Key Highlights

- Maize production in South Africa has increased in the recent past. According to the Crop Estimates Committee (CEC), maize production increased by 6.0% during the 2020-2021 cropping season compared to the previous.

- On a local level, maize is the most widely grown field crop and the most important source of carbohydrates in southern Africa. South Africa is currently the continent's leading maize producer, with the majority of output concentrated in the North West region, the Free State, the Mpumalanga Highveld, and the KwaZulu-Natal Midlands. Currently, white maize accounts for over half of the total output of human consumption. Regions such as Free State, Mpumalanga, and the North-West provinces accounted for 84.0% of the overall production of maize in the country in 2020-2021.

- Maize By Products has a wide potential for various industries in the domestic market. According to Grain South Africa, maize by-products are currently being used in animal feed, food industry, textile and paper, pharmaceuticals, and the alcohol industry in South Africa. As these allied markets are increasing, the demand for maize is expected to grow during the forecast period.

South Africa Maize Market Trends

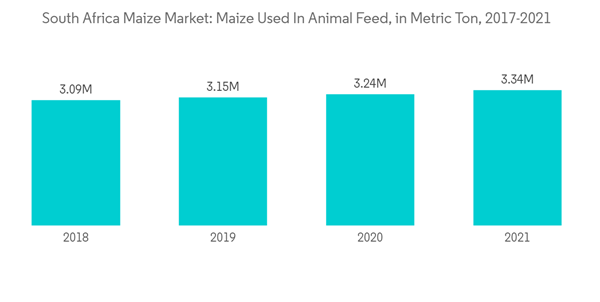

Increasing Use of Maize in Animal Feed

- South Africa needs to be more sufficient to produce raw materials required for making animal feeds; hence, animal feed manufacturers need to import a major chunk of the requirements.

- Since essential protein-containing raw materials are usually imported, the cost of feed-making rises. Imports of sunflower oilcake more than tripled, increasing by 44,500 metric tons, while soybean meal imports increased by 382 573 metric tons. Maize is abundantly available compared to other cereals and oilseed crops, making it highly potent for feed in the domestic market.

- Dairy producers in South Africa continue to need help dealing with the cost squeeze between money received for raw milk produced and rising farm input expenses, the majority of which are feed prices. This is paving the way for maize to be an excellent alternative for high-cost animal feeds, with both the producer and processing sides prefer maize-based feeds.

- Despite the decrease in the number of dairy farmers, milk output has increased from about 2,941,371.0 liters in 2015 to 3,154,673.7 liters in 2021, which is linked to greater use of animal feed. This is anticipated to drive the market for maize during the forecast period.

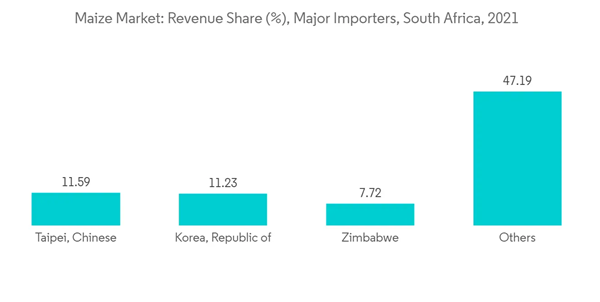

South Africa is a Major Exporter of Maize

- South Africa is a significant exporter of maize, with exports valued at USD 809,266.0 Thousand in the year 2021. According to ICT, the maize export increased by 65% in 2021, though there was a decrease in export in 2019. The decreased area under production during the 2018-2019 cropping season was the primary reason for a 31.0% decline in the export of maize in 2019, accounting for 1.1 million tons.

- In 2021, 22% of the total maize produced in the country was exported to Japan. Other significant destinations include Botswana, VieJapan Taipei, Chinese Korea, Republic of Zimbabwe Viet NamJapan Taipei, Chinese Korea, Republic of Zimbabwe Viet NamJapan Taipei, Chinese Korea, Republic of Zimbabwe, the Republic of Korea, Zimbabwe, Mozambique, Eswatini, and Tanzania which are the primary importers of maize from South Africa. The changing food patterns and developments in Maize processing can be attributed to the increasing demand for maize which is likely to increase its export.

- The South African government is investing heavily in smallholder agricultural development to escape poverty. Maize is a key export commodity and a staple that provides livelihood to millions of smallholder farmers. The emphasis on agricultural development through maize in South Africa is part of a larger trend that has seen increasing attention dedicated to crop technology and market integration as major components of agriculture-led poverty reduction in Africa during the last two decades, which is likely to boost production and export during the forecast period.

- The South African government is investing heavily in smallholder agricultural development as a means of escaping poverty. Maize is a key export commodity as well as a staple that provides livelihood to millions of smallholder farmers. The emphasis on agricultural development through maize in South Africa is part of a larger trend that has seen increasing attention dedicated to crop technology and market integration as major components of agriculture-led poverty reduction in Africa during the last two decades which is likely to boost production and export during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.