Key Highlights

- Southeast Asia has abundant water sources. However, tap water has many contaminants and pollutants that impact the health of a wider population. For instance, according to a United Nations International Children's Emergency Fund (UNICEF) report published in February 2022, nearly 70% of the household-sourced drinking water in Indonesia was contaminated with fecal waste, which further facilitated the spread of diarrheal disease. As a result of increased contamination of tap water, the demand for bottled water has been growing consistently for the past several years.

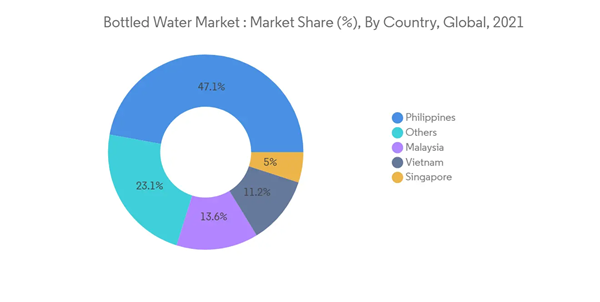

- Countries such as Indonesia, Philippines, Thailand, and Malaysia in the Southeast Asian region are categorized under newly industrialized countries globally, which led to a rapid expansion of the bottled water industry in the region. Observing the difference in the quality of the product, consumers prefer global players over domestic players, resulting in the domestic players not gaining a higher market share.

- Over the long term, changing customer preferences and growing demand for clean and safe drinking water aid the growth of the bottled water market in Southeast Asia. Rising southeast Asian disposable income coupled with an increase in traveling and consumption of food outside of home across the region are a few other macro factors likely to fuel growth in the market over the forecast period.

Southeast Asia Bottled Water Market Trends

Lack of Safe Drinking Water Propels the Market for Bottled Water

- The demand for bottled water continues to increase in Southeast Asian countries, where the increasing awareness about the consumption of clean water generates a significant proportion of the demand. Moreover, the growing challenge of accessing potable water and the increasing number of campaigns for healthy lifestyles that promote the consumption of large quantities of water are expected to contribute toward revenue generation in the Southeast Asian bottled water market.

- Globally, Indonesia is among the top 10 countries without access to clean and safe water. Furthermore, approximately 27 million people in the country lack access to safe water, and 51 million people lack access to improved sanitation. The increase in the number of water-borne diseases due to the consumption of groundwater and the increase in health consciousness among the Indonesian population is expected to aid the bottled water market to grow significantly during the forecast period.

- Additionally, the increasing consumer interest in bottled water owing to its convenience and the growing trend of sustainability products further encourage manufacturers to launch innovative products in the market to gain consumers' attention. For instance, in March 2021, Danone launched its first label-free and 100% recyclable PET bottle in Singapore.

Indonesia Accounted For Largest Share In The Market

- Indonesia is witnessing a major behavioral shift toward dependency on bottled water. In major cities like Jakarta, water has become increasingly contaminated due to urbanization, increased pollution of surface water sources, the leaching of sewage into groundwater, increased salinity from rising sea levels, and over-extraction by unregulated neighborhood wells and industry.

- According to Water Aid data, about 18 million Indonesian are undersupplied with safe water. As a result of the lack of access to clean water in households, the Indonesian population is highly dependent on bottled water for their household purpose, including cooking and drinking. Thus, the increasing adoption of bottled water is further strengthening the market growth over the forecast period.

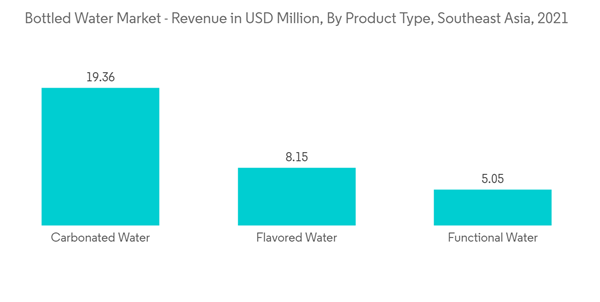

- Meanwhile, the health-conscious Indonesian consumer shifted to consuming vitamin and mineral-fortified sparkling water, which is further expected to boost the growth of the sparkling water segment of the market studied. Key players like Danone Aqua hold the maximum market share due to the high distribution network, multiple production facilities, brand value, and reputation for providing good quality, safe drinking water. In 2021, the still water segment dominated the market, with the highest revenue, followed by carbonated, flavored, and functional water.

Southeast Asia Bottled Water Industry Overview

The Southeast Asian bottled water market is fragmented, and some prominent players include Danone, Coco-Cola, Nestle, and PepsiCo. A combination of players dominates the individual nations. For instance: In Thailand, the market is dominated by players such as Singha, Nestle, PepsiCo, and Coca-Cola. Other players include Spritzer, Vinh Hao Mineral Water Corporation, Asian Brewery, Singha Corporation Co. Ltd, and others. Though the bottled water market doesn't have much product innovation, companies are trying new product launches as the next strategy to strengthen their market dominance, especially in the flavored and functional bottled water market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Danone S.A.

- Spritzer Bhd

- The Coca-Cola Company

- PepsiCo. Inc.

- SodaStream Inc.

- Fraser & Neave Holdings Bhd

- Nestle S.A.

- Vinh Hao Mineral Water Corporation

- Asia Brewery Incorporated

- Universal Robina Corporation