan Ice Cream Industry Overview

The market for vegan ice cream has grown significantly in recent years due to rising customer demand for plant-based substitutes for conventional dairy products. The market for vegan ice cream has grown to encompass a broad range of flavors, ingredients, and textures as more individuals choose vegan, lactose-free, and dairy-free diets. To satisfy the needs of vegans and people with dairy intolerances, companies are using plant-based ingredients like almond milk, coconut milk, soy milk, and oat milk to make rich, creamy ice cream substitutes. The market is expanding as a result of growing knowledge of the advantages of plant-based diets for health, animal welfare, and environmental sustainability.Innovative product development has helped the vegan ice cream industry, in addition to the rise in health-conscious consumers. In order to compete with conventional dairy ice creams, producers are putting more effort into enhancing flavor variety, taste, and texture. A wider audience has been drawn in as a result of the introduction of a variety of high-end and decadent products, such as sugar-free and exotic flavors. Vegan ice cream is becoming more widely available worldwide as stores and foodservice networks increase the variety of products they offer. As consumer tastes move toward more ethical, ecologically friendly, and healthful food options, the industry is anticipated to keep expanding. The global market for vegan ice cream is poised for sustained growth in the upcoming years due to rising awareness and innovation.

Due to growing consumer preferences for plant-based diets, the US has become a significant market for vegan ice cream. Growing knowledge of the negative effects of dairy production on the environment, such as greenhouse gas emissions, water use, and deforestation, is one factor contributing to this change. In 2024, about 3% of Americans will be vegan, according to the World Population Review. In the US, health consciousness is also increasingly influencing consumer purchasing decisions, especially among younger populations. To avoid problems with lactose intolerance, allergies, and the high saturated fat content of dairy products, many customers are switching to plant-based substitutes.

For these people, vegan ice creams - which are usually manufactured from plant-based milk - offer a better choice. Diverse flavors are also increasingly playing a significant role in the nation's market expansion. Traditional tastes like chocolate, vanilla, and strawberry are still in demand, but many companies are expanding their product lines to include more unusual and exotic selections to satisfy picky consumers.

Growth Drivers for the Vegan Ice Cream Market

The prevalence of dairy allergies and lactose intolerance in the general population

The prevalence of dairy allergies and lactose intolerance in the general population is the main reason propelling market expansion. Lactose intolerance, or the inability to digest sugar present in dairy products, affects a sizable portion of the global population. The demand for vegan ice cream is rising as a result of this circumstance. In this sense, dairy-related allergies are extremely serious and sometimes fatal. As a result, many who suffer from these illnesses need dairy-free substitutes, which is contributing to the market's promising future for vegan ice cream. These ice creams are made with cashew, almond, coconut, or soy instead of plant-based milk.Additionally, many corporations are expanding their product lines to accommodate those with these kinds of problems. A new lactose and cholesterol-free ice cream made with animal-free whey protein was introduced by Unilever's Breyers in 2024.

Health Awareness and Growing Interest in Plant-Based Products

Vegan ice cream is becoming more and more popular as plant-based diets and health concerns gain more attention. Health-conscious people require healthier substitutes without sacrificing flavor or appeal. Vegan ice cream is a healthier alternative to traditional dairy-based ice cream because it is created without saturated fats and cholesterol. 60% of people in North America prefer healthier desserts, ice cream, and confections, according to industry research. The need for vegan substitutes is further supported by the high incidence of lactose intolerance seen in India.Furthermore, plant-based diets have gained popularity recently because of their health advantages, which include improved heart and weight control. Consequently, customers are adopting plant-based diets and viewing vegan ice cream as a more fulfilling dessert that aligns with their objective of maintaining optimal health.

Growing Concern for Animal Welfare and Environmental Sustainability

The market's expansion is being aided by customers' increased awareness of the need to consume food in an environmentally sustainable manner and to protect animals. Additionally, rising concerns about traditional dairy farming's deforestation, water use, and greenhouse gas (GHG) emissions are pushing many people to search for ethical and sustainable substitutes. Vegan ice creams are seen to be a more environmentally friendly choice because they don't contain any components originating from animals. In addition to dietary needs, ethical considerations such as the need to reduce animal exploitation and worry about animal welfare also support the demand for vegan ice cream.Many ice cream firms are producing vegan ice creams and introducing new tastes as a result. In February 2024, Magnum launched their vegan blueberry cookie ice cream with sorbet center into the market. The vegan milk chocolate-covered ice cream is available in sticks and a three-piece bundle.

Challenges in the Vegan Ice Cream Market

Nutritional Concerns

One major obstacle facing the vegan ice cream sector is nutritional concerns. Many vegan ice creams use large quantities of sugar, fats, or chemical additions to provide the desired rich flavor and creamy texture, which may cause health concerns among consumers who are more health-conscious. The allure of plant-based substitutes may be weakened by excessive sugar and bad fats, particularly for people looking for better dessert options. Furthermore, the use of processed components may give the impression that vegan ice cream is less nutrient-dense than conventional dairy-free substitutes. For firms hoping to appeal to an increasing number of health-conscious consumers, striking a balance between enjoyment and better formulations - such as reduced sugar or fat content and cleaner ingredients - is essential.Higher Costs

One major obstacle facing the vegan ice cream sector is rising prices. High-end plant-based components including cashews, almond milk, coconut milk, and organic sweeteners are used by many manufacturers to make luxury products; these ingredients are typically more costly than conventional dairy ingredients. Furthermore, producing vegan ice cream frequently calls for more intricate techniques to get the right flavor and consistency, which raises prices even further. Because of this, vegan ice cream products are usually more expensive than their dairy equivalents, which limits their accessibility for those who are budget conscious. This may restrict market penetration, especially in areas or among certain populations where price plays a big role in decisions about what to buy. One of the biggest challenges for organizations trying to grow their customer base is striking a balance between quality and price.United States Vegan Ice Cream Market

The vegan ice cream market in the US is being driven by rising dietary preferences for plant-based products and health consciousness. About 6% of American consumers identify as vegan, according to recent studies, which has raised demand for dairy-free alternatives. The growing knowledge of lactose intolerance, which affects roughly 36% of Americans, is another factor contributing to the desire of vegan ice cream products. Popular foundation components including oat milk, almond milk, and coconut milk have become more well-liked because to their flavor profiles and health benefits. The rise of plant-based diets, which has been facilitated by celebrity endorsements and increased media attention, has spurred innovation in vegan ice cream tastes and textures.The market has expanded as a result of the arrival of well-known businesses like Ben & Jerry's and Häagen-Dazs. Customers are also growing interested in businesses that provide unique flavors and clean-label items. The expansion of e-commerce and the expansion of availability in supermarkets and specialty stores also contribute to accessibility. Additionally, because of environmental concerns surrounding dairy farming, consumers are shifting to sustainable plant-based substitutes.

United Kingdom Vegan Ice Cream Market

European customers' strong interest in ecological and ethical food options is fueling the demand for vegan ice cream. The UK has more vegans than any other nation in the world, per World Population Review statistics. Searches for vegan restaurants with vegan-only menus have increased threefold in the past four years. Between 2017 and 2020, the number of searches for vegan restaurants increased from 60,000 to over 200,000. Veganism is growing in popularity in the UK as a result of countless advertisements and prominent media personalities endorsing its many benefits. Other European countries with significant vegan populations include Germany, Sweden, Austria, and Switzerland.Strict food labeling regulations and the European Union's commitment to sustainability further promote the development of plant-based products. Countries like Germany and the UK are leading the vegan movement with a rise in vegan ice cream options in foodservice and retail channels.

India Vegan Ice Cream Market

Due to growing knowledge of lactose intolerance, increased health consciousness, and a growing desire for plant-based diets, the vegan ice cream business in India is expanding gradually. The demand for vegan ice cream is rising as a result of India's sizable vegetarian population and the vast number of people looking for dairy-free alternatives. For instance, according to the data by World Population Review, India’s population has around 30% vegetarians and 9% vegans. Popular bases for plant-based ice creams include coconut milk, almond milk, and soy milk; these options come in a variety of flavors to suit regional preferences. With both domestic and foreign firms introducing cutting-edge products, urban areas like Bangalore, Delhi, and Mumbai are dominating the market. The market is confronted with obstacles, nonetheless, including the need for more customer knowledge, restricted availability, and higher costs because of premium ingredients. Notwithstanding these obstacles, the market is anticipated to expand as more buyers look for ethical and healthier substitutes.United Arab Emirates Vegan Ice Cream Market

The market for vegan ice cream in the United Arab Emirates is expanding steadily due to rising health consciousness and a growing desire for dairy-free options. Particularly among vegan and health-conscious consumers, vegan ice cream has grown in popularity as people become more cognizant of lactose intolerance, ethical issues, and plant-based diets. The market gains from the cosmopolitan and varied population in places like Dubai and Abu Dhabi, where there is a growing demand for plant-based goods. Rich, creamy ice cream substitutes are made with common bases including coconut milk, almond milk, and soy milk. As more shops, cafes, and restaurants provide vegan options, the industry is growing even if premium ingredients are more expensive. The UAE market's potential is further supported by consumers' increased interest in ethical and sustainable food options.Vegan Ice Cream Market Segments

Source

1. Coconut Milk2. Soy Milk

3. Almond Milk

4. Cashew Milk

Flavor

1. Chocolate2. Caramel

3. Coconut

4. Vanilla

5. Coffee

6. Fruit

Sales Type

1. Impulse2. Take Home

3. Artisanal

Distribution Channel

1. Supermarkets and Hypermarkets2. Convenience Stores

3. Online Stores

4. Others

Country

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

The companies have been covered from 4 viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue

Company Analysis

1. Unilever PLC2. Tofutti Brands Inc.

3. Van Leeuwen Ice Cream

4. SorBabes

5. Perry's Ice Cream

6. NadaMoo!

7. Over The MOO

8. Morrisons

9. HappyCow

10. Double Rainbow Ice Cream

11. Booja-Booja

12. Arctic Zero

Table of Contents

Companies Mentioned

- Unilever PLC

- Tofutti Brands Inc.

- Van Leeuwen Ice Cream

- SorBabes

- Perry's Ice Cream

- NadaMoo!

- Over The MOO

- Morrisons

- HappyCow

- Double Rainbow Ice Cream

- Booja-Booja

- Arctic Zero

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 737.4 Million |

| Forecasted Market Value ( USD | $ 1110 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |