Magnetic Resonance Imaging: Introduction

Magnetic resonance imaging (MRI) is a medical imaging technique in which a magnetic field and computer-generated radio waves is used to create thorough detailed images of the organs and tissues that are present in human body. Generally, MRI machines are large and tube-shaped magnets. To perform the diagnosis, the patient is asked to lay down inside an MRI machine, the magnetic field then temporarily realigns water molecules in the patient's body. The radio waves cause the faint signal production of the aligned atoms which are used to create cross-sectional MRI images. It is frequently used to examine brain and spinal cord. It is also used to diagnose stroke, tumors, eye and ear disorders, multiple sclerosis, aneurysms of cerebral vessels.The functional MRI of the brain (fMRI) is a specific technique which generates images of blood flow to particular parts of the brain. This is used to identify the important language and movement control areas in the brains of people that are considered for brain surgery. It can also identify damage from a head injury or disorders such as Alzheimer's.

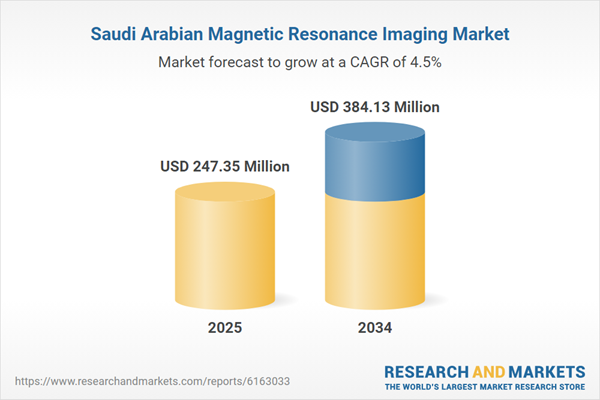

Saudi Arabia Magnetic Resonance Imaging Market Analysis

The rising prevalence of cancer such as breast cancer, prostate cancer, and colorectal cancer, among others, along with new product launches to help cure such conditions have been aiding the Saudi Arabia magnetic resonance imaging market expansion.Additionally, the campaign launching in order to spread awareness about cancer in the country is expected to elevate the demand of diagnostic modalities to treat cancer and support the market growth. Due to the positive reviews generated by Saudi Arabian physicians and radiologists about PACS system, there is an increased sense of trust and satisfaction among the patients for MRIs. Therefore, these positive view of PACS toward imaging modalities are also expected to create new opportunities for diagnostic imaging in Saudi Arabia and expand the market growth further.

Saudi Arabia Magnetic Resonance Imaging Market Segmentations

Saudi Arabia Magnetic Resonance Imaging Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Field Strength

- High-Field MRI Systems

- Low-to-Mid Field MRI Systems

- Very-High-Field MRI Systems

Market Breakup by Type

- Fixed

- Mobile

Market Breakup by Architecture

- Closed

- Open

Market Breakup by Source

- Import

- Domestic

Market Breakup by Application

- Brain and Neurological

- Oncology

- Spine and Musculoskeletal

- Abdominal

- Cardiac

- Others

Market Breakup by Region

- Northern and Central

- Western

- Southern

- Eastern

Saudi Arabia Magnetic Resonance Imaging Market Overview

The rising prevalence of neurological and brain diseases and disorders are primarily driving the growth of the market. The rising cases of cancer across the nation and surgery being the general mode of treatment, the demand for magnetic resonance imaging has been on a rise in Saudi Arabia. Increasing awareness about the effectiveness of magnetic resonance imaging is considered to support the Saudi Arabia magnetic resonance imaging market growth.The robust promotion by Saudi Arabia government to promote medical tourism as a part of its economic diversification strategy has been intensifying the market growth. The patients seeking advanced healthcare services, including diagnostic imaging are the target population of the government. The high availability of state-of-the-art MRI systems and high-quality imaging services in Saudi Arabian hospitals have directly been contributing to the magnetic resonance imaging (MRI) market expansion, attracting both domestic and international patients.

Saudi Arabia Magnetic Resonance Imaging Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- General Electric El Seif Healthcare Arabia Co. Ltd.,

- Toshiba Corporation

- FUJIFILM Holdings Corporation

- Hitachi Saudi Arabia, Ltd.

- Medtronic Saudi Arabia Co.

- Siemens Ltd. Saudi Arabia

- Philips Healthcare Saudi Arabia Ltd.

- Esaote SpA

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- General Electric El Seif Healthcare Arabia Co. Ltd.,

- Toshiba Corporation

- FUJIFILM Holdings Corporation

- Hitachi Saudi Arabia, Ltd.

- Medtronic Saudi Arabia Co.

- Siemens Ltd. Saudi Arabia

- Philips Healthcare Saudi Arabia Ltd.

- Esaote SpA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 247.35 Million |

| Forecasted Market Value ( USD | $ 384.13 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 8 |