This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

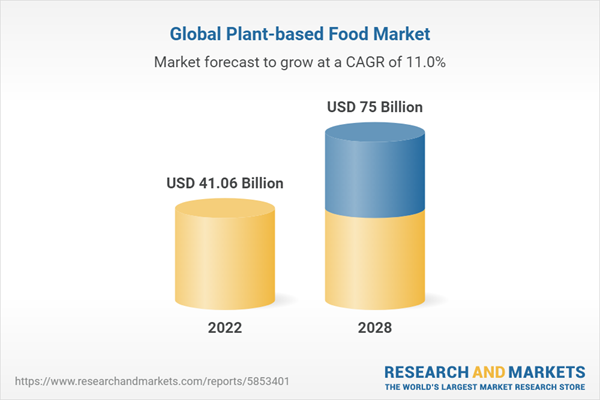

According to the research report, Global Plant-based Food Market Outlook, 2028 the market is expected to cross USD 75 Billion market size, increasing from USD 41.06 Billion in 2022. The global market is forecasted to grow with 10.95% CAGR by 2023-28. The need for dairy and meat alternatives as well as the expanding trends of veganism and flexitarianism is major factors fueling the global market for plant-based foods. Similar to how flexitarian and vegan populations are growing and how awareness in animal welfare is growing, so will the demand for plant-based foods. Due to their advantages for both human health and the environment, these food products are becoming increasingly popular worldwide. The plant-based meal market is anticipated to grow gradually in the next years due to its high nutritious content and ecologically friendly nature. Numerous businesses are creating clean-label and plant-based food products in response to the growing acceptance of plant-based meals and food. During the projected period, rising rates of various cardiovascular diseases will have a favorable impact on sales of plant-based foods worldwide. People are becoming more and more aware of the numerous advantages of consuming plant-based goods thanks in large part to the increasing use of social media and the internet. The biggest players use these platforms to reach the largest audiences and boost sales. Over the next ten years, this will contribute to the plant-based food industry's rapid growth. Additionally, a number of plant-based food producers are making significant investments in research and development in order to market novel plant-based meals that have the same texture, flavour, and taste as dairy products and foods derived from animals.

Based on the region, The Asia-Pacific is dominating the market with major revenue share with 11.35% CAGR by 2023-28.

The market in Asia-Pacific is demonstrating signs of strong growth in the future. The high market growth in Asia-Pacific is attributed to the factors such as the growing adoption of emerging technologies for product innovation, collaborations between international and domestic food companies, increasing R&D investments by governments in the food sector, presence of a large number of key players in the market, and the rising number of vegan restaurants. The high market growth in the Asia-Pacific is further supported by factors such as the rapid growth in urbanization, the growing middle-class population and rising income level, and the growing awareness about the benefits of protein-rich diets. On the other hand, Europe plant-based food market is expected to be the second-largest market during the forecast period owing to a growing preference among consumers in the country for sustainable food with health advantages. Europe represents the most profitable plant-based foods market region, with the most potential for expansion. According to the European Union (Europa.eu), sales of plant-based meat and seafood substitutes have increased dramatically in Europe over the last two years.

Based on the product type, plant-based milk segment is dominating the market with more than 40% market share in 2022.

The large market share of this segment is attributed to factors such as the increasing number of lactose intolerant people, the growing ethical concerns amongst consumers about animal abuse in modern dairy farming practices, and the nutritional benefits offered by plant-based dairy products. According to the research, about 65% of the adult human population worldwide suffers from lactose intolerance cause by decreasing activity of the LCT gene. This is compelling people to opt for dairy substitutes. People are choosing plant-based milk as a healthier alternative to traditional dairy milk; as it is generally lower in calories, cholesterol-free. To meet growing demand for dairy substitutes, leading plant-based food manufacturers are expanding their existing portfolios by launching new products. For instance, in 2021, Wundu, a new pea-based milk alternative was launched by Nestle. Another significant factor contributing to the adoption of plant-based milk is environmental sustainability. Animal agriculture, including dairy farming, has a significant impact on greenhouse gas emissions, deforestation, and water usage. Plant-based milk production requires fewer resources and generates fewer greenhouse gas emissions, making it a more sustainable option.

However, the yogurt segment is expected to grow at the fastest CAGR during the forecast period. The demand for plant-based yogurt is increasing at a higher rate in developed countries due to the growing number of vegan and health-conscious consumers. Plant-based yogurt offers a range of health benefits, as it is often lower in saturated fats, cholesterol-free, and contains no lactose or dairy allergens. Additionally, plant-based yogurts can be fortified with essential nutrients like calcium and vitamin D, making them a nutritionally rich option. In recent years, significant advancements have been made in improving the taste and texture of plant-based yogurt. Manufacturers have developed innovative techniques and ingredients to create creamy and flavourful alternatives. This has helped overcome the perception that plant-based yogurts may be inferior in taste or texture to their dairy counterparts, making them more appealing to a broader consumer base.

Based on Distribution channel, hypermarkets & supermarkets segment is dominating the market with over USD 17 Billion in 2022.

The large share of this segment is attributed to factors such as the increased sales of plant-based food in well-established supermarkets and hypermarkets chains; consumers prefer shopping from brick-and-mortar grocers due to easy access and availability, and the increasing consumer expenses on vegan food products. Factors such as wider reach, greater shelf space, attractive discounts, and bundling strategies are projected to boost the market growth by the upcoming time period. For instance, there are more than 14,600 supermarkets present in the U.S. including Walmart, The Kroger Co., and others. Consumers prefer shopping from brick-and-mortar grocers due to easy access and availability. Additionally, wide product availability of domestic and international brands along with physical verification of product details before any purchase also encourages consumers to purchase through offline stores. However, due to the pandemic, e-commerce portals have also become a major channel adopted by consumers to purchase their products. The segment is gaining a lot of traction with internet penetrating rapidly a lot of sub-urban and rural areas of different economies. Consumers can procure their products from the comfort of their home and millennials and Gen Z are majorly attracted to online shopping than the more conventional ways. A lot of major retail chains like Walmart, worldwide have been investing significantly in online distribution channels.

Market Drivers

Environmental Sustainability: Growing concerns about the environmental impact of animal agriculture and the desire to reduce carbon footprints have led to the rising demand for plant-based foods. Plant-based diets generally have a lower carbon and water footprint, require fewer resources, and generate fewer greenhouse gas emissions compared to animal-based diets. Consumers are increasingly considering the environmental implications of their food choices, driving the demand for plant-based alternatives. Also, the ethical treatment of animals and animal welfare concerns has become important factors for many consumers. Plant-based foods offer an alternative to animal-derived products, reducing the reliance on animal agriculture and addressing ethical concerns related to animal exploitation and cruelty. As consumers become more conscious of these issues, the demand for plant-based food products continues to rise.Government Initiatives and Policies: Governments and regulatory bodies around the world are implementing initiatives and policies that support and promote the consumption of plant-based foods. These measures include dietary guidelines, nutritional education programs, and the inclusion of plant-based options in public institutions and school meals. Such governmental support helps create a favorable environment for the growth of the plant-based food market. Also, many governments and health organizations have incorporated plant-based diets into their dietary guidelines and recommendations. They emphasize the importance of consuming plant-based foods, such as fruits, vegetables, whole grains, legumes, nuts, and seeds, for optimal health. These guidelines provide guidance to individuals and encourage the consumption of plant-based foods. Many governments have integrated plant-based food options into school meal programs. By including plant-based menu choices in schools, governments promote the consumption of nutritious plant-based foods among children and young adults.

Market Challenges

Taste and Texture Expectations: One of the challenges for plant-based foods is meeting consumer expectations for taste and texture. Consumers often compare plant-based alternatives to their animal-based counterparts, and any perceived differences in flavor or texture can impact consumer acceptance. Ensuring that plant-based products closely mimic the sensory experience of animal-based foods remains an ongoing challenge for the industry. Ensuring that plant-based food products offer a well-balanced nutritional profile is crucial. Also, some plant-based alternatives may lack certain essential nutrients found in animal-based foods, such as vitamin B12, iron, or omega-3 fatty acids. Fortification and the development of plant-based products that provide a complete range of nutrients are ongoing challenges for the industry.Cost and Affordability: Plant-based foods, especially some meat alternatives and specialty products, can be more expensive than their animal-based counterparts. The cost of ingredients, manufacturing processes, and economies of scale play a role in pricing. Achieving cost competitiveness with traditional animal-based products can be a challenge, limiting access and affordability for some consumers. Since plant-based goods are intended to be used for a longer period of time, they require specific care at every step of production. Advanced processes are necessary for these items during phases such as manufacture, packaging, and distribution. Its whole procedure needs experienced supervision and contemporary equipment. These items are expensive because of the complex procedures involved and the high level of oversight required.

Market Trends

Emergence of 3D Printing Plant-Based Meat: The emergence of 3D printing technology in the plant-based food market, specifically for meat alternatives, has gained attention as a promising innovation. 3D printing technology allows for precise control over the composition and structure of plant-based meat products. By layering plant-based ingredients, such as proteins, fats, and fibers, in specific patterns, 3D printers can create customizable meat-like structures with desired textures and mouthfeel. 3D printing can potentially reduce food waste in the production of plant-based meats. The technology allows for precise ingredient deposition, minimizing excess waste and optimizing ingredient utilization. This can contribute to the sustainability and cost-effectiveness of plant-based meat production. Several startups and research organizations are actively exploring the 3D printing of plant-based meats. These initiatives aim to refine the technology, enhance the sensory experience, and commercialize 3D-printed plant-based meat products. Collaborations between food scientists, engineers, and culinary experts are driving innovation in this space.Technological Integration: Technological integration plays a crucial role in the plant-based food market, enabling innovation, efficiency, and improved consumer experiences. Researchers and food scientists are exploring new techniques to extract proteins, fats, and other components from plant sources, enhancing their functional properties and nutritional profiles. This allows for the creation of plant-based alternatives that closely mimic the taste, texture, and sensory experience of animal-based products. Augmented Reality (AR) and Virtual Reality (VR) technologies are also being utilized to enhance consumer experiences and engagement in the plant-based food market. Companies are using these technologies to create virtual tasting experiences, product visualizations, and interactive educational platforms that provide consumers with immersive and informative encounters with plant-based foods.

Covid-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the global plant-based food market. The pandemic has disrupted global supply chains, impacting the availability and distribution of plant-based food products. Restrictions on transportation, labor shortages, and closures of manufacturing facilities have affected the production and timely delivery of plant-based food items. Some companies faced challenges in sourcing ingredients, leading to temporary shortages of certain products. With the closure of restaurants and foodservice establishments during lockdowns and social distancing measures, consumers shifted their food consumption to home cooking. This led to increased sales of plant-based food products in retail channels, including supermarkets and online platforms. Consumers explored plant-based alternatives and incorporated them into their home-cooked meals. The plant-based food market relies heavily on the foodservice sector, including restaurants, cafes, and catering services. The closure of dine-in options and reduced foot traffic during the pandemic significantly affected the demand for plant-based food products in this segment. However, some plant-based food companies adapted providing takeout and delivery options or partnering with foodservice providers to offer plant-based menu items.The pandemic has led to delays in new product launches and innovation in the plant-based food sector. Companies faced challenges in product development, testing, and market introductions due to disruptions in research and development activities, supply chain limitations, and shifting priorities. However, the pandemic has highlighted health and sustainability concerns, leading to increased consumer interest in plant-based foods. As people become more conscious of their health and the potential risks associated with animal-based products, there has been a surge in demand for plant-based alternatives. Consumers are seeking products that support their overall well-being and align with their values. Despite the short-term challenges, the pandemic has reinforced the importance of sustainable and resilient food systems. The crisis has accelerated interest in plant-based foods as a way to mitigate environmental risks and promote food security. The long-term potential for the plant-based food market remains strong, as more consumers recognize the benefits of plant-based diets.

Key Players

The plant-based food market has seen the emergence of several key players who have played a significant role in driving innovation, product development, and market growth. The plant-based food market major player such as the Kellogg Company, Danone S.A., Archer Daniels Midland Company, Blue Diamond Growers, Nestlé S.A., JBS S.A., The Kraft Heinz Company, Unilever plc, General Mills, Inc.,, Conagra Brands, Inc., Beyond Meat, Inc., Maple Leaf Foods Inc, Vitasoy International Holdings Limited, Impossible Foods Inc, Bob's Red Mill, SunOpta, Inc., Amy's Kitchen, Inc., JUST, Inc., The Hain Celestial Group, Inc., Plamil Foods Ltd, and others are working on expanding the market demand by investing in research and development activities.Recent Developments

- In April 2023, Beyond Meat announced the restaurant launch of Beyond Pepperoni and Beyond Chicken Fillet. The promise of Beyond Meat to provide plant-based proteins with the additional health & environmental advantages of plant-based meat is met by these products.

- In November 2022, Beyond Popcorn Chicken and Beyond Chicken Nuggets were launched by Beyond Meat, Inc. The latest additions are available in 5000 Kroger and Walmart stores nationwide and few selected Albertsons and Ahold divisions.

- In 2022, a new Diary & Plant Blend baby formula was launched by Danone to meet parents’ desire for feeding their babies vegan and plant-based diets.

- In September 2022, to expand its portfolio of sustainable, delicious, and nutritious plant-based meat products, Beyond Meat launched the Revolutionary Plant-Based Steak.

- On July 5th, 2022, Danone announced the new dairy & plants mix infant formula, to satisfy parents' demand for the correct dietary alternatives for a vegetarian, flexible, and plant-based diet while meeting their baby's unique nutritional needs. Danone has retained dominance in 50 decades of scientific breast milk research and plant-based foods and has produced this innovative dairy and plant-based infant formula formulation via well-known brands such as Alpro and Silk.

- In June 8, 2022; Australian baby nutrition startup Sprout Organic has partnered with Amazon, the world's largest e-commerce platform, to bring its plant-based baby formula to more parents. The move comes as online formula sales have skyrocketed following the global COVID-19 outbreak, and grocery supplies have dwindled.

- In May 2021, food conglomerate Nestle announced the launch of a new vegan milk brand named Wunda, a pea-based milk alternative. The company focuses on launching the product in France, the Netherlands, and Portugal.

- In January 2022, a new biotech company, Gaia’s Farming Co., launched its first two milk alternatives made with hemp and oats to cater to the growing vegan population.

Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Plant-based Food with its value and forecast along with its segments

- Region-wise Plant-based Food market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product Type

- Plant-based Milk

- Plant-based Meat and Seafood (Tofu, Quorn, Seitan, Fish, TVP, Burger Patties, Tempeh, Hot Dogs and Sausages, Meatballs, Ground Meat, Nuggets, Crumbles, Shreds, Crab, shrimp, Others)

- Plant-based Cheese

- Plant-based Desserts (Cakes, Pastries, Custard, Pudding, etc.)

- Plant-based Ice Cream

- Plant-based Yogurt

- Plant-based Butter

- Plant-based Bars (Protein Bars, Energy Bars, Cereal Bars, Fruit & Nut Bars, etc.)

- Plant-based Bakery Snacks and Confectionery (Biscuit and Cookies, Bread and Rolls, Chocolate, etc.)

- Plant-based Creamer

- Plant Based Mayonnaise and Salad Dressing

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- E-Commerce

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations and organisations related to the Plant-based Food industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | July 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 41.06 Billion |

| Forecasted Market Value ( USD | $ 75 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |