Inadequate preventive measures interrupted traditional methods of relationship with the patient, medication shortages, disruption of routine diabetic care, and a lack of the necessary infrastructure for telehealth services are the most significant challenges of diabetes care management in developing countries during the COVID-19 pandemic. Diabetes is becoming more common in Iran, as it is in many other countries. In addition to the difficulties inherent in diabetes management in impoverished countries, Iran has faced new challenges in the last two years as sanctions have tightened. The weight of sanctions in Iran more than tripled during the COVID-19 crisis.

Regular blood glucose monitoring, following a healthy diet, regular physical activity, and compliance with medication and foot care are the most important components of diabetes self-management that should be considered to better control hyperglycemia and prevent or at least delay complications in diabetic patients. During the COVID-19 crisis, shortages or high pricing of devices such as insulin pens heightened patients' concern and hindered their illness management.

Insulin has a substantial market share in the pharmaceutical industry. Insulin is used by around 100 million people globally, including all patients with Type 1 diabetes and 10% to 25% of people with Type 2 diabetes. Insulin manufacturing is highly complicated, with just a few insulin producers on the market. As a result, there is tremendous competition among these companies, which are always seeking to meet patient requests by offering the highest-quality insulin.

Iran Diabetes Care Drugs Market Trends

Oral-Anti Diabetes Drugs Segment is Having the Highest Market Share in the Current Year.

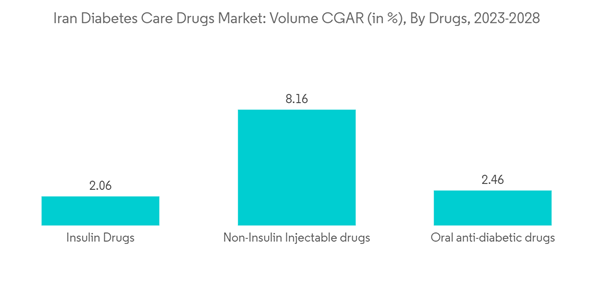

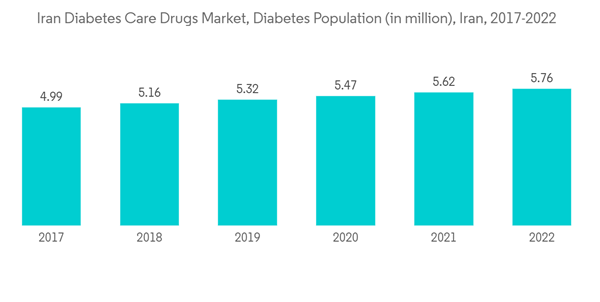

The Oral-Anti Diabetes Drugs segment is expected to increase with a CAGR of over 3.8% during the forecast period, mainly due to the demand from the diabetes population, which was more than 5.7 million by the end of the current year.People living with Diabetes in Iran confront financial difficulties. Pharmacies do not sell enough insulin to people with diabetes; instead, insulin is sold on the open market at a higher price. Sometimes a diabetic child's parent is unable to locate insulin. Insulin costs 20-30% of a family's monthly income for type 1 diabetic children and adults. This does not include the excessively high cost of test strips and other supplies. In addition, insurance firms in Iran are lowering financial assistance for diabetes treatments. Because insulin is scarce, Iranian families with diabetes children adapt by limiting the number of carbs in their child's diet. Though food and lifestyle are highly helpful in managing blood glucose levels, they frequently fail and necessitate oral medication therapy. If the second phase of pharmacological therapy fails, multiple oral therapies will be used. Multiple therapies will be optimized, and in the ultimate stages, it will be shifted to oral-injectable multiple treatments. With broad modifications in hyperglycemia prescription therapy, guidelines for regulating blood glucose levels have evolved. Considering these developments in diabetes care, the trend in glucose-lowering medicines and their efficacy in blood glucose is critical.

One of the most prevalent difficulties in patients is poor drug adherence. Many patients struggle to adhere to therapy suggestions. Adherence to oral hypoglycemic medications (OHAs) ranges from 36% to 93% in controlling type 1 and type 2 diabetes. Sulphonylureas are commonly used to treat type 2 diabetes. Patient compliance is critical to the efficacy of oral diabetes therapy. It became vital to emphasize the recent status of diabetic medication adherence among type 2 diabetes patients in Tehran and the cultural variances within the same Iranian community.

Through the Iran government's encouragement, the usage of Drugs increased over the forecast period.

The rising prevalence of diabetes in Iran is boosting the country's diabetes drugs market.

In Iran, diabetes is a leading cause of mortality, blindness, renal failure, heart attack, stroke, and amputation of lower limbs. According to estimates by the National Program for Prevention and Control of Diabetes, diabetes will affect 9.2 million Iranians by 2030. This steady and large rise in diabetes prevalence reflects Iran's high disease burden, particularly when diabetes-related comorbidities are included. Through serious worldwide attempts to lower the burden of diabetes, Iran's National Program for Prevention and Control of Diabetes (NPPCD) has achieved significant progress in providing effective diabetes prevention for the general population and long-term treatment for diabetic patients. Despite the NPPCD's ongoing efforts to provide local, regional, and subnational estimates of diabetes, the current state of type-specific status, natural history, comorbidities, quality and accessibility of care, indicators of control, diabetes-related complications, and burden of diabetes among patients with diabetes in Iran remains poorly characterized.Thus, the above factors are expected to drive the market growth over the forecast period.

Iran Diabetes Care Drugs Industry Overview

The diabetes drugs market is moderately fragmented, with few significant generic players. The insulin drugs and Sglt-2 drugs market are dominated by a few major players, like Novo-Nordisk, Sanofi, AstraZeneca, and Bristol Myers Squibb. The market for oral drugs, like Sulfonylureas and Meglitinides, comprises more generic players. The intensity of competition among the players is high, as each player is striving to develop new drugs and offer them at competitive pricing. Furthermore, players are tapping into new markets to increase their market shares, especially in emerging economies where the demand is very high compared to the supply.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Takeda

- Novo Nordisk

- Pfizer

- Eli Lilly

- Janssen Pharmaceuticals

- Astellas

- Boehringer Ingelheim

- Merck And Co.

- AstraZeneca

- Bristol Myers Squibb

- Novartis

- Sanofi