Medical Loupes: Introduction

Medical loupes are optical devices that are worn by healthcare professionals, such as surgeons and dentists, during medical procedures. They are used to enhance the vision and improve precision for healthcare professionals. These medical loupes have built-in or attached magnifying lenses that are attached to a frame or headband. It allows healthcare professionals to see small details more clearly and perform tasks with greater accuracy and precision.Medical loupes are extremely helpful for everything from very complex surgical procedures to a basic suture removal at a healthcare facility. There are two types of medical loupes which are (through-the-lens) TTL or flip up loupes. There are two different kind of medical loupes and so are their advantages. The (through-the-lens) TTL need not to be adjusted ever as they are designed specifically for the user's requirements such as their specific eyesight. Flip-up lenses, however, need to be adjusted as they can be used by multiple users. It is important to use appropriate medical loupe as it can help in improving the posture and using the right medical loupe will also take the stress off of shoulders, neck, and back.

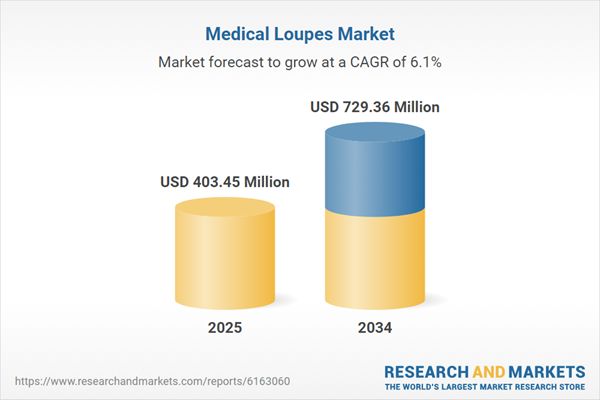

Medical Loupes Market Analysis

The increasing adoption of loupe-integrated technologies is primarily driving the growth of the market. Manufacturers are incorporating advanced features in medical loupes now, such as installing LED lighting, camera systems, and wireless connectivity into medical loupes. LED lighting provides better vision by adding better lightning to the surgical site, which allows healthcare professionals to visualize the area more clearly.Camera systems enable live video streaming or image capture, facilitating documentation, teaching, and telemedicine applications. Wireless connectivity allows seamless synchronization with other medical devices or systems, enabling data sharing and enhanced communication. There is a trend which allows healthcare professionals to enhance visual clarity and field of view with advanced medical loupes that also visualize intricate details more clearly and expands their field of vision during procedures.

Medical Loupes Market Segmentations

Medical Loupes Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Flip-Up Loupes

- Through-the-lens (TTL) Loupes

- Clip-On Loupes

- Headband Mounted

Market Breakup by Magnification

- 3.0x-5.0x

- Up to 3.0x

- Above 5.0x

Market Breakup by Lens Type

- Galilean

- Prismatic

Market Breakup by Application

- Surgical

- Dental

- Others

Market Breakup by Distribution Channel

- Offline

- Online

Market Breakup by End User

- Hospitals

- Dental Clinics

- Ambulatory Surgery Centres

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Medical Loupes Market Overview

The market for medical loupes has been witnessing significant growth in the recent years, driven by the increasing demand for precise visualization and improved ergonomics in healthcare industry. Medical loupes are specialized magnifying devices worn by healthcare professionals, such as surgeons, dentists, and veterinarians, to enhance their vision and accuracy during procedures.The medical loupes market development is driven by the rapid advancements in optics, design, and technology. Manufacturers are focusing more on developing high-quality lenses and advanced optics for medical loupes to provide clear and high-quality images. Additionally, lightweight and ergonomic designs have also gained prominence, ensured user comfort and reduced fatigue during long hours of use.

Medical Loupes Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- NEITZ INSTRUMENTS Co., Ltd.

- L.A. Lens

- ErgonoptiX

- Carl Zeiss Meditec AG

- Envista Holdings Corporation (Orascoptic)

- Thermo Fisher Scientific Inc.

- HOYA Corporation

- General Scientific Corporation (SurgiTel)

- Heine Optotechnik GmbH & Co. KG

- Enova Illumination

- LW Scientific

- Integra Lifescience Holding Corporation

- Neitz Instruments Co., Ltd.

- SheerVision Inc.

- MeridentOptergo (Optergo AB)

- Designs for Vision, Inc.

- Den-Mat Holdings, LLC

- Halma plc

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- NEITZ INSTRUMENTS Co., Ltd.

- L.A. Lens

- ErgonoptiX

- Carl Zeiss Meditec AG

- Envista Holdings Corporation (Orascoptic)

- Thermo Fisher Scientific Inc.

- HOYA Corporation

- General Scientific Corporation (SurgiTel)

- Heine Optotechnik GmbH & Co. KG

- Enova Illumination

- LW Scientific

- Integra Lifescience Holding Corporation

- Neitz Instruments Co., Ltd.

- SheerVision Inc.

- MeridentOptergo (Optergo AB)

- Designs for Vision, Inc.

- Den-Mat Holdings, LLC

- Halma plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 403.45 Million |

| Forecasted Market Value ( USD | $ 729.36 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |