In North America, the United States is having the highest number of COVID cases with 82 million by April 2022, the country also registered the highest death rate. According to the Diabetes Voice article published in May 2020, close to 40,000 deaths are people with diabetes. In the North American region diabetes patients are more concerned about stocking up the monitoring and managing devices due to this the market increased during these years.

The North American region had witnessed an astounding increase in the prevalence of diabetes, in recent years. In developed countries, such as the United States and Canada, the rate of diabetes is at an all-time high, mainly due to lifestyle changes. Diabetes is associated with many health complications. Comparing the population with and without diabetes, those with diabetes have a 300% increased risk of being hospitalized and thus incur more healthcare expenses compared to non-diabetic people. Patients with Type 2 diabetes require many corrections throughout the day for maintaining nominal blood glucose levels, such as the administration of additional insulin or ingestion of additional carbohydrates.

Meglitinides are a type of non-sulfonylurea insulin secretagogues with a fast onset and short duration of action. They stimulate glucose-sensitive first-phase insulin release, lowering the risk of hypoglycemia. Meglitinides cause the body to release more insulin in people with type 2 diabetes, who have chronically high blood sugar levels.

The World Health Assembly agreed on a Resolution to strengthen diabetes prevention and control in May 2021. It recommends actions such as increasing access to diabetes medicines and health products and assessing the feasibility and potential value of establishing a web-based tool to share information relevant to market transparency for diabetes medicines and health products.

This is driving the demand for Meglitinides in North America, thereby driving the market in focus during the forecast period.

North America Meglitinide Market Trends

Rising Diabetes Prevalence in North America Region

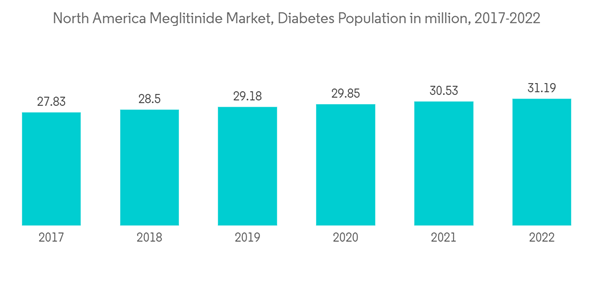

According to the National Diabetes Statistics Report, approximately 37.3 million people, or approximately 11.3% of the US population, have diabetes. People who are overweight are more likely to develop prediabetes, which can progress to type-2 diabetes, putting them at risk for complications, acute and long-term complications, and death. Obesity, an unhealthy diet, and a sedentary lifestyle are all contributing to an increase in newly diagnosed type-1 and type-2 diabetes cases. The increased prevalence of diabetic patients and global healthcare expenditure are indicators of a greater proclivity for diabetic drugs. Type-2 diabetes (T2D) is becoming more common and is linked to an increased risk of cardiovascular and renal disease. Meglitinides are oral medications used to treat type-2 diabetes in conjunction with lifestyle changes. They work by stimulating insulin release from pancreatic beta cells, which lowers blood glucose levels. Meglitinides do not work in people with type-1 diabetes because their action is dependent on the presence of functioning beta cells. In recent years, the prevalence of diabetes has increased alarmingly throughout the North American continent. The prevalence of diabetes is at an all-time high in industrialized nations like the United States and Canada, mostly because of alterations in lifestyle. Numerous health problems are brought on by diabetes. Diabetes patients must make many adjustments throughout the day to keep their blood glucose levels within normal ranges. These adjustments may include giving themselves extra insulin or eating more carbs.The market under study is thus expected to increase during the course of the analysis period as a result of the aforementioned factors.

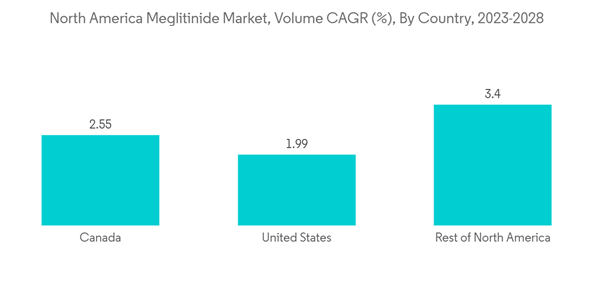

The United States is Expected to Dominate the North America Meglitinides Market.

According to the American Diabetes Association, 1.4 million Americans are thought to receive a diabetes diagnosis each year. In Canada and other North American nations, diabetes is one of the main killers. The disease's rising incidence, prevalence, and progressive nature have driven the development of novel medications to give diabetic patients more treatment options. Non-insulin medications, which serve as first-line therapy for people with type-2 diabetes, currently account for more than half of sales in the anti-diabetic market. Because they are seen as medically essential, most health insurance policies cover diabetes drugs. Medicare often covers medication for diabetes. A guide on Medicare and diabetes prescription drug benefits is available from the American Diabetes Association. Patients with insurance typically pay a copay for prescription drugs that can range from USD 10 to USD 50, depending on the medication. The patient's copays may reach USD 200 or more a month if they are for many medications.Meglitinides, for example, bind to the sulfonylurea receptor in beta cells (pancreatic insulin-producing cells) but at a different part of the receptor than sulfonylureas do. This class of drugs, also known as non sulfonylurea secretagogues, is relatively new in comparison to the sulfonylureas (chlorpropamide [brand name Diabinese], glyburide [DiaBeta, Glynase, Micronase], glipizide [Glucotrol], glipizide extended-release [Glucotrol XL], and glimepiride [Amaryl]). Meglitinides work in a similar way to sulfonylureas, but with a few key differences. Meglitinides' interaction with the receptor is not as "tight '' as sulfonylureas', resulting in a much shorter duration of action and a higher blood glucose level required before the drugs produce insulin secretion from the pancreas. In the United States, two meglitinides are currently available: repaglinide (Prandin) and nateglinide (Starlix). Both are approved for use in people with type-2 diabetes, both alone and in combination with other oral diabetes medications. Meglitinides' main effect is to lower after-meal blood glucose levels, which results in a lower HbA1c (an indicator of blood glucose control over the previous 2-3 months).

Owing to the aforementioned factors, the market is expected to grow during the forecast period.

North America Meglitinide Industry Overview

The North American meglitinides market is fragmented, with manufacturers like Novo Nordisk, Glenmark, and Novartis having a global market presence, and the market is highly competitive due to generic drug manufacturers' presence.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novo Nordisk

- Novartis

- Glenmark

- Boehringer Ingelheim

- Biocon

- Kissei Pharmaceuticals