The US government is investing in the expansion of their manufacturing industry due to the rise in Industry 4.0. In January 2021, US President announced the plan to strengthen the US manufacturing sector under ‘Made in America’ initiative, which focused on making technologically advanced and automated manufacturing sectors. The President announced an investment of US$ 300 billion in the manufacturing sector to boost the country's production output. This investment can catalyze manufacturing companies’ economy, leading to the adoption of energy-efficient and advanced technological solutions. It will also give rise to new manufacturing units. As a result, there will be a constant need for power supply in the manufacturing sector, which can further lead to the adoption of steel poles over wooden poles as an energy-efficient solution, contributing to US power transmission steel poles market size.

Moreover, there is a rise in industrial infrastructure developments in the US. In March 2023, a new nuclear power plant started in the US. In addition, automakers such as Ford, Rivian, Hyundai, and others are investing in expanding their manufacturing plants in the country. These plants require a constant electricity supply. Thus, growing infrastructure developments in the US are expected to create a lucrative opportunity for boost US power transmission steel poles market size during the forecast period.

Rise in demand for electricity and high electricity consumption by consumers from end-use industries such as commercial, residential, and industrial drive the requirement for power transmission poles. Moreover, there is an increase in government investments to modernize the aging electrical transmission and distribution infrastructure. Several advantages of steel poles, such as durability, eco-friendly, reduced maintenance cost, and strength, over wooden poles, are leading to a rise in wood-to-steel pole replacement projects to modernize the aging infrastructure, which generates the demand for steel poles for power transmission. The country's growing focus on green energy solutions is anticipated to augment the demand for steel poles for power transmission, fueling the US power transmission steel poles market growth.

Valmont Industries Inc, Weatherspoon & Williams LLC, Sabre Industries Inc, Browning Enterprise Inc, Nello Corp, SAE Towers Holdings LLC, Metalpol SA de CV, Central Steel Service Inc, Nova Pole International Inc, Nucor Corp, Meyer Utility Structures are a few US power transmission steel poles market players profiled in this market study.

Based on pole size, the US Power transmission steel poles market is segmented into three types: below 40ft, 40 to 70ft, and above 70ft. In 2022, the above 70ft segment held the largest US power transmission steel poles market share, followed by below 40ft. The below 40 ft steel poles for power transmission are widely used to transmit power at longer distances. These poles are widely used for power lines carrying bulk electricity, typically between 60 kV and 500 kV, from the generating power station to several substations. Due to the rise in the demand for clean energy, the electricity generated from renewable sources is gaining traction. This factor has led to installing power lines for renewable energy generation , which is anticipated to supplement the demand for efficient solution to transmit high voltage power lines. Therefore, steel poles being an effective solution over the wooden poles the demand for 40 ft power transmission steel poles is expected to increase over the forecast period, driving US power transmission steel poles market growth.

The US was the most affected country in North America due to the COVID-19 pandemic. Owing to the strict regulations imposed by the majority of states in Q2 of 2020, human movements were restricted which resulted in temporarily discontinuing all business operations across various industries. During the pandemic, there was a temporary suspension of all production activities in the manufacturing and transportation industries, which negatively affected the manufacturing and supply of steel poles, further hampering US power transmission steel poles market. In addition, investments in electricity transmission and distribution in the US decreased at the start of the pandemic. Due to mandatory restrictions on social distancing and lockdowns, there was a decline in economic growth across the globe, which reduced investment in infrastructure development and replacement projects across the country. However, in 2021, with the ease of lockdown restrictions, a restart of manufacturing plants, and government efforts to boost economic growth, the US power transmission steel poles market started to stabilize. In December 2022, Kathy Hochul, the governor of New York, announced the initiation of the construction of Smart Path Connect, a transmission project led by the New York Power Authority and National Grid NY to restructure and strengthen approximately one hundred miles of transmission system in the North Country and the Mohawk Valley. Therefore, the demand for steel poles is anticipated to increase in the coming years. Further, with increasing focus of government on replacing wooden power transmission poles with power transmission steel poles owing to increased reliability and durability is projected to boost US power transmission steel poles market growth.

Table of Contents

Companies Mentioned

- Valmont Industries Inc

- Weatherspoon & Williams LLC

- Sabre Industries Inc

- Browning Enterprise Inc

- Nello Corp

- SAE Towers Holdings LLC Holdings LLC

- Metalpol SA de CV

- Nova Pole International Inc International Inc

- Nucor Corp

- Meyer Utility Structures, LLC

- Pelco Structural LL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 104 |

| Published | July 2023 |

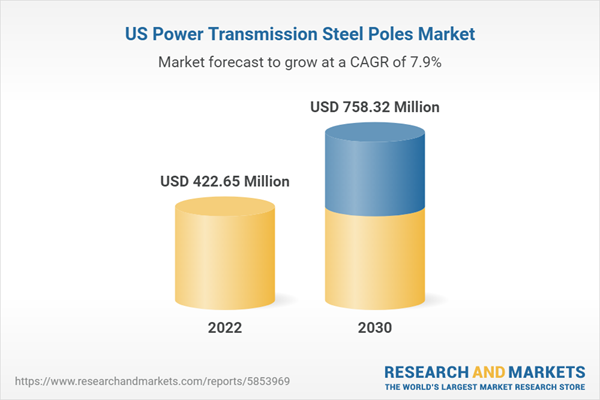

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 422.65 Million |

| Forecasted Market Value ( USD | $ 758.32 Million |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |