Key Highlights

- As a cereal grain, rice is the most widely consumed staple food for most of the human population. Rice is cultivated in more than 120 countries, with Egypt being the largest producer of rice in the Middle East. Rice is the primary agricultural commodity, with the third-highest worldwide production after maize and sugarcane.

- Egypt is the most important rice market in the North African region. Due to its available land base on the banks of the river Nile, the country produces most of the rice in North Africa. The Nile's waters are used extensively to irrigate rice crops. The North African region, led by Egypt, accounts for one-third of the rice demand in Africa. The majority of rice in Egypt is produced in lower Nile river areas. The country's rice supply is recorded at 60.9 kg paddy/per capita/per year.

- The increasing food and restaurant sector in Egypt is anticipated to promote market growth in the future. Likewise, continuous development in rice mill machinery and attractive packaging enhance product demand emerging in the country's economy. Furthermore, the rising demand for specialty rice varieties has increased the trade for long-grain rice, which in turn is driving market growth. Additionally, consumers' constantly changing lifestyles and food habits are accelerating the fast-food industry market, which is expected to drive significant market growth during the forecast period.

Egypt Rice Market Trends

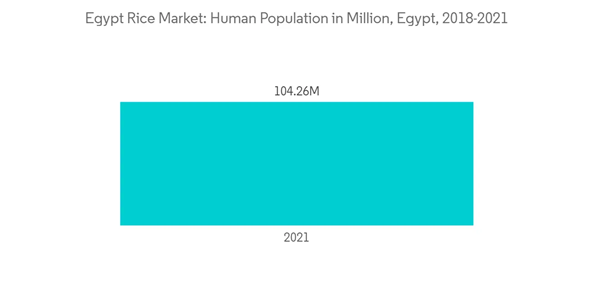

Increase in demand of rice due to rising population

- Egypt is the largest country in the Middle East and Africa and 33rd in the largest economy in the world. The influx of expatriates into this country has helped the economy and increased the population. According to World Bank data, in 2021, the total population of Egypt stands at 104.3 Million. Egypt's population is approximately 1.31% of the world's population. Egypt ranks number 14 in the list of countries (and dependencies) by population.

- The country's population is expected to double in the next 20 years nearly. Thus, the demand for rice as a staple food has risen among the population owing to increasing demand by middle-class consumers. Rice has become a major part of the diet of the Egyptian people due to its convenience in recipe preparation and palatability. The long shelf-life of rice, when stored in appropriate climatic conditions, has also attracted regional consumers.

- Besides, a majority of the population in the region has been levitating toward the consumption of gluten-free food. This has further skyrocketed the demand for rice in this country. In Egypt, most of the population suffers from issues related to celiac disease, mainly caused by gluten consumption. People are becoming more aware of the disease, creating higher demand for gluten-free food products.

- Furthermore, rice is one of the main grain crops in Egypt, on which most Egyptians rely for their food. Moreover, it is also the most successful food crop in Egypt, where rice is considered a substitute for the loaf of bread, succeeding it in order on the tables of Egyptians, both the poor and the rich.

Enhancing Production Capacities

- Rice is one of the most important agricultural crops in Egypt. Rice is used in many cuisines in restaurants and at home as well. For instance, Koshari, the country's national dish, and widely popular street food, uses rice as the main ingredient. Other rice dishes that are prepared by the Egyptians include the Ruzz mu'ammar bi-I-tuyur, or baked rice with milk and pigeon, which is regularly served in restaurants in major cities such as Alexandria.

- With the introduction of focused cultivation of rice through several studies, domestic production has increased during the study period. The high solar radiation, the long days, and the cool nights between May and September are favorable for a high rice yield. Thus, Egyptian Rice cultivates from the beginning of May till the end of June, and its harvest season starts in the middle of August till the middle of October of the year. Japonica, Sakha 101, 102, 104, and Giza 177, 178 are the major varieties cultivated in the country.

- Egyptian farmers, with the help of Egyptian researchers, are producing one of the world's highest rice yields. According to the Food and Agriculture Organization (FAO) Statics, rice production was 3,123,708 metric tons in 2018, which increased by 56.7% and reached 4,893,507 metric tons in 2020.

- Furthermore, the growing popularity of agricultural equipment, like power tiller, seeder, weeder, reaper, ASI thresher, and other post-harvest machinery, has improved the yield by reducing post-harvest, as well as cultivation losses. Moreover, with the increased investment by the Egyptian government in the region on R&D activities, in collaboration with various stakeholders, the rice market is steered toward growth and development.

Egypt Rice Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.