There is a tremendous demand for pure and organic herbs all across the globe. Countries like India, China, and Vietnam in the Asia-Pacific region are promoting organic cultivation of spices, which turns out to be healthier than conventional spices. The high growth in this region can be attributed to the rising demand for different spices as the demand for western cuisine is gaining momentum in areas like India and China. The trend toward internationalization and the increasing consumption of ethnic foods have created a growing interest in spices and herbs in the market studied, which is significantly driving the overall market growth and also increasing the consumption of blended spices such as biryani blended spice, as they provide a mixed variety of spices in one packet, thus enhancing the overall cooking experience.

The demand for easy-to-prepare and ready-cooked meals is increasing in the Asia-Pacific region. Consumers are spending less and less time preparing meals due to their busy schedules, while the number of single households is increasing. Easy-to-prepare and ready-cooked meals rely on spices and herbs to retain and enhance food flavor (e.g., ready-to-use spices, herbs, seasonings, and condiments). Moreover, the clean-label trend has now extended to flavorings and extracts, with natural herbs and spices becoming more popular. At the same time, consumers are looking for simpler labels with a shorter list of ingredients, which they perceive as an indication that the product is better for them. India is the major market where seasoning and spices have a higher demand, owing to the customer inclination towards processed food.

APAC Seasonings and Spices Market Trends

Surging Demand for Processed Food Products

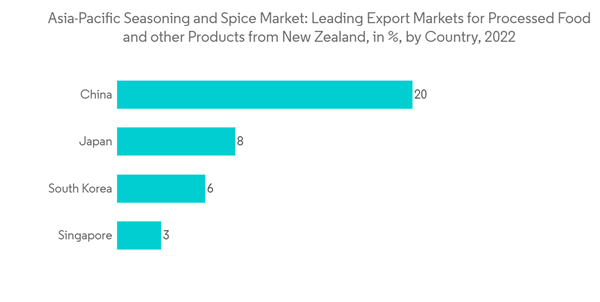

The growth of the processed food industry is fueling an increase in the Asia-Pacific market for spices and seasonings. There has been an increase in consumer spending owing to changing lifestyles, an increasing population of working women, increased product offerings, and penetration of retail channels on savory snacks, soups, noodles, beverages, and ready-to-eat food, particularly in China, India, and Japan. Consequently, sectors such as sauces, salads & dressings are buying more spices, which in turn, driving the market growth significantly. According to the Ministry of International Trade and Industry, In 2021, the retail value of processed foods sold at convenience stores in Japan amounted to around 3.07 trillion Japanese yen.With western foods becoming increasingly accessible and mainstream, consumers are developing an appetite for new and exciting spices and seasonings. Moreover, increasing awareness about harmful ingredients and additives in processed food pushes consumers toward organic spices. Reasons for this increase in western cuisine include the growing multicultural population and the fact that people travel more and more to exotic destinations. As a result, the demand for spices, herbs, and seasonings used in exotic cuisine is also growing. This growing demand for western food in Asia-Pacific has led to significant growth in Asian region imports of spices, herbs, and seasonings from developing countries, boosting the growth of western cuisines in the region.

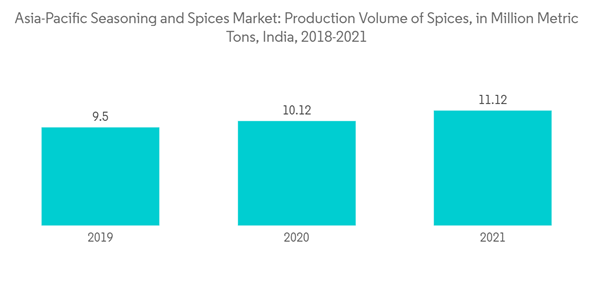

India Holds a Prominent Share in The Market

The major driving factor of India's spices and seasonings market is the growing middle-class population, increasing awareness amongst end-users regarding health, and increased usage of spices as natural preservatives. India is one of the major exporters and consumers of spices globally, with a market share of 46% by the Spice Board of India, thereby commanding a dominating position in the world spice trade. This region produces about 75 of the 109 varieties listed by the International Organization for Standardization (ISO). Spices in India are grown in small landholdings, with organic farming gaining prominence. It exports a large number of spices across the globe. Most of the demand is observed from countries such as the United States, China, Vietnam, the United Arab Emirates, Indonesia, Malaysia, the United Kingdom, Sri Lanka, and Germany.APAC Seasonings and Spices Industry Overview

Asia-Pacific's spices and seasonings market is highly fragmented and competitive, with various players. Companies constantly try to optimize the supply chain, which may ensure efficient product circulation in the market. The companies are making themselves more competitive by strengthening their distribution systems, entering partnerships, acquisitions, new regions, expanding product range, etc. Some major players operating in the market are McCormick & Company, Inc., Dohler Gmbh, Olam International, Kerry Group PLC, and Sensient Technologies Corporation.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- McCormick & Company, Inc.

- Kerry Group PLC

- Sensient Technologies Corporation

- Dohler GmbH

- Frontier Co-op

- Olam International

- Schulze & Co. KG

- Cargill, Incorporated

- Kikkoman Corporation

- SHS Group