Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As end-user industries such as consumer electronics, food service, healthcare, and e-commerce adopt circular packaging models, molded pulp is gaining traction not simply for its biodegradability, but for its ability to replace plastic at scale without compromising protection, branding, or operational efficiency. The market is positioned for sustained growth, driven by advancements in automated molding technology, material innovation, and the expanding integration of molded pulp into primary and premium packaging formats. Far from being a transitional solution, molded pulp packaging is solidifying its role as a core component of long-term packaging strategies across global supply chains.

Key Market Drivers

Growth of E-commerce and Direct-to-Consumer Retail

The growth of e-commerce and direct-to-consumer (DTC) retail is a powerful catalyst for the expansion of the Global Molded Pulp Packaging market, fundamentally reshaping packaging priorities across industries. As of 2025, the global online shopper base has reached 2.77 billion, representing approximately 33% of the world’s population. This reflects a year-over-year growth of 2.2%, signaling continued expansion of digital commerce penetration across both developed and emerging markets.Unlike traditional retail, where products are displayed and purchased in-store, e-commerce involves multiple handling stages from warehouse storage to last-mile delivery. This raises the risk of damage during transit. Molded pulp packaging offers superior cushioning and structural integrity, making it ideal for safeguarding fragile and high-value items such as electronics, cosmetics, glassware, and small home appliances. Its ability to be molded into custom shapes allows it to securely encase and protect products, reducing breakage and minimizing returns a critical factor for online retailers seeking to optimize customer satisfaction and operational efficiency.

Today’s e-commerce customers are increasingly eco-conscious and expect brands to use sustainable packaging. Molded pulp packaging, made from recycled paper or agricultural waste, is biodegradable, compostable, and recyclable, making it an attractive choice for businesses looking to enhance their environmental credibility. Consumer purchasing behavior has shifted significantly, with 72% of buyers reporting increased consumption of eco-friendly products compared to five years ago. In parallel, global online searches for sustainable goods have surged by 71% over the same period, reflecting a growing demand for environmentally responsible options.

Notably, 55% of consumers indicate a willingness to pay a premium for brands that demonstrate strong sustainability commitments, reinforcing the competitive advantage of integrating eco-conscious practices into product and packaging strategies. In direct-to-consumer retail, packaging is part of the brand experience. Unlike traditional shelf packaging, DTC packaging is the customer’s first physical interaction with the product. Brands leveraging molded pulp demonstrate a clear commitment to sustainability, aligning with modern consumer values and boosting brand loyalty.

With e-commerce deliveries often scrutinized for excessive or plastic-heavy packaging, there is a growing push toward minimalist, plastic-free solutions. Molded pulp eliminates the need for plastic fillers, bubble wrap, or foam peanuts, offering a compact, efficient alternative that reduces waste and simplifies disposal for consumers. This supports efforts to reduce packaging volume and aligns with environmental regulations in many countries, especially in Europe and North America.

Key Market Challenges

High Initial Capital Investment and Limited Access to Advanced Machinery

One of the primary barriers to entry in the molded pulp packaging industry is the high cost associated with setting up production facilities, especially those utilizing advanced thermoforming or automated molding technologies. Compared to traditional plastic packaging manufacturing which benefits from decades of industrial optimization molded pulp production often requires specialized molds, drying systems, and high-efficiency forming machines that come with significant upfront capital requirements.This is particularly challenging for small and mid-sized enterprises (SMEs) or companies in developing regions, where access to financing and modern infrastructure may be limited. As a result, manufacturers may be hesitant to transition from conventional packaging to molded pulp, slowing market penetration in cost-sensitive sectors.

Key Market Trends

Premiumization of Sustainable Packaging

A growing number of brands across industries especially in luxury goods, consumer electronics, cosmetics, and wine & spirits are moving beyond basic sustainability to deliver packaging that is both eco-friendly and visually sophisticated. This trend, known as premiumization, is driving demand for high-end molded pulp solutions that offer a combination of aesthetic appeal, tactile quality, and structural precision.Manufacturers are responding by Investing in thermoformed pulp technologies to create smooth, detailed, and elegant packaging finishes. Offering custom embossing, color treatments, and branding integration to meet the visual standards of luxury and boutique brands. Developing minimalist, plastic-free unboxing experiences that reinforce a company’s environmental values without compromising on quality or style. This trend is pushing molded pulp from utilitarian protective uses into front-facing, customer experience-driven applications, opening up new premium market segments.

Key Market Players

- Brødrene Hartmann A/S

- Huhtamäki Oyj

- CKF Inc

- Genpak

- Pro-Pac Packaging Limited

- Henry Molded Products Inc.

- Sabert Corporation

- Laizhou Guoliang Packing Products Co., Ltd

- MVI ECOPACK

- Qingdao Xinya Molded pulp Packaging Products Co. Ltd

Report Scope:

In this report, the Global Molded Pulp Packaging Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Molded Pulp Packaging Market, By Molecule Type:

- Wood Pulp

- Non-wood Pulp

Molded Pulp Packaging Market, By Molded Type:

- Thick Wall

- Transfer

- Thermoformed

- Processed

Molded Pulp Packaging Market, By Product:

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

Molded Pulp Packaging Market, By End Use:

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

Molded Pulp Packaging Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Molded Pulp Packaging Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Molded Pulp Packaging market report include:- Brødrene Hartmann A/S

- Huhtamäki Oyj

- CKF Inc

- Genpak

- Pro-Pac Packaging Limited

- Henry Molded Products Inc.

- Sabert Corporation

- Laizhou Guoliang Packing Products Co., Ltd

- MVI ECOPACK

- Qingdao Xinya Molded pulp Packaging Products Co. Ltd

Table Information

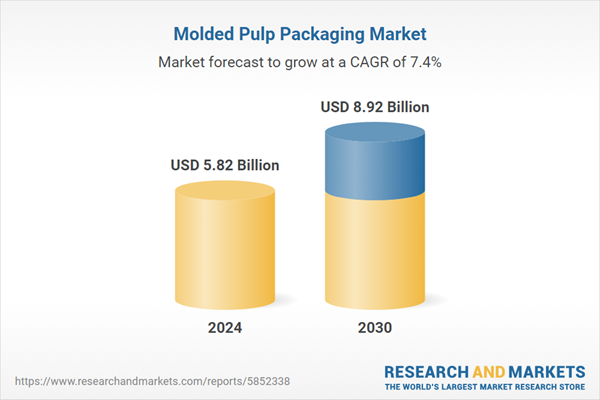

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.82 Billion |

| Forecasted Market Value ( USD | $ 8.92 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |