Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

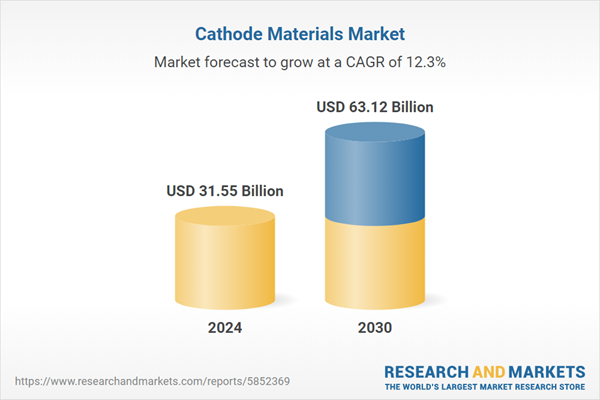

With the accelerated global push toward electrification and decarbonization, cathode materials have moved to the forefront of strategic procurement and innovation within the battery supply chain. Industry stakeholders ranging from automotive OEMs and battery manufacturers to raw material processors are making targeted investments in next-generation cathode chemistries, localized production hubs, and upstream integration, aimed at improving cost structures, minimizing geopolitical risks, and meeting performance targets for differentiated applications.

The market is positioned for sustained growth, anchored by the scaling of EV manufacturing capacity, wider deployment of stationary storage in renewable energy grids, and technological advancements in cobalt-free and high-nickel formulations. As battery platforms become increasingly application-specific and performance-driven, cathode materials will serve as a critical lever for maintaining competitive differentiation, ensuring supply chain security, and enabling sustainable energy transitions across multiple verticals.

Key Market Drivers

Rapid Electrification of the Automotive Industry

The rapid electrification of the automotive industry is one of the most significant forces driving the growth of the global cathode materials market. As the global transportation sector undergoes a transformative shift from internal combustion engine (ICE) vehicles to electric vehicles (EVs), demand for high-performance batteries particularly lithium-ion batteries has surged. At the heart of these batteries lies the cathode material, which plays a critical role in determining a battery’s capacity, energy density, lifespan, and safety. Electric vehicle (EV) adoption surged in 2023, with EVs accounting for nearly 20% of all new car sales globally.During the year, more than 14 million new electric cars were registered, pushing the total global EV fleet to over 40 million units. The exponential growth in EV sales driven by consumer demand, environmental concerns, and government mandates is directly translating into higher consumption of lithium-ion batteries. EVs such as battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) rely heavily on cathode materials such as nickel cobalt manganese (NCM), nickel cobalt aluminum (NCA), and lithium iron phosphate (LFP).

The push to deliver longer driving ranges and faster charging times requires cathodes with higher energy densities and enhanced thermal stability, thereby driving innovation and volume demand for advanced cathode chemistries. Global automotive giants are investing extensively in battery gigafactories, EV platforms, and vertical integration of battery supply chains. Companies such as Tesla, Volkswagen, Ford, BYD, and General Motors are not only ramping up EV production but also forming partnerships and joint ventures with cathode material suppliers to secure long-term supply. This vertical integration model ensures a steady and scalable demand pipeline for cathode materials as automakers seek to control quality, cost, and supply chain risk.

Governments across the world are introducing stringent emissions regulations and setting deadlines to ban new ICE vehicle sales accelerating the shift to electric mobility. Policies such as the European Green Deal, China’s New Energy Vehicle (NEV) program, and the U.S. Inflation Reduction Act provide tax credits, purchase subsidies, and R&D funding for EVs and battery technologies.

These initiatives significantly boost battery production, increasing consumption of cathode materials, especially those aligned with energy efficiency and safety standards. Consumer preferences are shifting toward EVs that offer higher driving range, faster charging, and better performance. To meet these expectations, battery makers are optimizing cathode chemistries with higher nickel content (such as NCM 811 and NCA) for improved energy density and lower cobalt content for cost efficiency. As a result, the demand for specific cathode materials especially those with high nickel and low cobalt compositions has seen a notable rise.

Key Market Challenges

Supply Chain Constraints and Raw Material Dependency

One of the most significant barriers to market growth is the limited availability and uneven geographic distribution of key raw materials used in cathode production, such as lithium, cobalt, nickel, and manganese.Cobalt mining is heavily concentrated in the Democratic Republic of the Congo (DRC), while lithium and nickel supplies are dominated by a handful of countries like Chile, Australia, Indonesia, and China. This concentration creates geopolitical risk and market vulnerability to export restrictions, political instability, or labor issues. Prices of these critical minerals are highly volatile due to supply-demand imbalances and speculation, making it difficult for battery and cathode manufacturers to maintain cost stability and forecast long-term production costs. The lack of sufficient refining and processing infrastructure particularly outside of Asia has led to bottlenecks, delaying the delivery of high-purity materials required for advanced cathode formulations.

These factors collectively create uncertainty, increase manufacturing costs, and discourage potential investments, thereby slowing the pace of market expansion.

Key Market Trends

Shift Toward High-Nickel and Cobalt-Free Cathode Chemistries

One of the most prominent trends in the cathode materials market is the transition toward high-nickel and cobalt-free formulations to achieve higher energy density, reduce reliance on costly and ethically sensitive materials, and improve overall battery performance.These offer higher energy density and longer driving range, which are critical for next-generation electric vehicles (EVs). Battery manufacturers are increasingly adopting these cathode types to meet evolving performance benchmarks in automotive and grid storage applications. Companies are investing in R&D to eliminate cobalt entirely due to its supply risks and ethical concerns. Cobalt-free cathodes are being explored for both cost efficiency and enhanced safety. Manufacturers are developing application-specific cathode materials for instance, LFP for budget EVs and energy storage, and high-Ni NCM/NCA for premium vehicles and aerospace.

This material evolution is redefining cathode production standards, prompting new investment in synthesis technologies, raw material procurement strategies, and cell architecture design.

Key Market Players

- BASF SE

- Targray Technology International Inc

- L&F Co., Ltd

- Johnson Matthey

- Sumitomo Metal Mining Co., Ltd

- Umicore

- LG Chem, Ltd

- EcoPro BM

- Nichia Corporation

- Toda Kogyo Corp

Report Scope:

In this report, the Global Cathode Materials Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Cathode Materials Market, By Battery Type:

- Lithium-Ion

- Lead-Acid

- Other

Cathode Materials Market, By Application:

- Pharmaceuticals

- Nutraceuticals

- Herbal Based Industries

- Others

Cathode Materials Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Cathode Materials Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Cathode Materials market report include:- BASF SE

- Targray Technology International Inc

- L&F Co., Ltd

- Johnson Matthey

- Sumitomo Metal Mining Co., Ltd

- Umicore

- LG Chem, Ltd

- EcoPro BM

- Nichia Corporation

- Toda Kogyo Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.55 Billion |

| Forecasted Market Value ( USD | $ 63.12 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |