Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As global trade flows evolve, and industries recalibrate supply chains for resilience and compliance, insulated packaging is gaining traction as a mission-critical infrastructure asset, especially in industries where even minor temperature deviations can result in significant financial or reputational losses. The market's forward trajectory is being shaped not only by volume demand but also by technological differentiation, material innovation, and ESG-aligned packaging practices.

The market is well-positioned for sustained, high-value growth, particularly as businesses embed product integrity, traceability, and environmental stewardship into core operational strategies. In this context, insulated packaging emerges as a key enabler of both regulatory compliance and competitive differentiation across high-risk, high-value supply chains.

Key Market Drivers

Expansion of the Cold Chain Logistics Industry

The expansion of the cold chain logistics industry plays a pivotal role in driving the growth of the Global Insulated Packaging Market, as it directly increases the demand for reliable, high-performance solutions that preserve product integrity across complex, temperature-sensitive supply chains. As more industries rely on cold chains to transport perishable and sensitive goods globally, insulated packaging becomes a critical infrastructure component supporting quality, compliance, and customer satisfaction. The international trade of perishable food products, pharmaceuticals, biologics, chemicals, and specialty goods has surged significantly in recent years.These products require precise temperature control from origin to destination, often over long distances and through multiple transit points. The expansion of cold chain networks encompassing refrigerated warehouses, reefer containers, and cold transport fleets has created a robust ecosystem that depends on insulated packaging to maintain uninterrupted thermal protection during handling, storage, and distribution. Without insulated packaging, even a momentary temperature excursion could lead to product spoilage or compliance failure.

The cold chain logistics industry has seen exponential growth in the frozen foods, fresh produce, seafood, dairy, and beverage segments. Rising demand for convenience, health, and quality is driving year-round consumption of seasonal or perishable products across geographies. As these products are highly susceptible to temperature variations, contamination, and spoilage, insulated packaging such as corrugated insulated boxes, foam containers, and thermal liners is essential for preserving product freshness and ensuring food safety. The growth of this sector reinforces consistent, high-volume demand for insulated packaging solutions globally. The pharmaceutical and biotechnology industries are heavily reliant on cold chain systems for transporting vaccines, biologics, insulin, diagnostic kits, blood samples, and other temperature-sensitive medical supplies. The emergence of mRNA vaccines, personalized medicine, and clinical trial shipments has increased the complexity and criticality of cold chain logistics.

Infrastructure investment demand across Asia is both substantial and regionally concentrated. East Asia accounts for 58% and South Asia for 17% of total investment requirements reflecting the fact that these two sub-regions collectively represent over 70% of the region’s population. Emerging economies across Asia-Pacific, Latin America, and the Middle East are investing heavily in building and upgrading their cold chain infrastructure, driven by rising consumer demand for imported food, expanding pharmaceutical access, and government initiatives to reduce post-harvest losses. As these regions scale their cold chain capabilities through new cold storage facilities, temperature-controlled transport fleets, and digital monitoring systems they simultaneously drive the need for affordable and scalable insulated packaging that can adapt to diverse climatic conditions and operational environments.

Key Market Challenges

High Cost of Advanced Insulated Packaging Solutions

One of the most significant challenges is the high cost associated with premium insulated packaging products, especially those designed for stringent cold chain requirements. Solutions incorporating vacuum insulated panels (VIPs), phase change materials (PCMs), smart sensors, or reusable thermal containers offer superior performance but come with substantially higher upfront costs compared to conventional packaging options.These cost constraints are particularly problematic for Small and medium-sized enterprises (SMEs), Emerging markets with price-sensitive customers, Low-margin industries such as fresh produce and meal kits. While large pharmaceutical or global food exporters may absorb these costs, many businesses struggle to justify the expense especially for short-duration deliveries or one-time shipments. This limits adoption and delays innovation rollout across price-sensitive segments.

Key Market Trends

Integration of Smart Packaging Technologies for Real-Time Monitoring

A prominent trend influencing the future of insulated packaging is the adoption of smart technologies particularly integrated temperature sensors, RFID tags, GPS trackers, and data loggers that enable real-time monitoring of package conditions during transit. Companies are increasingly leveraging smart insulated packaging that can Record and transmit temperature fluctuations, Detect tampering or unauthorized opening, Monitor humidity, light exposure, and shock impacts.This trend is especially valuable in sectors such as pharmaceuticals, clinical trials, premium foods, and vaccines, where end-to-end traceability and compliance documentation are critical. By combining insulation with smart sensors, businesses can Ensure product integrity, Reduce spoilage-related losses, Strengthen regulatory adherence (e.g., GDP, IATA), Improve logistics transparency and customer trust. As IoT adoption grows and sensor costs decline, smart insulated packaging is expected to move from high-end use cases to mainstream applications, driving innovation and differentiation across the market.

Key Market Players

- Sonoco Products Co

- DuPont de Nemours, Inc.

- Cryopak Industries Inc

- The Wool Packaging Company Limited

- Cascades Inc.

- DS Smith PLC

- Innovative Energy Inc.

- Marko Foam Products, Inc.

- Thermal Packaging Solutions Ltd.

- Insulated Products Corporation

Report Scope:

In this report, the Global Insulated Packaging Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Insulated Packaging Market, By Type:

- Rigid

- Flexible

- Semi-rigid

Insulated Packaging Market, By Product:

- Corrugated Cardboards

- Metal

- Glass

- Plastic

- Others

Insulated Packaging Market, By Application:

- Cosmetic

- Pharmaceutical

- Industrial

- Food & Beverages

- Others

Insulated Packaging Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Insulated Packaging Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Insulated Packaging market report include:- Sonoco Products Co

- DuPont de Nemours, Inc.

- Cryopak Industries Inc

- The Wool Packaging Company Limited

- Cascades Inc.

- DS Smith PLC

- Innovative Energy Inc.

- Marko Foam Products, Inc.

- Thermal Packaging Solutions Ltd.

- Insulated Products Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | September 2025 |

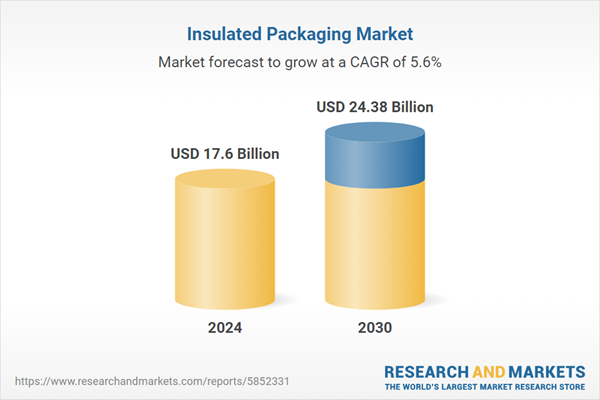

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.6 Billion |

| Forecasted Market Value ( USD | $ 24.38 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |