Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising adoption of Agricultural Coated Products

The global agricultural sector is witnessing a growing shift towards the use of coated products due to their ability to enhance efficiency and crop performance. Coated seeds, fertilizers, and pesticides offer controlled-release benefits, improved adherence to crops, and better handling during sowing. A recent survey across large farms in the U.S. Midwest revealed that nearly 78% of corn growers are now using seed coatings to improve germination rates and reduce pest-related losses, showcasing strong acceptance of this technology at the field level.One of the major benefits driving adoption is improved environmental resilience. In drought-prone regions of Africa and Asia, polymer-coated seeds have demonstrated a 25-50% increase in germination rates compared to non-coated seeds under dry conditions. This significant improvement not only ensures better crop establishment but also supports sustainable farming by minimizing the need for reseeding and excess input use. The ability of coatings to protect seeds and nutrients during unpredictable weather events is proving critical in climate-sensitive regions.

Fertilizer coatings, particularly controlled-release and slow-release variants, are also gaining traction. Field studies have shown that farmers using coated urea experienced a 20-35% reduction in nitrogen loss through volatilization, leading to better nutrient absorption and healthier plant growth. These coatings help deliver nutrients more efficiently over time, aligning with the needs of the plant and reducing the frequency of fertilizer applications. This not only boosts productivity but also supports environmentally conscious farming practices.

The growing awareness and training programs offered by agricultural extension services and NGOs are further accelerating adoption among smallholder farmers. In India, training and subsidy programs led to an increase in coated seed usage from 18% to 60% within two cropping cycles among participating villages. Such initiatives, combined with the visible yield improvements from coated inputs, are encouraging farmers across both developed and developing regions to integrate coated agricultural products into their standard practices. As a result, coated products are quickly becoming a vital tool in modern, efficient, and sustainable agriculture.

Key Market Challenges

High Cost of Coated Products

The high cost associated with coated agricultural products remains one of the most significant challenges in the market. Coating technologies often require specialized materials such as polymers, bio-based films, or nanocomposites, along with advanced manufacturing processes like microencapsulation or controlled-release layering. These inputs and processes significantly elevate the production cost of coated seeds, fertilizers, and pesticides compared to conventional products. For many small and marginal farmers - especially in developing countries - this upfront cost is a major deterrent, even when long-term benefits like improved yields and reduced input waste are proven. In regions where agricultural income is already unstable or heavily weather-dependent, investing in high-cost inputs becomes a risk. Moreover, subsidies or financial incentives for coated products are either limited or non-existent in several countries, making affordability a key barrier to mass adoption across low-resource farming communities.Key Market Trends

Sustainable & Biodegradable Formulations

The agricultural coatings market is witnessing a significant shift toward sustainable and biodegradable formulations, driven by increasing environmental regulations and the need for eco-friendly farming solutions. Traditional solvent-based coatings often contribute to soil and water contamination, raising long-term ecological concerns. In response, manufacturers are investing heavily in developing bio-based coatings derived from natural polymers such as starch, cellulose, chitosan, and lignin.These biodegradable alternatives minimize harmful residues and support regenerative agriculture. Additionally, governments across Europe, North America, and Asia-Pacific are encouraging the use of sustainable inputs through policy incentives and research funding. Farmers, too, are showing greater willingness to adopt coatings that are safe for soil microbiota and beneficial insects. This trend is further reinforced by the rising demand for organic and low-chemical agriculture, making sustainable coatings a vital component of modern crop management practices.

Key Market Players

- BASF SE

- Solvay SA

- Clariant AG

- Croda International Plc

- ICL Group Ltd

- Sollio Groupe Cooperatif

- PPG Industries

- Germains Seed Technology Inc

- Precision Laboratories, LLC

- Dorf Ketal Chemicals India Private Limited

Report Scope:

In this report, Global Agricultural Coatings market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Agricultural Coatings Market, By Category:

- Seed Coatings

- Fertilizer Coatings

- Pesticide Coatings

Agricultural Coatings Market, By Coating Material:

- Polymers

- Colorants

- Pellets

Agricultural Coatings Market, By Coating Type:

- Powder Coating

- Liquid Coating

Agricultural Coatings Market, By Application:

- Agricultural Vehicles

- Agricultural Machinery

- Agricultural Tools

- Others

Agricultural Coatings Market, By End Use:

- Insecticides

- Herbicides

- Fungicides

- Rodenticides

- Others

Agricultural Coatings Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive landscape

Company Profiles: Detailed analysis of the major companies in Global Agricultural Coatings Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Solvay SA

- Clariant AG

- Croda International Plc

- ICL Group Ltd

- Sollio Groupe Cooperatif

- PPG Industries

- Germains Seed Technology Inc

- Precision Laboratories, LLC

- Dorf Ketal Chemicals India Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | August 2025 |

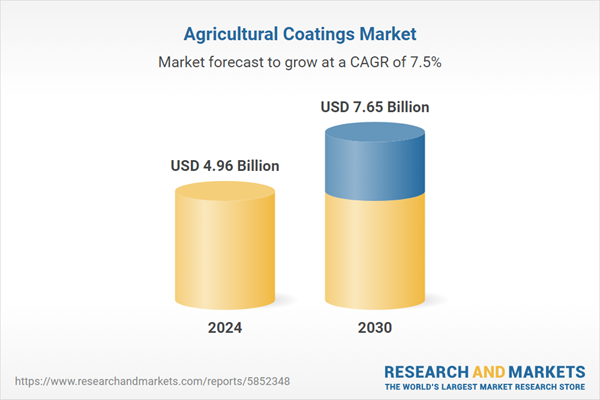

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.96 Billion |

| Forecasted Market Value ( USD | $ 7.65 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |