Surgical Gloves: Introduction

Surgical gloves are worn by healthcare professionals while performing invasive surgeries in order to maintain the environment and keep it as sterile as possible so that there are minimal chances of cross contamination while performing the surgery. These surgical gloves are made out of different materials like latex, neoprene, and nitrile, among others. In order to take complete care of a patient's health, a healthcare professional must choose to wear the appropriate gloves around them.Global Surgical Gloves Market Analysis

The increasing focus on creating and maintaining the environment that is sterile has been driving the market growth. The use of high-quality surgical gloves has been increasing in healthcare facilities, which is significantly aiding the surgical gloves market development.Additionally, due to the pandemic and increasing surgical disposable waste, the demand for re-usable surgical gloves has also increased. Owing to the high risk of cross-contamination, the demand for disposable surgical gloves surpassed the demand of reusable surgical gloves. Increasing awareness about infection control in daily life and in healthcare facilities, along with increasing healthcare expenditure, is contributing to the market growth.

Global Surgical Gloves Market Segmentations

Surgical Gloves Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Nitrile

- Latex

- Neoprene

- Others

Market Breakup by Origin

- Synthetic

- Natural

Market Breakup by Form

- Non-Powdered

- Powdered

Market Breakup by End User

- Hospitals and Clinics

- Ambulatory Care Centres

- Others

Market Breakup by Distribution Channel

- Distributors/Wholesalers

- Direct Sales

- Drug Stores/Pharmacies

- Online Stores

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Surgical Gloves Market Overview

There are several factors that are driving the market growth and some of them include the rising incidence of chronic diseases, along with increasing geriatric population. Ever since the pandemic started, there has been an extra effort seen by everyone and everywhere to protect themselves against infections and viruses. This factor has skyrocketed the global surgical gloves market expansion. The rising number of surgical procedures globally is also directly contributing to the growth of the market.Additionally, the manufactures are now addressing the issues with the traditional surgical gloves as powder related issues in gloves and latex related allergies. In order to deal with all these concerns, manufacturers are now focusing on manufacturing powder free gloves. The market has been growing ever since the number of surgeries has increased worldwide, and it is expected to keep growing for the forecast period as well.

Global Surgical Gloves Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Top Glove Corporation Bhd.

- Supermax Corporation Berhad

- Hartalega Holdings Berhad

- Cardinal Health

- 3M Company

- Motex Healthcare Corporation

- Honeywell International Inc.

- Ansell Limited

- Mölnlycke Health Care AB

- Asma Rubber Products Pvt. Ltd.

- Crown Healthcare (K) Ltd.

- Shandong Yuyuan Latex Gloves Co., Ltd.

- Medline Industries, Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Top Glove Corporation Bhd.

- Supermax Corporation Berhad

- Hartalega Holdings Berhad

- Cardinal Health

- 3M Company

- Motex Healthcare Corporation

- Honeywell International Inc.

- Ansell Limited

- Mölnlycke Health Care AB

- Asma Rubber Products Pvt. Ltd.

- Crown Healthcare (K) Ltd.

- Shandong Yuyuan Latex Gloves Co., Ltd.

- Medline Industries, Inc.

Table Information

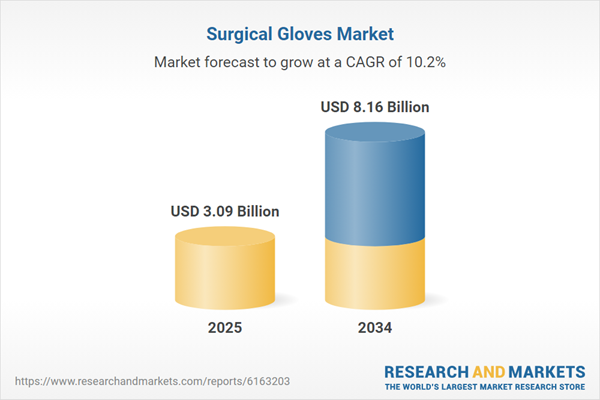

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.09 Billion |

| Forecasted Market Value ( USD | $ 8.16 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |