Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

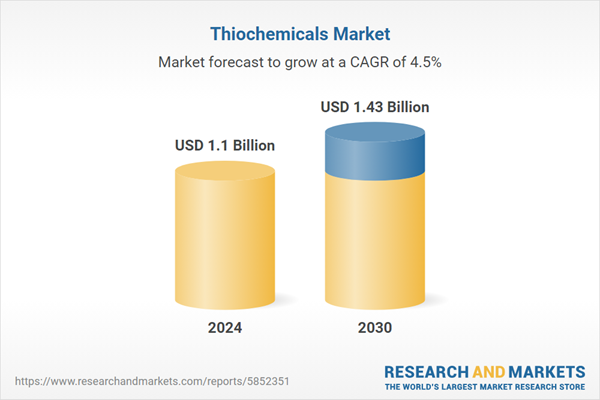

The market’s relevance is reinforced by its deep integration into technically demanding and regulation-sensitive industries, where product performance, purity, and reliability are non-negotiable. As demand rises for methionine-enriched feed additives, low-sulfur fuels, and specialty polymers, thiochemicals are increasingly viewed as performance enablers rather than commodity inputs.

Although the sector faces ongoing headwinds from sulfur feedstock price volatility, complex handling requirements, and tightening environmental controls, leading producers are mitigating risks through vertical integration, supply chain optimization, and investment in safer, cleaner production technologies. With established usage in mature applications and expanding penetration in advanced electronics, sustainable agriculture, and energy storage, the thiochemicals market is well-positioned for resilient, innovation-led growth in the years ahead.

Key Market Drivers

Rising Demand for Methionine in Animal Nutrition

The most significant drivers accelerating the growth of the global thiochemicals market is the rising demand for methionine in the animal nutrition industry. Methionine, a sulfur-containing essential amino acid, plays a vital role in the growth, health, and productivity of livestock, especially poultry, swine, and aquaculture species. Its large-scale production heavily depends on thiochemicals, particularly methyl mercaptan, a core intermediate in the methionine synthesis process. As the global population and protein consumption trends evolve, the role of thiochemicals in enabling efficient methionine production is becoming increasingly critical.The world is experiencing a structural shift in dietary habits, especially in emerging economies across Asia, Latin America, and Africa, where rising incomes and urbanization are leading to increased consumption of meat, eggs, and dairy products. This trend is driving substantial growth in commercial livestock farming, which in turn requires high-quality feed enriched with essential amino acids like methionine. Since animals cannot synthesize methionine naturally, it must be supplemented in their diet creating a steady and growing demand for this amino acid.

The synthesis of methionine involves the use of methyl mercaptan (CH₃SH), a key thiochemical derived from natural gas or petrochemical feedstocks. Methyl mercaptan reacts with other chemicals such as acrolein or hydrocyanic acid in industrial processes to form DL-methionine. As methionine demand rises globally, the need for methyl mercaptan and other supporting thiochemicals also expands proportionally.

This direct correlation significantly strengthens the demand base for thiochemicals worldwide. Modern animal husbandry emphasizes feed conversion efficiency, rapid weight gain, and optimal animal health, all of which are supported by methionine supplementation. In regions like China, India, Brazil, and Southeast Asia, the livestock industry is transitioning from traditional to industrial-scale operations. This transformation involves scientifically formulated feeds, where methionine is a standard additive, boosting thiochemical consumption through increased methionine production needs.

In response to growing concerns around antibiotic resistance and environmental sustainability, many countries are implementing regulations that restrict the use of antibiotics in animal feed. This shift is prompting feed manufacturers to turn to nutritional solutions like methionine, which supports animal growth and immunity naturally. As producers look for safe and effective alternatives, methionine’s role and consequently, the importance of thiochemicals in its manufacture becomes more central.

Key Market Challenges

Environmental and Health Hazards Associated with Thiochemicals

Thiochemicals are characterized by their high sulfur content, which often gives them pungent odors, toxicity, and flammability. Compounds like methyl mercaptan and dimethyl disulfide (DMDS) can pose significant risks to both human health and the environment when not handled properly. Their production, storage, and transport require strict safety protocols due to the potential for air and water pollution, toxic exposure, and fire hazards.Regulatory scrutiny around emissions and waste disposal is increasing globally, raising compliance costs for manufacturers. Communities and environmental bodies often oppose the setup of new thiochemical facilities due to odor complaints and health risk concerns, delaying or halting project approvals. End-users, particularly in the food and pharmaceutical sectors, may avoid thiochemical-based products over perceived contamination risks.

To ensure long-term growth, companies must invest heavily in safe handling practices, odor mitigation technologies, and environmentally compliant production systems, which may raise capital and operating costs.

Key Market Trends

Integration of Bio-Based Feedstocks and Green Chemistry Practices

A growing emphasis on sustainability and carbon footprint reduction is pushing chemical manufacturers to adopt bio-based and renewable feedstocks for thiochemical production. Companies are exploring green chemistry techniques to replace or supplement fossil fuel-derived raw materials, aiming to reduce environmental impact and align with global climate goals.R&D initiatives are focusing on fermentation-based routes or enzymatic synthesis methods to produce sulfur-containing compounds like thiols and sulfides. Bio-derived thiochemicals could open new opportunities in pharmaceuticals, food ingredients, and personal care, where sustainability and safety are increasingly prioritized. Investors and end-users are showing greater preference for eco-certified and clean-label chemical solutions, which encourages market differentiation through sustainable thiochemicals.

Companies that invest early in bio-based process innovation are likely to gain competitive advantage through product differentiation, regulatory benefits, and enhanced brand perception in eco-sensitive markets.

Key Market Players

- Arkema

- Chevron Phillips Chemical Co. LLC

- BASF SE

- Bruno Bock GmbH

- Daicel Corporation

- Dr. Spiess Chemische Fabrik GmbH

- Tokyo Chemical Industry (India) Pvt. Ltd.

- TORAY FINE CHEMICALS CO., LTD.

- Merck KGaA

- Huhhot Guangxin Chemical Trade Co., Ltd.

Report Scope:

In this report, the Global Thiochemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Thiochemicals Market, By Product Type:

- Mercaptan

- Dimethyl Sulfoxide (DMSO)

- Dimethyl disulfide (DMDS)

- Thioglycolic Acid and Ester

- Thiourea

- Others

Thiochemicals Market, By Application:

- Animal Nutrition

- Oil and Gas

- Polymers and Chemicals

- Food and Agrochemicals

- Automotive and Transportation

- Others

Thiochemicals Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Thiochemicals Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Thiochemicals market report include:- Arkema

- Chevron Phillips Chemical Co. LLC

- BASF SE

- Bruno Bock GmbH

- Daicel Corporation

- Dr. Spiess Chemische Fabrik GmbH

- Tokyo Chemical Industry (India) Pvt. Ltd.

- TORAY FINE CHEMICALS CO., LTD.

- Merck KGaA

- Huhhot Guangxin Chemical Trade Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.43 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |